The United States Department of Justice (DOJ) has revealed a landmark settlement involving Binance, the world’s largest crypto exchange by trading volume. Under the agreement, Binance will pay $4.3 billion to settle with the law enforcement authority. This significant development was disclosed during a DOJ press briefing on cryptocurrency enforcement, which took place at 3:36 p.m. Eastern Time (ET) on Tuesday.

Crypto Giant Binance Settles for $4.3 Billion With U.S. Justice Department

In line with expectations stemming from a day’s worth of rumors and headlines, the Department of Justice (DOJ) has reached a settlement with Binance, wherein the crypto exchange consents to a payment of $4.3 billion as part of the agreement. The DOJ’s investigation into Binance had been previously reported, indicating an ongoing probe, yet no developments occurred until now. According to the DOJ, Binance breached certain anti-money laundering (AML) and sanctions regulations since the investigation commenced.

The press conference featured Attorney General Merrick Garland, Secretary of the Treasury Janet Yellen, Deputy Attorney General Lisa Monaco, and Chairman Rostin Behnam of the Commodity Futures Trading Commission (CFTC). “Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed – now it is paying one of the largest corporate penalties in U.S. history,” Attorney General Garland said. He added:

In just the past month, the Justice Department has successfully prosecuted the CEOs of two of the world’s largest cryptocurrency exchanges in two separate criminal cases. The message here should be clear: using new technology to break the law does not make you a disruptor, it makes you a criminal.

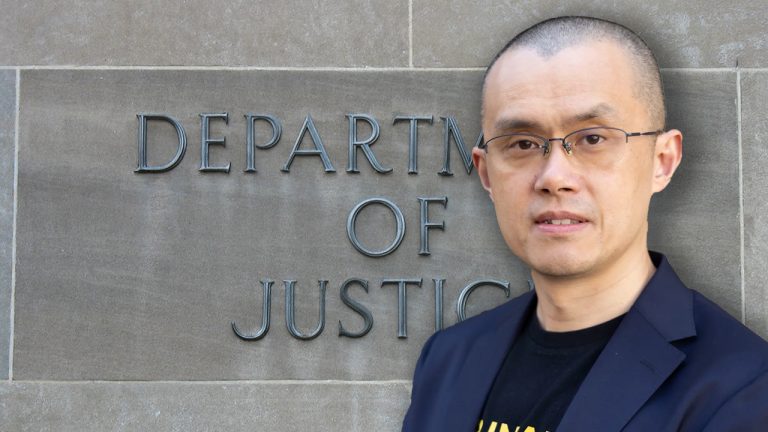

This agreement between Binance, the DOJ, Treasury, and the Commodity Futures Trading Commission (CFTC), marks the conclusion of the ongoing investigation. Binance’s Chief Executive, Changpeng Zhao (CZ), intends to resign and has pleaded guilty to infringing upon U.S. criminal anti-money laundering laws in a Seattle courtroom. CZ’s deal will be similar to the former Bitmex CEO Arthur Hayes’s plea bargain when he pleaded guilty to violating the Bank Secrecy Act (BSA).

In court documents unsealed on Tuesday, the DOJ disclosed that since as early as August 2017, CZ and several other employees “knowingly failed to register as a money services business.” The executives “willfully violated the Bank Secrecy Act by failing to implement and maintain an effective anti-money laundering (AML) program, and willfully caused violations of U.S. economic sanctions issued pursuant to the International Emergency Economic Powers Act.” While Binance is pleading to three counts, CZ’s guilty plea involves BSA violations and comes with millions of dollars in civil penalties.

Binance agreed to a total financial penalty of $4.316 billion, which includes forfeiting over $2.5 billion and paying a criminal fine of approximately $1.8 billion. Additionally, Binance will appoint an independent compliance monitor for three years to improve its anti-money laundering (AML) and sanctions compliance programs. The company has also reached settlements with the CFTC, FinCEN, and OFAC, with the Department crediting about $1.8 billion towards those agreements.

The DOJ further detailed that the resolution considers Binance’s failure to voluntarily disclose its misconduct and its delayed cooperation with the investigation, resulting in a 20% reduced penalty. CZ admitted to serving U.S. users without proper registration and prioritizing the company’s growth over legal compliance, leading to transactions in violation of U.S. sanctions.

CZ also posted about the actions on Tuesday and said that he’s passing the leadership to Richard Teng, Binance’s former Global Head of Regional Markets. “I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself,” the Binance founder said.

What do you think about the DOJ’s deal with Binance? Share your thoughts and opinions about this subject in the comments section below.