Microstrategy reported a 3.3% increase in total revenues to $129.5 million in the third quarter of 2023, even as the company took impairment losses of $33.6 million on its bitcoin holdings, according to the firm’s latest financial disclosure. The firm’s founder, Michael Saylor, revealed that Microstrategy purchased an additional 155 BTC for $5.3 million in October and the company now holds a grand total of 158,400 BTC.

Microstrategy Sees Revenue Growth Despite Bitcoin Impairments in Q3

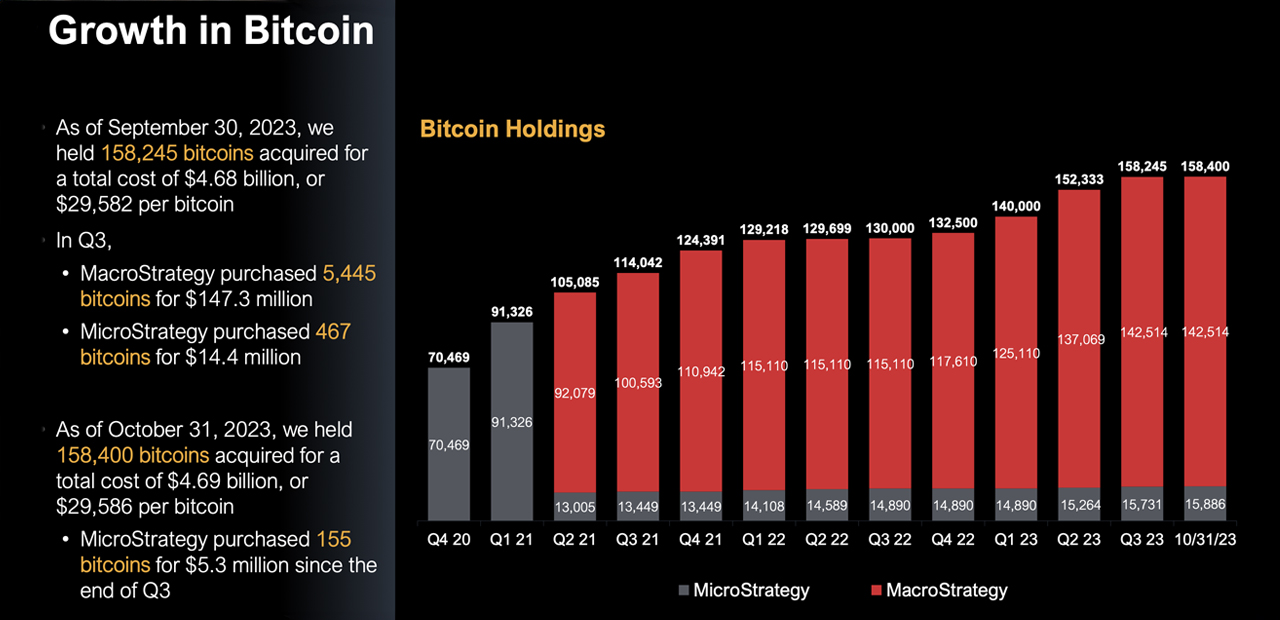

This week Microstrategy (Nasdaq: MSTR) published the firm’s Q3 2023 Earnings Presentation which gives a comprehensive overview of the company’s current financial standings. In the press announcement released on Wednesday, the business intelligence (BI) software company said it has acquired approximately 158,400 bitcoins to date as part of its crypto investment strategy.

Microstrategy also launched its new Microstrategy AI software in Q3, its first offering to integrate AI capabilities using Microsoft Azure Openai. The company detailed it saw growth across its core revenue streams, including a 16% increase in software licenses revenue to $45 million and a 28% growth in subscription services revenue to $21 million in the third quarter.

However, Microstrategy reported a net loss of $143.4 million for the quarter, driven primarily by the impairment losses on its bitcoin holdings as prices declined in the cryptocurrency bear market. Microstrategy has been aggressively acquiring bitcoin since August 11, 2020, making it the largest publicly-listed corporate holder of the cryptocurrency.

According to the presentation, the company added 5,912 bitcoins in Q3 2023, bringing its total holdings for the quarter to 158,245 bitcoins acquired at an aggregate purchase price of $4.68 billion and an average cost of $29,582 per bitcoin. The company would then add 155 more coins to the pile, after Q3, noting:

As of October 31, 2023, we held 158,400 bitcoins acquired for a total cost of $4.69 billion, or $29,586 per bitcoin.

Despite cumulative impairment losses to date, Microstrategy said it remains committed to its bitcoin investment thesis.

“We further increased our total bitcoin holdings to 158,400 bitcoins, adding 6,067 bitcoins since the end of the second quarter,” Andrew Kang, Microstrategy’s chief financial officer said in a statement on Wednesday. “Our commitment to acquire and hold bitcoin remains strong, especially with the promising backdrop of potential increased institutional adoption.”

Microstrategy’s financial results for the third quarter have been unveiled amid substantial excitement and anticipation surrounding the potential authorization of a spot bitcoin exchange-traded fund (ETF). Numerous financial institutions, including Blackrock, Fidelity, Valkyrie, and Vaneck, have submitted their applications to the U.S. Securities and Exchange Commission (SEC), eagerly awaiting approval from the regulatory body.

What do you think about Microstrategy’s October purchase upping its bitcoin stash to 158,400 bitcoins? Share your thoughts and opinions about this subject in the comments section below.