A new era for the crypto industry approaches as the world’s largest exchange, Binance, changes leadership. Yesterday, the company’s founder and CEO, Changpeng “CZ” Zhao, stepped down as part of an agreement with the US government.

The deal might have sparked a new era of adoption and legitimacy for the nascent industry at the cost of CZ’s position and a $4 billion fine. Fresh data looked into Binance’s transactions to check if users believe in the company’s future following the historic decision.

Binance Safe From FTX Like Bank Run?

According to crypto analysis firm Nansen data, Binance recorded almost $1 billion in negative netflow following yesterday’s news. The data indicates that the platform’s USDT value decreased by $246 million, followed by Bitcoin’s value, which declined by $76 million.

Users who feel uncertain about the platform’s future withdraw their money, potentially triggering a bank run. However, Nansen’s data shows that this scenario is far from materializing in this trading venue.

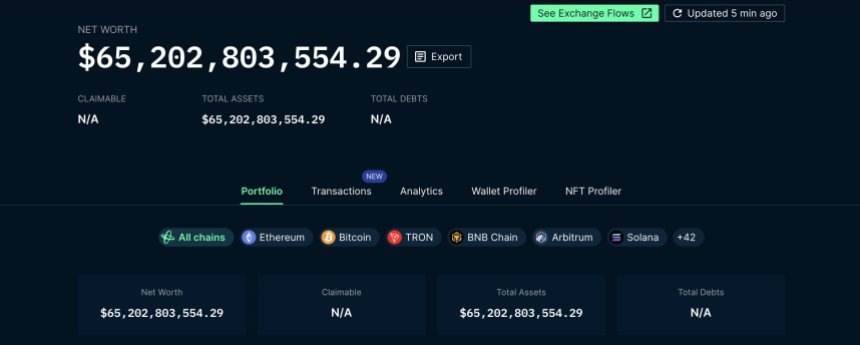

While the negative netflows stand at $955 million, there is no “mass exodus” or panic from users trading on Binance. Nansen claims the platform’s holding value increased from $64.6 billion to $65.2 billion.

The analytics firm previously stated that Binance handled bigger net flows. First, when the US Securities and Exchange Commission (SEC) filed a lawsuit against the company, and later, when FTX went bankrupt following a massive bank run.

As mentioned, Binance seems unlikely to follow a similar fate. Nansen stated:

In the past, Binance has processed higher volumes of outflow and negative netflow: Jun 2023 after the SEC sued Binance, December 2022 after insolvency rumors, and the immediate aftermath of FTX. We will provide another update 24 hours after the news originally broke.

CZ’s Departure Forecast Good Times For Crypto

Across the crypto community, the debate around CZ’s departure has been fierce. However, the consensus is optimistic.

A report from The Block cites major banking institution JPMorgan claiming that the Binance deal removes a “systemic risk” for the industry. In 2022, when FTX collapsed, the price of Bitcoin crashed to a low of $15,000 and took months to recover.

With 150 million users on its platform and millions of capital injected into multiple ecosystems. Binance’s collapse would have been equally, if not more, catastrophic than FTX for the nascent industry.

JPMorgan analyst Nikolaos Panigirtziglou told The Block:

We see the prospect of settlement as positive as uncertainty around Binance itself would subside and its trading and Smart Chain business would benefit. For crypto investors the prospect of settlement would see the elimination of a potential systemic risk emanating from a hypothetical Binance collapse.

Cover image from Unsplash, chart from Tradingview