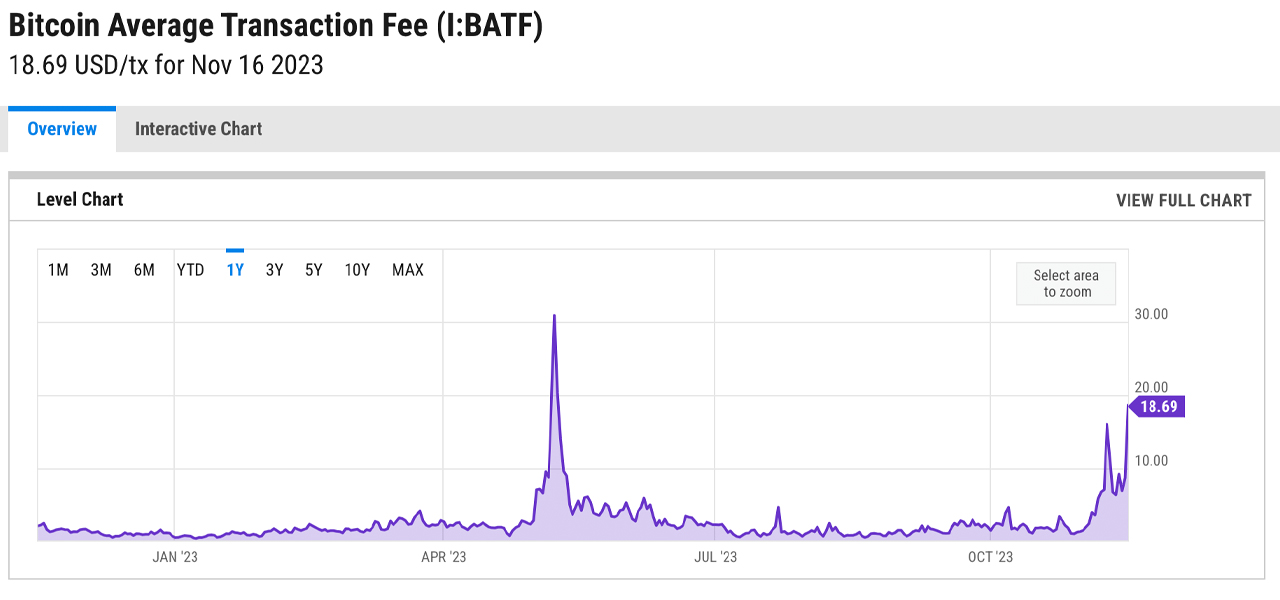

On Thursday, November 16, 2023, Bitcoin saw its average transaction fees peak at $18.69 per transfer, marking a high of 0.00051 BTC. This surge represented the second-largest increase in 2023. However, the following day saw a reduction in onchain fees. Despite this, as of 8:13 a.m. Eastern Time, there was a considerable backlog of approximately 239,862 unconfirmed transactions.

Onchain Fees on Bitcoin Network Soar, Reaching Near-Record Heights

On the same day, data from bitinfocharts.com and ycharts.com revealed that the Bitcoin network’s average transaction fee was $18.69. The median fee also escalated to 0.00032 BTC or $11.61 per transfer.

This increase in transactional activity can be attributed to the renewed interest in Ordinal inscriptions, a trend that persists. According to November 17 statistics from mempool.space, a high-priority BTC transaction incurs a fee of $4.61, while a no-priority transaction costs about $1.64.

The mempool is currently dealing with a backlog of 239,862 pending transactions, awaiting miner confirmation. Clearing this congestion requires miners to process 288 blocks or 588 megabytes (MB) of block space.

Data from two distinct sources suggest that Bitcoin’s average block time oscillates between 9 and 10.1 minutes. Notably, the average fee on November 16 is the year’s second-highest, trailing only behind May 8, 2023, when fees averaged around $31 per transaction that day.

Moreover, on November 9, 2023, the average fee rose to $15.86 per transfer, marking the third-highest spike since May’s all-time high. Bitcoin’s highest fee run-up before the May 2023 spike was a high of $62 per transfer 940 days ago on April 21, 2021.

What do you think about Bitcoin’s network fees on the rise again? Share your thoughts and opinions about this subject in the comments section below.