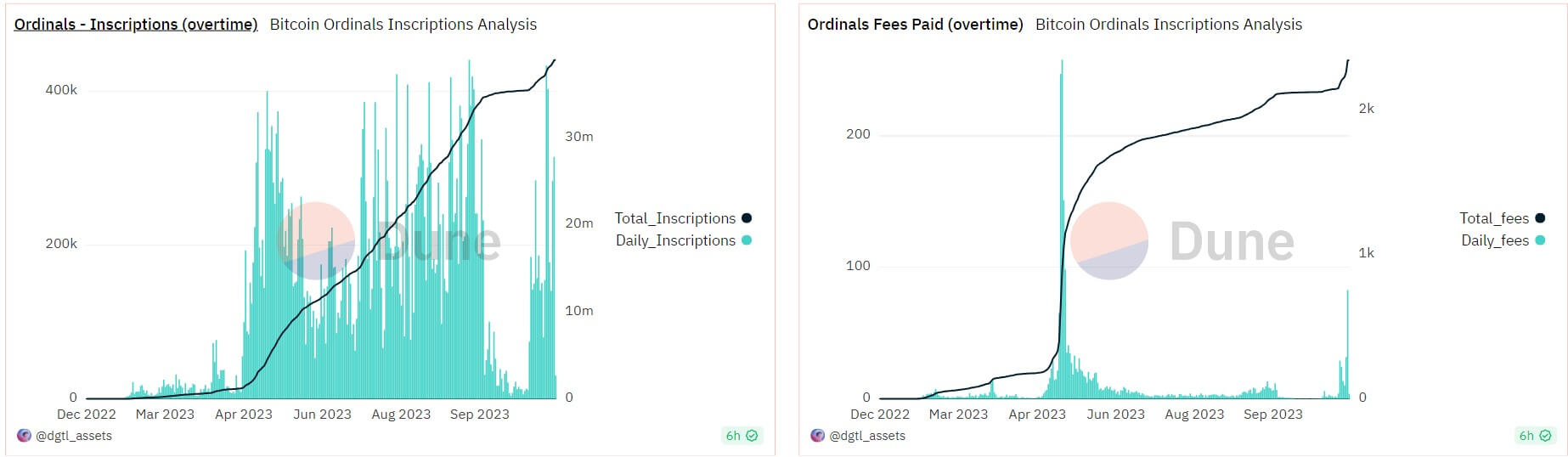

Bitcoin transaction fees have risen to a six-month high amidst a resurgence in the popularity of Ordinals Inscriptions.

Data from BitInfoCharts reveals that Bitcoin’s average transaction fee has reached its highest point since May, surging over 2,000% since its August low of $0.64.

Per the data aggregator, an average BTC transaction would cost around $15.86 as of press time.

Market observers have attributed this spike to the renewed enthusiasm surrounding Ordinals.

Ordinal Inscriptions are digital assets similar to NFTs inscribed on a satoshi, BTC’s lowest denomination. These assets had gained popularity earlier in the year and heralded Bitcoin’s foray into the NFT space. But interest in them soon faded as the market landscape evolved.

The post Bitcoin fees up more than 2000% since August due to renewed interest in Ordinals appeared first on CryptoSlate.