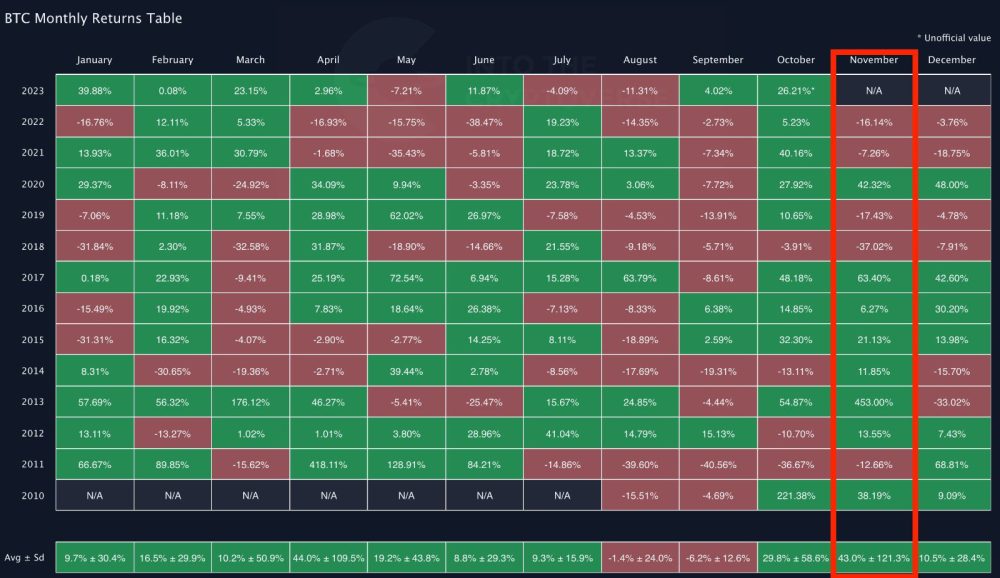

November has often been a standout month for Bitcoin, with historical data indicating an impressive average price jump of 43%. This would propel Bitcoin to around $48,000. But with October already showing a significant price increase, the question arises: Will Bitcoin continue its bullish trend, or is a retrace on the horizon?

November Monthly Returns

November has been particularly bullish for Bitcoin over time, with an average of 43% of price increases over the years. If this trend holds true for this year, we might see Bitcoin touching $48,000.

Related Reading: Bitcoin Price To Reach $170,000 in 2025 – Mathematical Model Predicts

However, it’s worth noting that this very high average is significantly influenced by the extreme 453% surge in 2013. If we exclude this outlier, the average settles around 11.54% This leads to a more conservative forecast, pointing to a potential rise to around $38,000.

Diving deeper into historical data, 8 of the past 13 years have shown price increases in November, making another increase this month seem plausible. Yet, a closer look reveals that 4 of the last 5 times in November there was a price dip.

In 2022, the FTX collapse played a pivotal role and 2021 marked the peak for Bitcoin, suggesting that these decreases might be outliers rather than indicative of a changing trend.

For a closer comparison, 2019 stands out as it too was a pre-halving year, just like 2023. That year, after a promising October, Bitcoin saw a 17% dip in November, which would equate to a value of $28,000 if repeated this year.

Bitcoin Price Action In 2023

Through 2023, Bitcoin has demonstrated a recurring behavior following significant price increases of more than 20%. Typically, these surges have been followed by consolidation periods, and subsequently, a retrace to at least half of the initial increase.

Related Reading: Bitcoin Season: Leading The Charge In The Crypto Market

Take January, for instance. Bitcoin’s price increased from $16,500 to $24,000, only to decline to $20,000 by March – a retrace of 60% from the initial increase.

One particularly extreme example was in August when Bitcoin retraced the entirety of a prior 20% rise.

It’s noteworthy that these retraces haven’t always been immediate. After the rise in March, it wasn’t until June – a span of three months – that the price saw a 50% retrace. On average, this year’s price retraces have taken between 1 to 3 months to manifest post-rise.

Furthermore, before any retrace occurs, there’s still room for additional upside. To illustrate, after the aforementioned March rise, Bitcoin experienced an additional 10% increase before eventually retracing the initial surge.

Potential Scenarios For November

Using the above, potential scenarios for November are listed below:

- Very bullish scenario: Bitcoin rises by 10-20%, potentially reaching up to $42,000.

- Bullish scenario: Bitcoin rises by 1-10%, potentially reaching up to $38,000.

- Bearish scenario: Bitcoin decreases by 10%, dropping to around $31,000. This would mean a 50% retrace of the surge in October.

- Very bearish scenario: Bitcoin decreases by 20%, dropping to around $28,000. This would mean a 100% retrace of the surge in October.

In conclusion, given past trends and current market behavior, November promises to be a pivotal month for Bitcoin.

Predycto is the author of a cryptocurrency newsletter. Sign up for free. Follow @Predycto on Twitter.