On-chain data shows exchanges have registered Bitcoin deposits of about $1.2 billion in the past month.

Bitcoin Exchange Supply Has Seen A Significant Increase In The Past Month

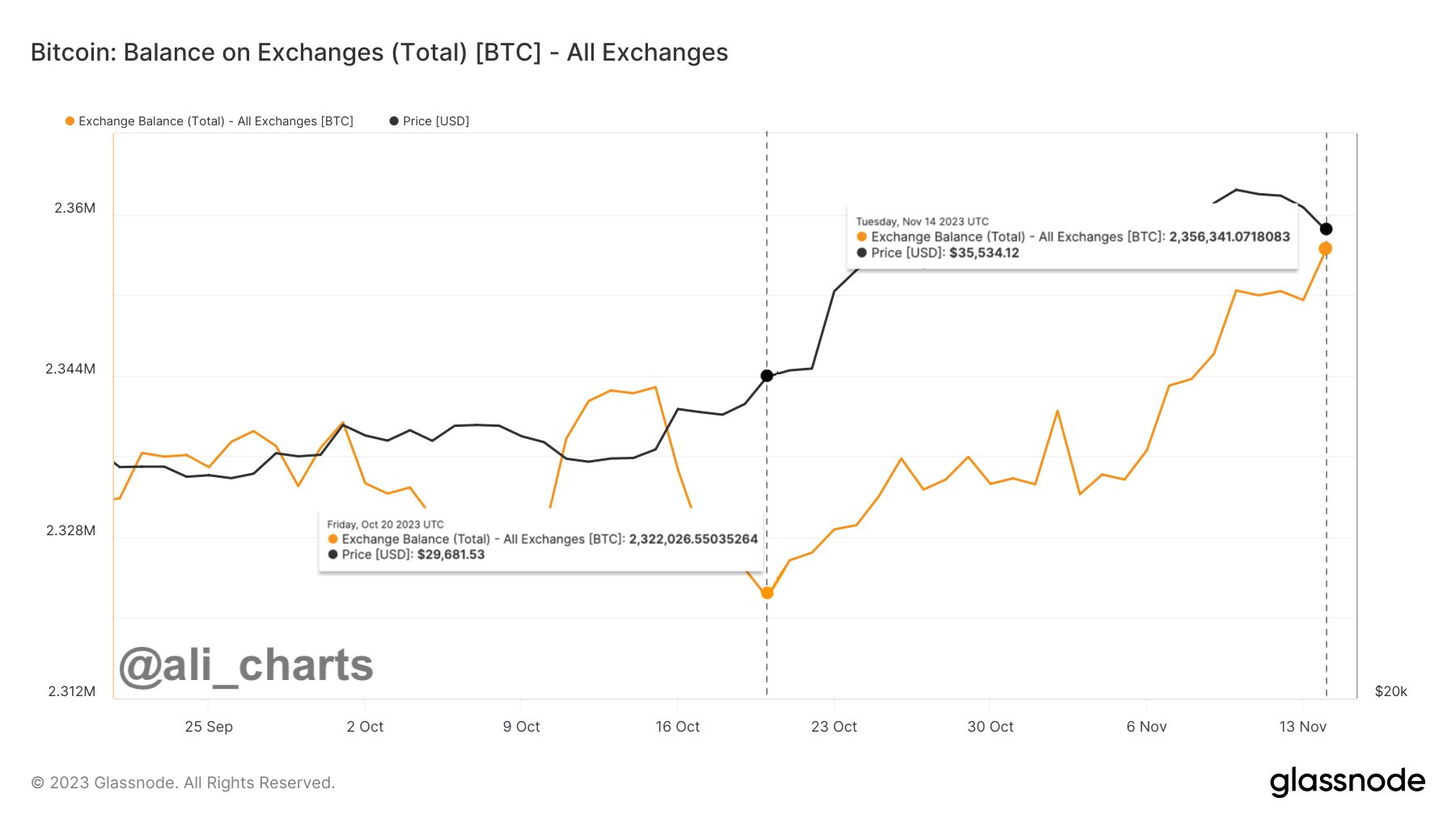

As explained by analyst Ali in a new post on X, exchanges have seen hefty inflows recently. The relevant indicator here is the “balance on exchanges,” which keeps track of the total amount of Bitcoin in the wallets of all centralized exchanges.

When this metric’s value rises, these platforms are receiving a net amount of deposits right now. Generally, one of the main reasons investors would choose to transfer their coins to exchanges from their self-custodial wallets is for selling purposes, so a high amount of inflows can be a sign that a selloff may be taking place in the market.

On the other hand, the indicator’s value going down suggests the holders are withdrawing their coins currently. The investors usually transfer their BTC to self-custodial wallets to hold onto them for extended periods. This kind of behavior, when sustained, could prove to be bullish for the price in the long term.

Now, here is a chart that shows the trend in the Bitcoin balance on exchanges over the past couple of months:

As displayed in the above graph, the Bitcoin balance on exchanges has been rising during the past month, suggesting that a net amount of supply has been constantly flowing into these platforms.

This latest uptrend in the indicator started around when BTC’s recent upward push began, a potential sign that the deposits were being made to take advantage of the profitable exit opportunity.

The metric’s rise had been slow at first, but after Bitcoin’s latest adventure above $37,000, the exchanges have seen a sharp growth in their supply. This elevated selling pressure could be why the asset has slowed down in the last few days.

The exchanges have received inflows of about 34,000 BTC in the past month, equivalent to about $1.2 billion at the current exchange rate. While this is significant selling pressure in the short-term, this amount is still not much in the grand scheme of things, as the total balance on exchanges is of the scale of more than 2.5 million BTC right now.

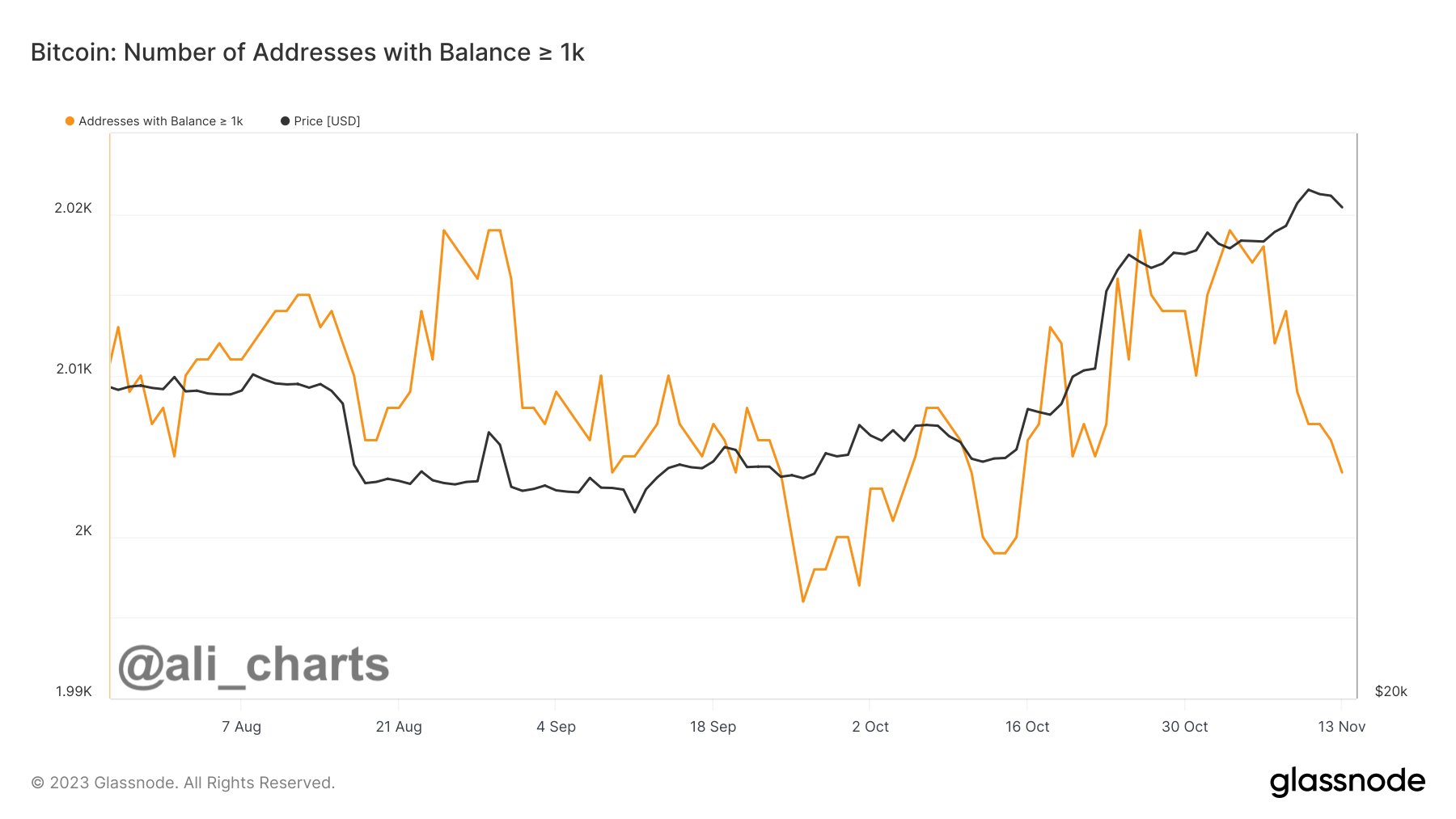

The recent increased selling pressure in the market is also visible in the form of the number of addresses owned by the whales (entities holding at least 1,000 BTC), as the chart shared by the same analyst shows.

The number of addresses under this cohort has seen a notable decline recently, implying that these humongous investors have been selling off their coins and exiting the sector.

BTC Price

Bitcoin has registered some decline during the past few days as its price is now floating around the $36,000 level.