The countdown to the next Bitcoin halving has begun, with projections pointing towards April 20, 2024, exactly five months away. This event, merely 22,000 blocks away, underpins one of the most significant occurrences in the Bitcoin lifecycle, significantly influencing the market dynamics.

CryptoSlate observed a significant surge in the Bitcoin hash rate – the computational power used to process transactions and generate new blocks in the Bitcoin network. On Nov. 19, the network recorded its single biggest one-day hash rate of over 550 exahashes per second (EH/s). This surge is indicative of the increased activity of miners.

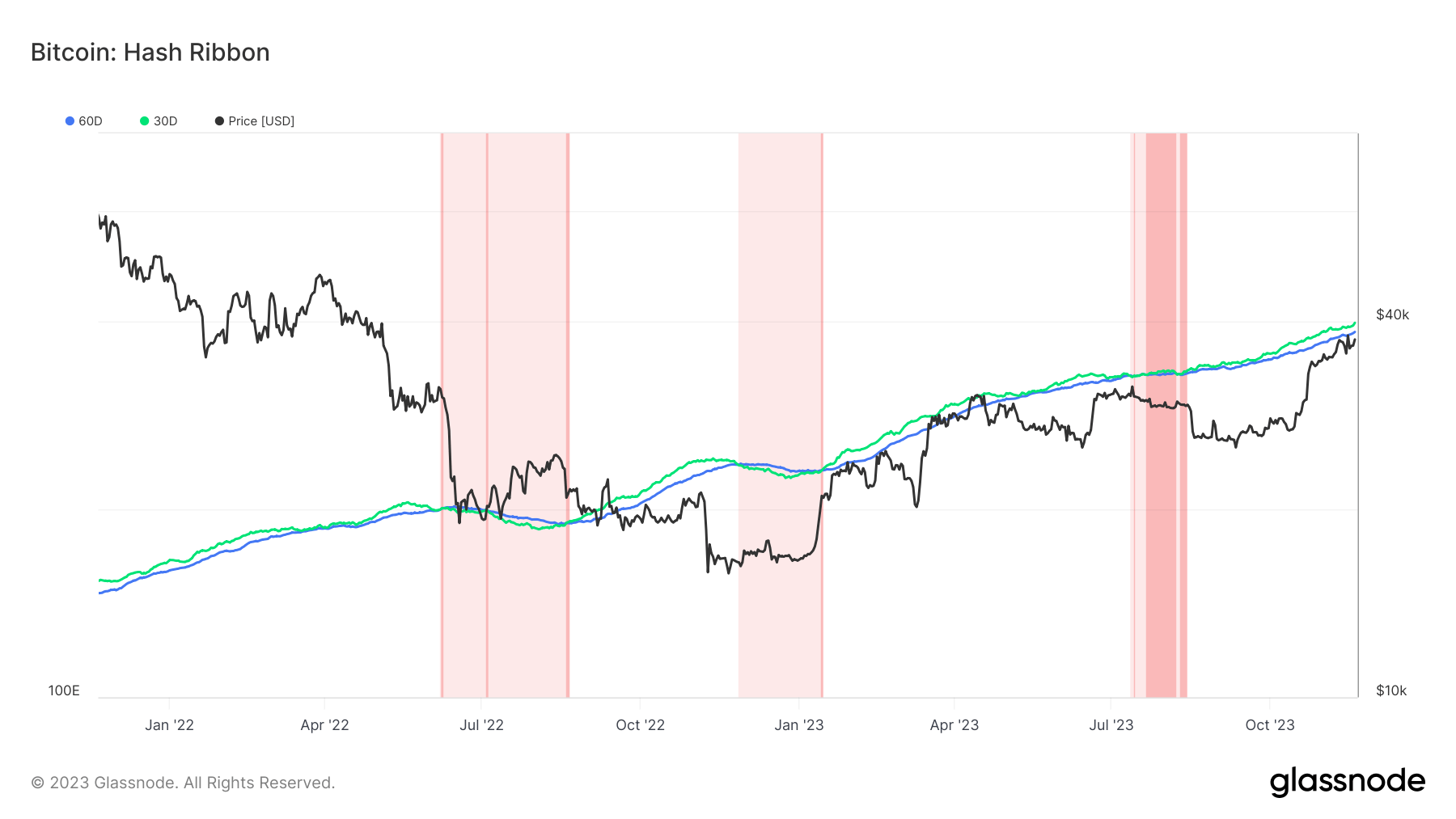

The Hash Ribbon, a critical market indicator, has been instrumental in assessing the state of the Bitcoin mining ecosystem. It postulates that Bitcoin typically bottoms out when miners capitulate – when the cost of mining surpasses the profitability. A cross, characterized by the 30-day moving average (MA) of the hash rate above the 60-day MA, usually indicates the end of miner capitulation. Historically, such instances, coupled with a shift from negative to positive price momentum, have presented attractive buying opportunities.

Over the past two years, there have been only three instances of miner capitulation, each signaling a local bottom: the Luna collapse in June 2022, the FTX collapse in November 2022, and the downturn in August 2023. The Bitcoin mining ecosystem currently sees one of the most significant divergences between the 30-day and 60-day hash rate averages. This trend illustrates that miners seize every opportunity to plug into the network, further bolstering the network’s computational power.

Projections for the next difficulty epoch – the period between difficulty adjustments in Bitcoin mining – hover around 9.5 minutes. This estimate sets the anticipated timing of the halving between April 18 and April 23, 2024, a range that will be subject to changes in the network’s hash rate.

| Block Time | Halving Estimate |

|---|---|

| 9:00 | 8 April 2024 at 05:59:47 |

| 9:20 | 13 April 2024 at 10:02:07 |

| 9:40 | 18 April 2024 at 14:04:27 |

| 10:00 | 23 April 2024 at 18:06:47 |

| 10:20 | 28 April 2024 at 22:09:07 |

| 10:40 | 4 May 2024 at 02:11:27 |

| 11:00 | 9 May 2024 at 06:13:47 |

Source: bitcoin.clarkmoody

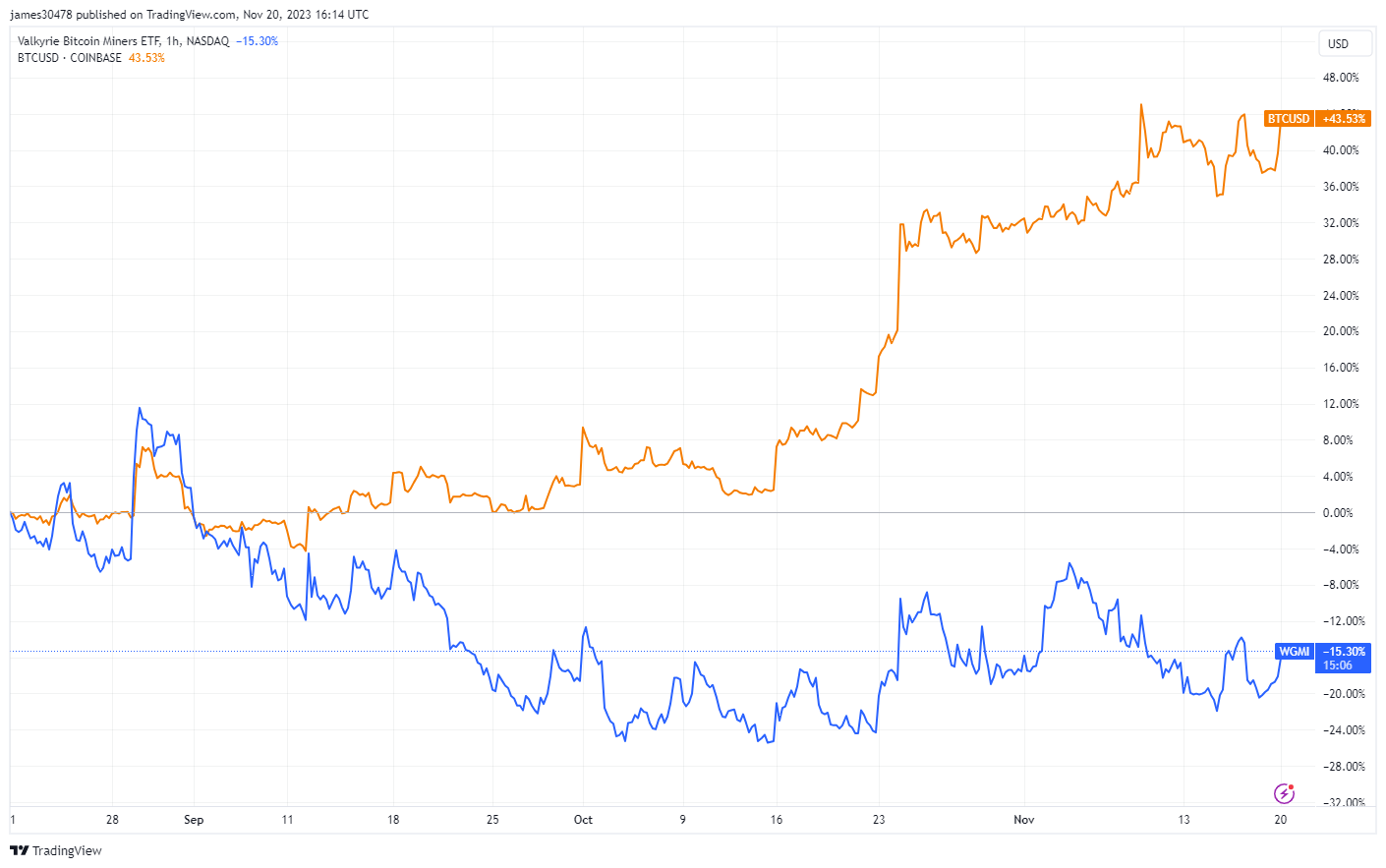

As we inch closer to the next Bitcoin halving, the market’s response, particularly from the miners, will be pivotal in molding the course of Bitcoin. Cryptoslate has previously underscored the importance of monitoring the performance of mining stocks in the lead-up to the halving as a critical indicator of miners’ health.

Over the past three and six months, we have noticed a significant divergence in this area. Bitcoin has seen a substantial surge of 44%, while the proxy mining ETF, WGMI, has experienced a dip of 15%. However, an intriguing query arises: if Bitcoin continues its upward trajectory in value, will mining stocks align with this trend and close the gap? The coming months will be pivotal in determining this correlation.

Market indicators, like the Hash Ribbon and mining stocks share price, will continue to provide valuable insights into the state of the Bitcoin network as we navigate this anticipatory phase.

The post Surge in Bitcoin hash rate signals strong miner commitment before 2024 halving appeared first on CryptoSlate.