Bitcoin’s price jumped from $35,708 to $37,279 between Nov. 8 and Nov. 9, triggering a massive response from the futures market.

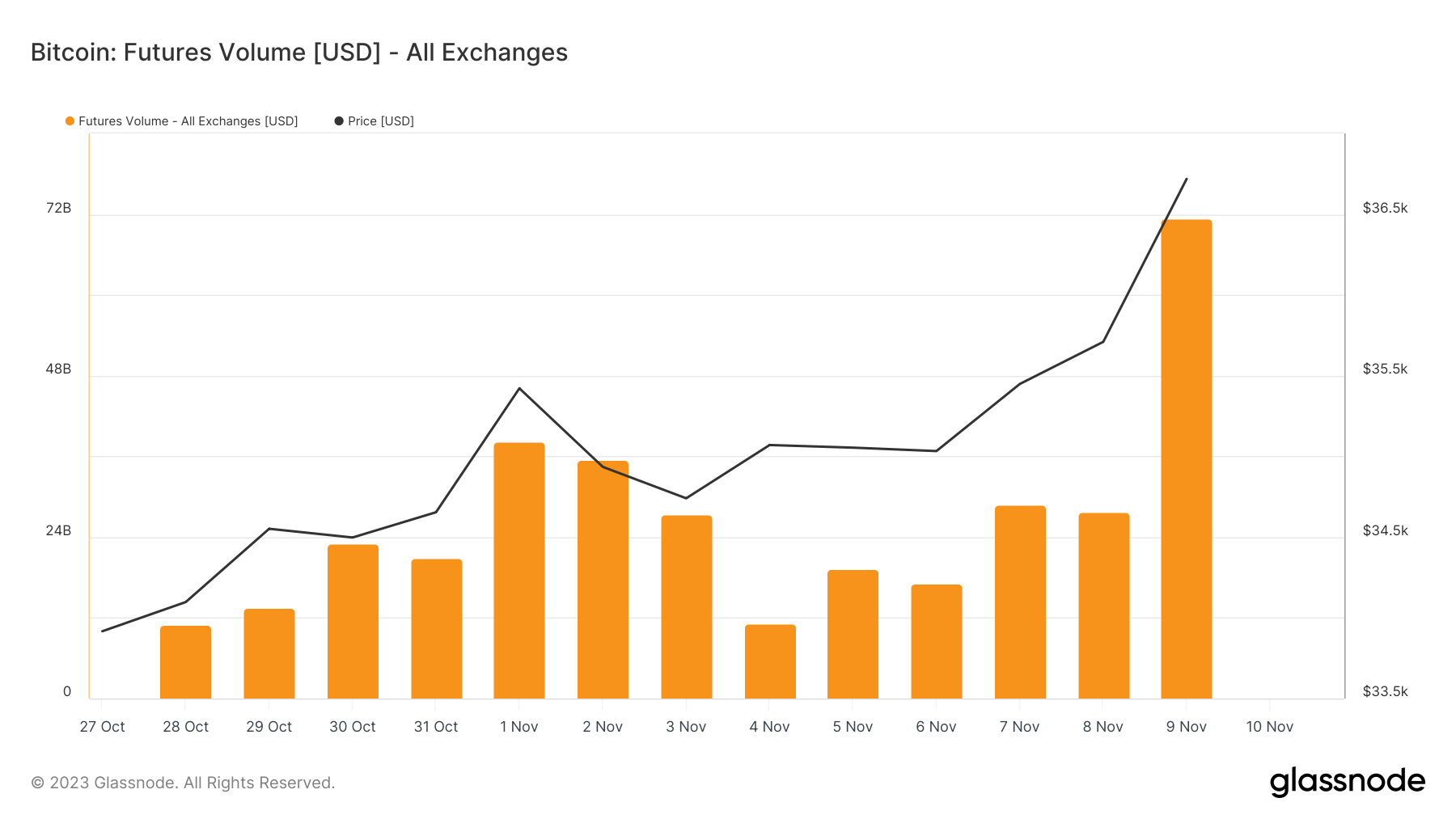

The total volume of Bitcoin futures traded across all exchanges leaped from $27.69 billion to $71.29 billion, showing a notable increase in speculative activity in Bitcoin.

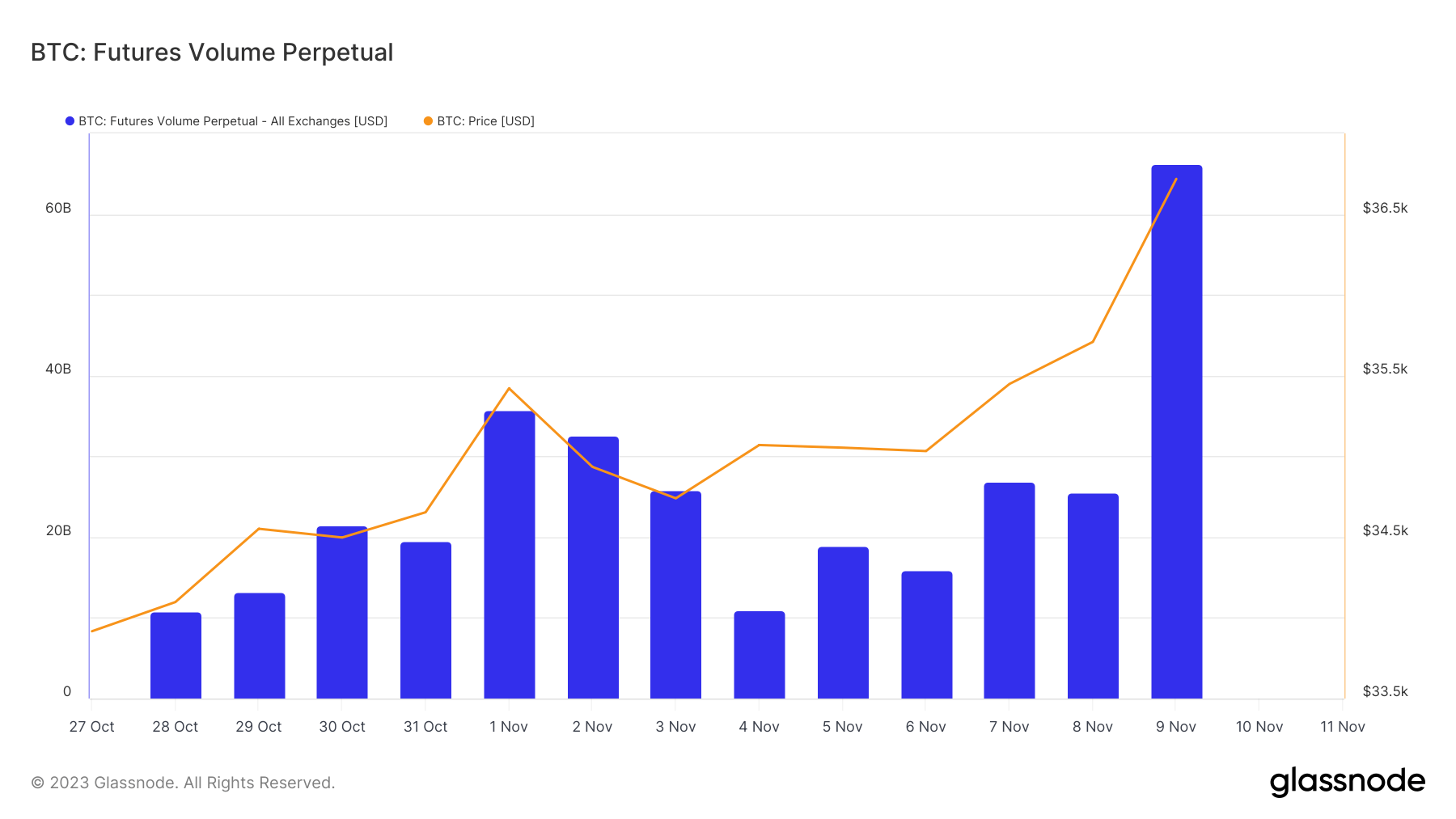

This was followed by a similar trend in perpetual futures volume, which grew from $25.06 billion on Nov. 8 to $66.31 billion on Nov. 9. Such a high volume in perpetual futures is particularly noteworthy as it indicates ongoing interest and a speculative mood among traders due to their non-expiry nature.

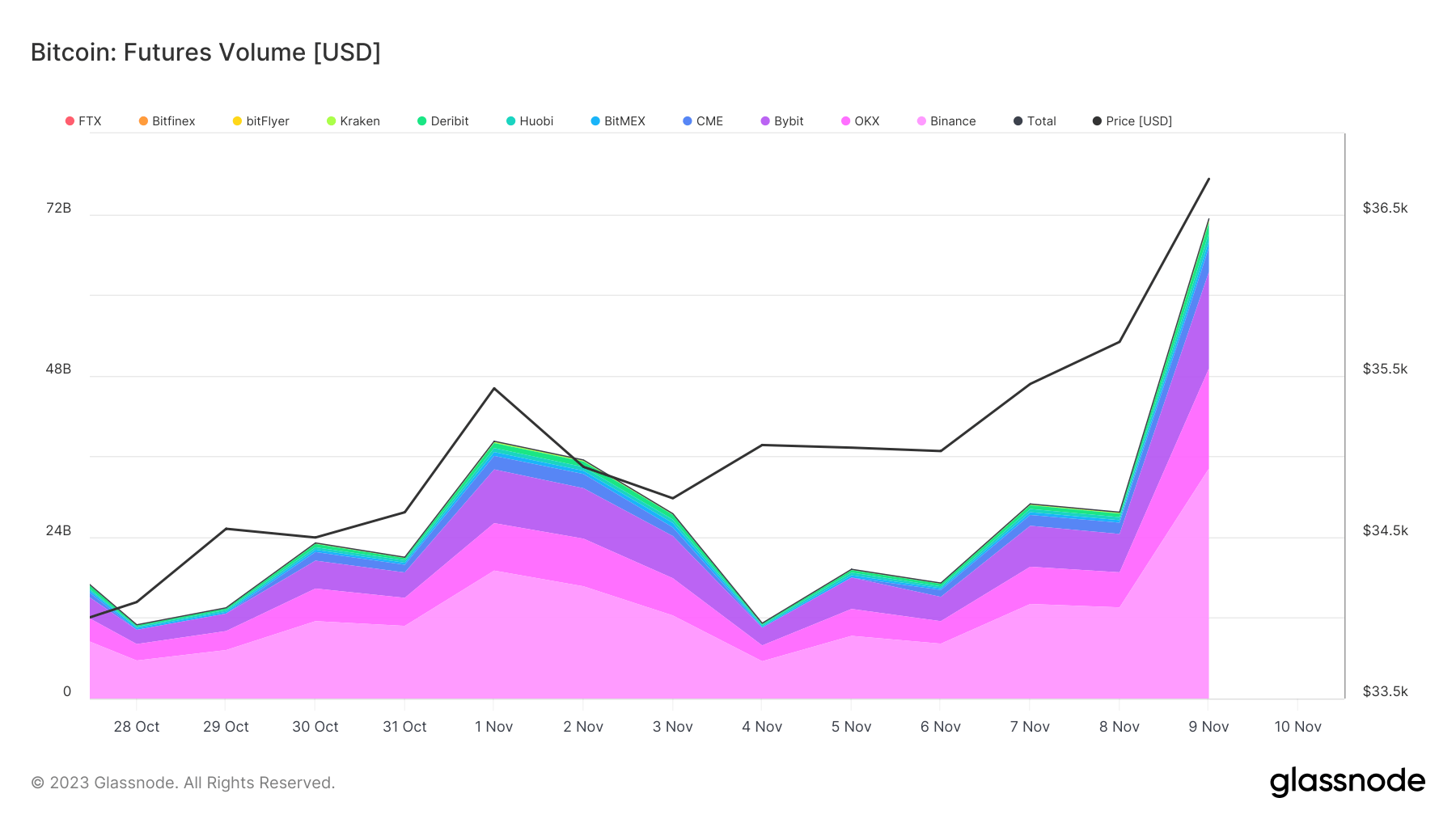

The distribution of this increased volume across major exchanges like Binance, OKX, Bybit, and CME provides insight into the market’s breadth. Binance, for instance, saw its futures volume more than double, reaching $34.19 billion. This broad-based increase is indicative of widespread trader participation and interest.

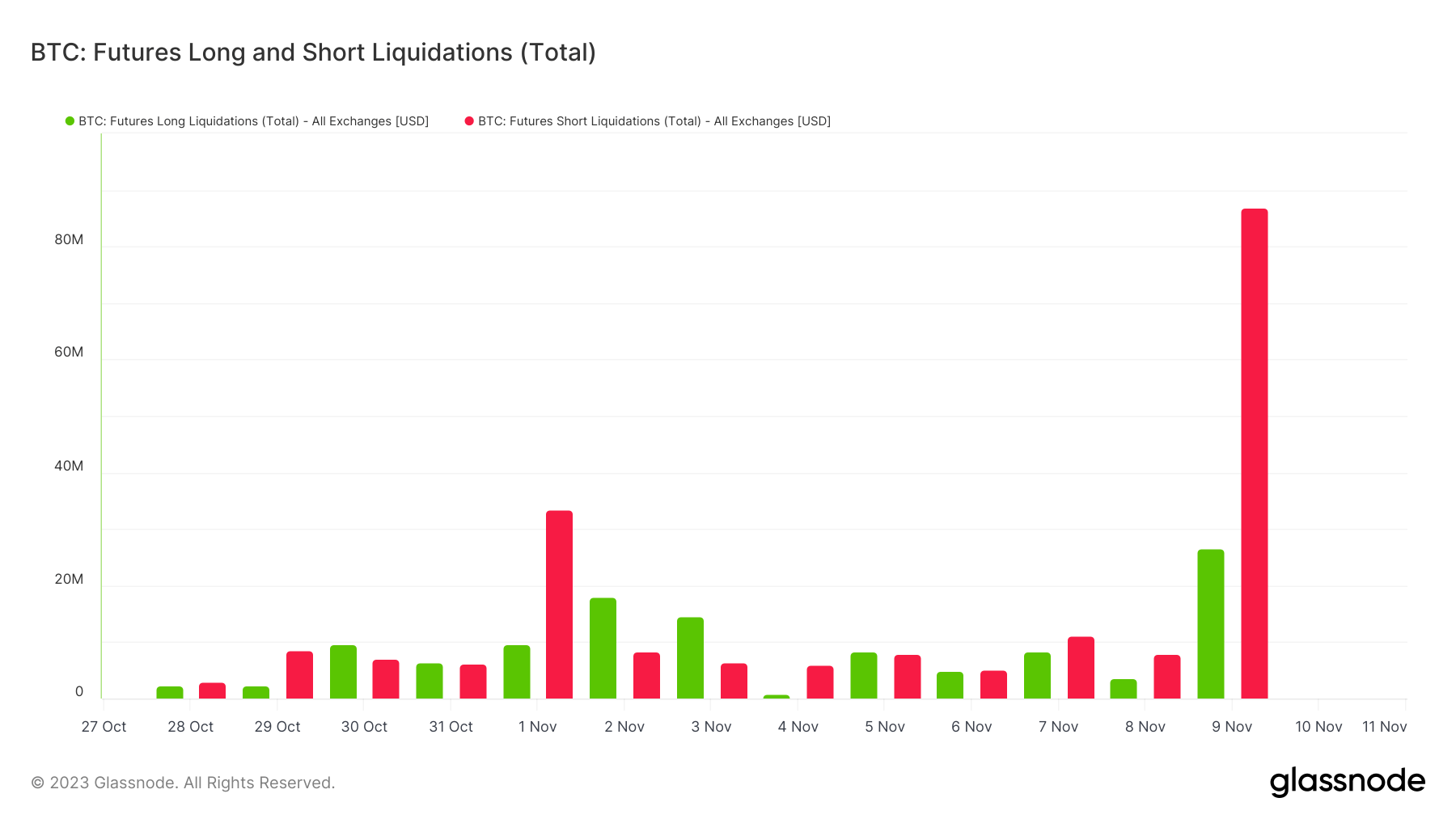

An essential aspect of this market movement is the pattern of liquidations. Long liquidations rose from $3.72 million to $26.5 million, but more dramatically, short liquidations increased from $7.83 million to $86.86 million. This suggests that many traders who bet against Bitcoin were compelled to exit their positions, possibly fueling the upward price momentum.

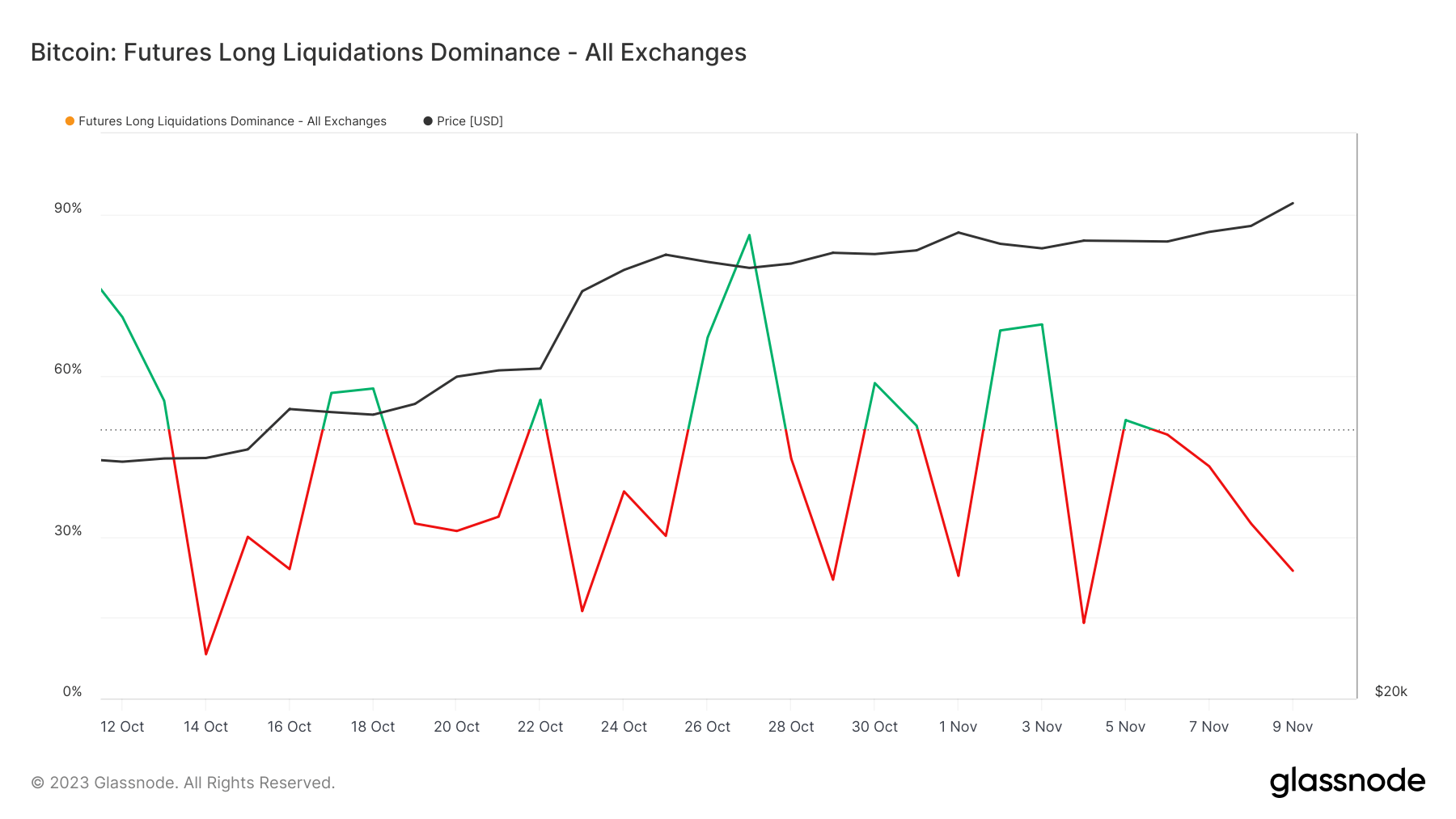

The long liquidations dominance at 23.73% on Nov. 9 implies that while there were significant long liquidations, the market predominantly experienced a squeeze on short positions.

Monitoring the futures market is vital as it indicates trader sentiment and potential price movements. The rise in liquidations, particularly the sharp increase in short liquidations, can signal a shift in market sentiment and often precedes a price movement, as seen in this instance. Similarly, the rise in volume, especially in a market like Bitcoin’s, can denote heightened investor interest or speculative trading, both of which can significantly impact the price.

The significant increase in short liquidations indicates a strong market correction against bearish bets, reinforcing the bullish trend.

The post Bitcoin futures volume surges 157% as BTC crosses $37k appeared first on CryptoSlate.