As the primary holding area for unconfirmed Bitcoin transactions, the mempool offers vital insights into the network’s operational status.

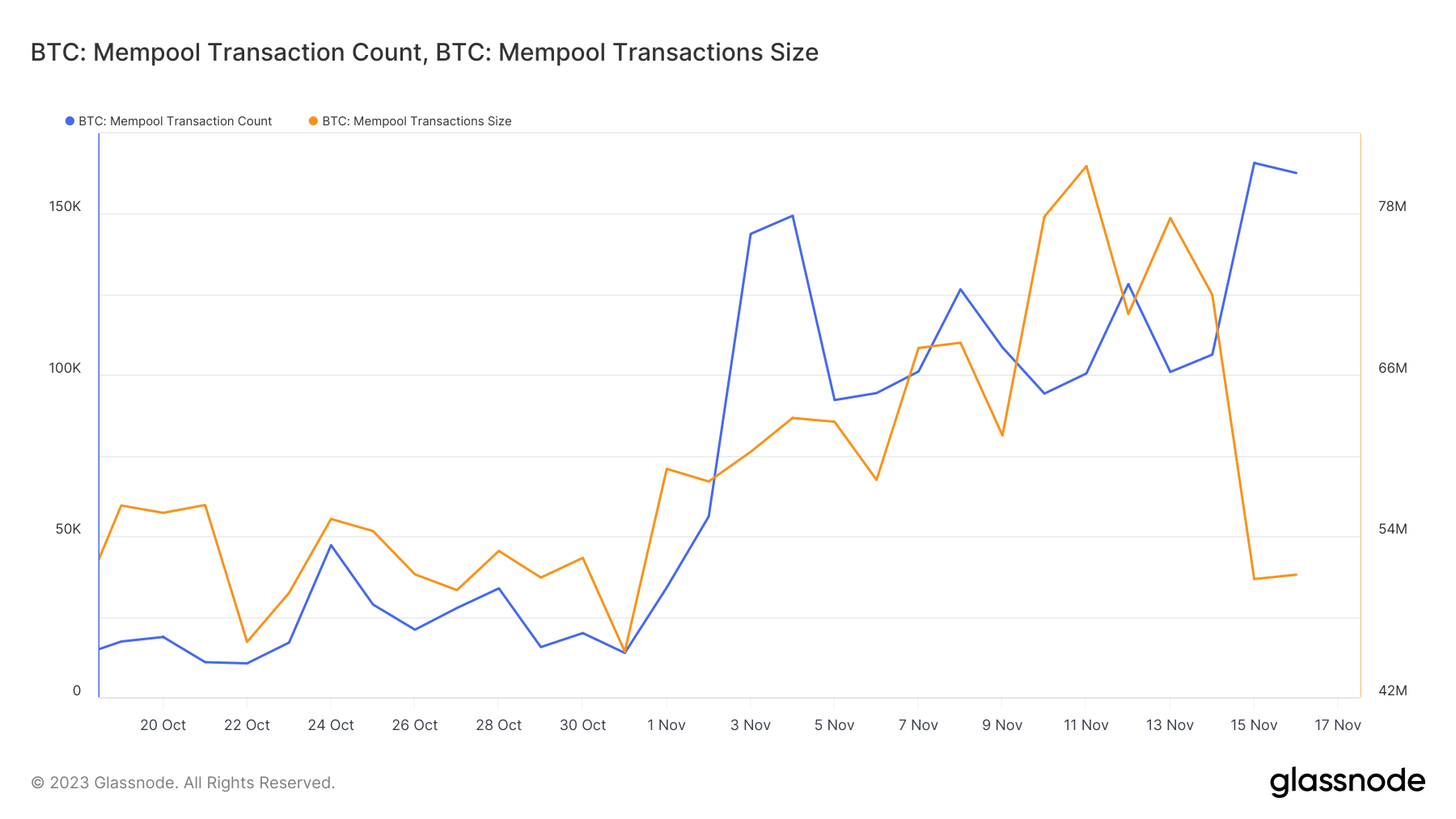

High fees within the mempool typically signal increased network activity and potential congestion, impacting transaction processing times and user costs. There has been a notable increase in both the number of transactions and the total size of transactions in the Bitcoin mempool throughout November.

From late October to mid-November 2023, the number of transactions swelled from 13,778 to 165,829, while the total transaction size escalated from 45.3 million to 81.5 million virtual bytes, eventually decreasing to 50 million. This correlation signifies heightened network usage and congestion, leading to longer wait times for transaction confirmations.

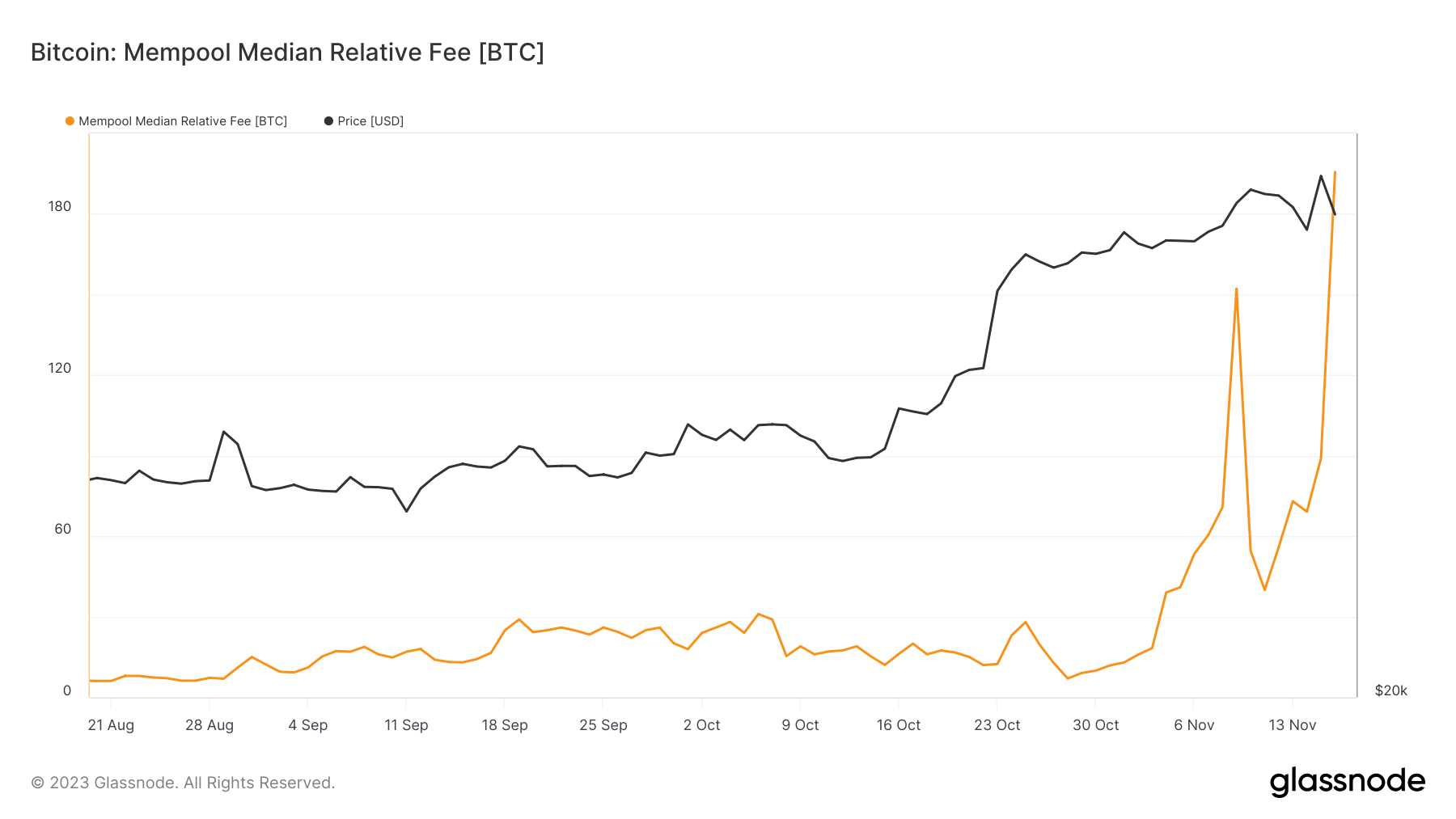

Another uptick was observed in the median and average transaction fees within the mempool. The average fee jumped from 14.85 BTC to 207.6 BTC, and the median fee increased from 11.8 BTC to 195.6 BTC over the same period. These figures reflect the growing cost burden on Bitcoin users, especially during peak activity periods.

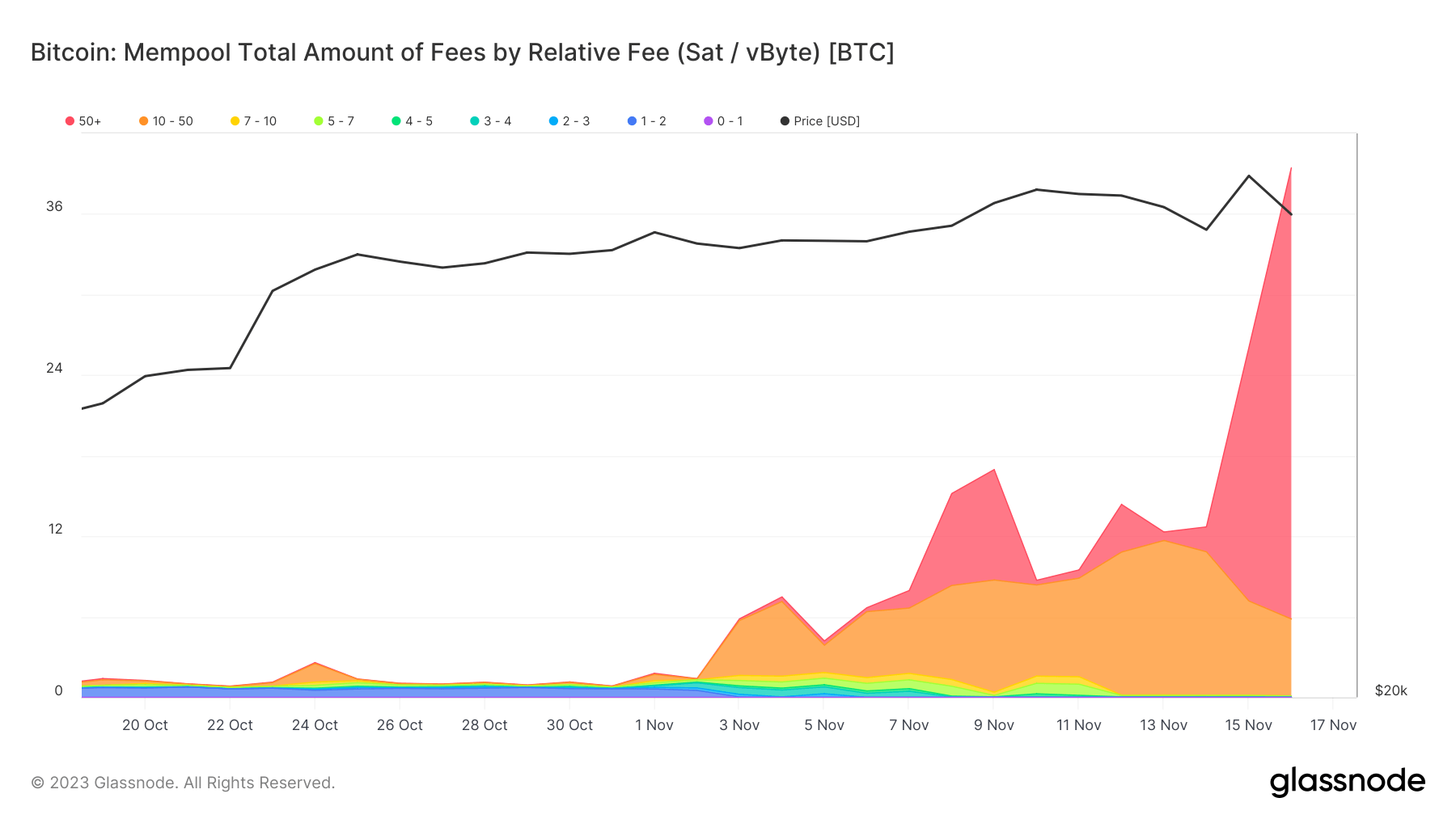

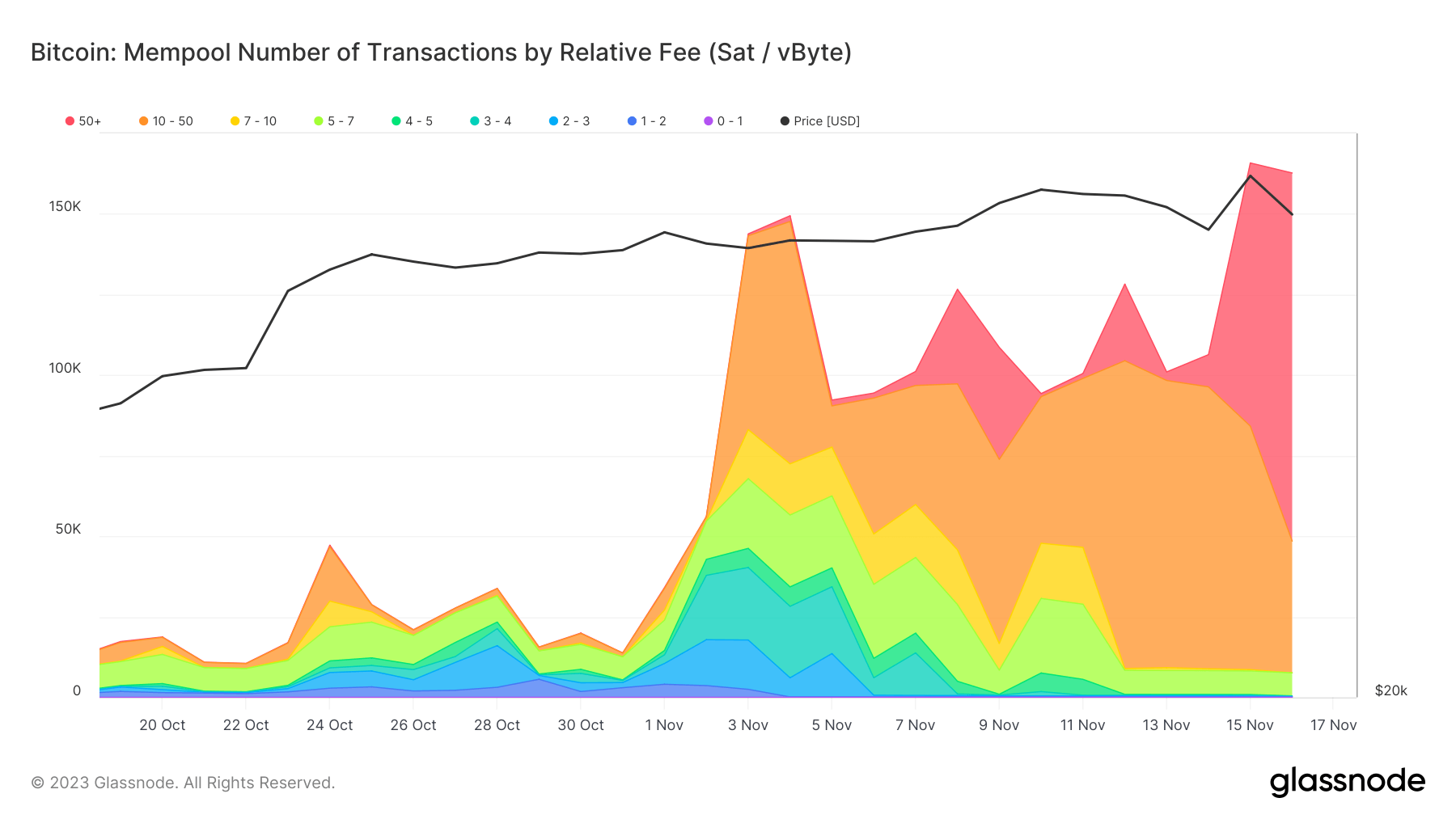

Diving deeper, Glassnode data reveals significant insights into the total amount of fees across different relative fee cohorts, measured in Satoshis per virtual byte (Sat/vByte). The distribution of fees across various brackets like 10-50 and 5-7 Sat/vByte indicate a wide range of transactions, from small-scale transfers to high-value exchanges.

Particularly noteworthy is the presence of transactions in the 50+ bracket, showing that some users were willing to pay premium fees for faster processing, a testament to the urgency or importance of these transactions.

Parallel to this, each fee bracket’s total number of transactions paints a picture of user behavior under varying network conditions. The concentration of transactions in lower fee brackets suggests a preference for cost efficiency. In contrast, the fewer, high-fee transactions imply a willingness among a smaller group of users to prioritize speed over cost.

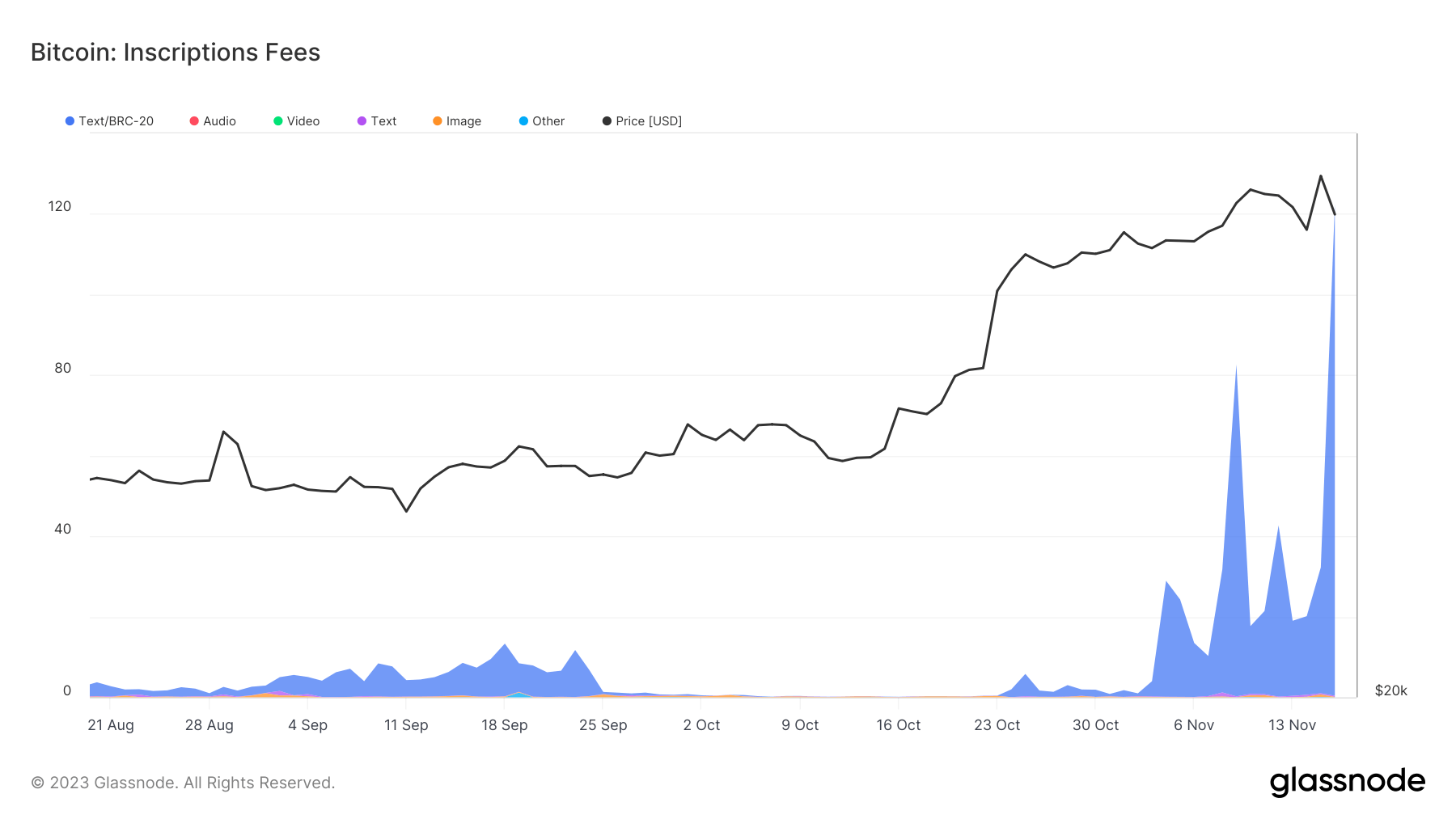

Inscription fees have grown substantially since the beginning of November – from 0.8 BTC to 122.4 BTC. This increase, in tandem with the general hike in transaction fees, signifies a growing financial burden on users engaging in these specific transaction types.

The market implications of these trends are profound. For one, the surge in inscription fees emerges as a significant driver of the overall fee increase. This phenomenon points to a rising demand for specific transaction types. Furthermore, the escalation in fees and mempool congestion could deter potential users, push current users to seek alternatives, or forego using the network entirely, potentially affecting Bitcoin’s market position.

The post Mempool overload leads to skyrocketing Bitcoin transaction costs appeared first on CryptoSlate.