Bankrupt cryptocurrency exchange FTX has expressed readiness to sell $744 million worth of its Trust assets held at Grayscale and Bitwise, according to a Nov. 3 court filing.

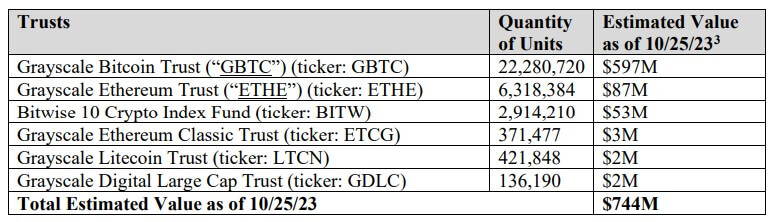

The Trust assets consist of various exchange-traded products managed by Grayscale, including its Bitcoin and Ethereum Trusts and Bitwise’s 10 Crypto index fund. The filing shows that Grayscale oversees approximately $691 million in FTX assets, while Bitwise manages around $53 million as of October 25, 2023.

The failed crypto company explained that selling these assets was important to mitigate “against potential downward price swings in the Trust Assets, maximize the value of the Debtors’ estates, and allow for forthcoming dollarized distributions to creditors.”

It added:

“Executing the proposed procedures and monetization of the Trust Assets represents a sound exercise of the Debtors’ business judgment and will benefit creditors and stakeholders by mitigating market risk and preparing the estates for plan distributions.”

Due to this, FTX said it would appoint an investment adviser in consultation with the Committee and the Ad Hoc Committee of Non-US Customers of FTX.com. This adviser would be tasked with marketing and selling the Trust Asset under an investment services agreement approved by the Court.

Edgar W. Mosley II, a managing director at one of FTX’s current financial advisers, Alvarez & Marsal North America, declared that:

“The proposed sale will help allow the [FTX] estates to prepare for forthcoming dollarized distributions to creditors and allow the Debtors to act quickly to sell the Trust Assets at the opportune time.”

Meanwhile, this move marks another significant step by FTX’s bankruptcy managers as they strive to compensate customers and investors who suffered losses from the firm’s crash last year.

CryptoSlate reported that the company had begun divesting part of its crypto holdings as part of its bankruptcy processes and recently proposed a settlement of customer property disputes that could see it return up to $9 billion to customers.

Also, Sam Bankman-Fried, the exchange founder, was found guilty of all seven charges by the jury last week and potentially faces more than 100 years of imprisonment.

The post Bankrupt FTX wants to liquidate $744 million in assets from Grayscale and Bitwise appeared first on CryptoSlate.