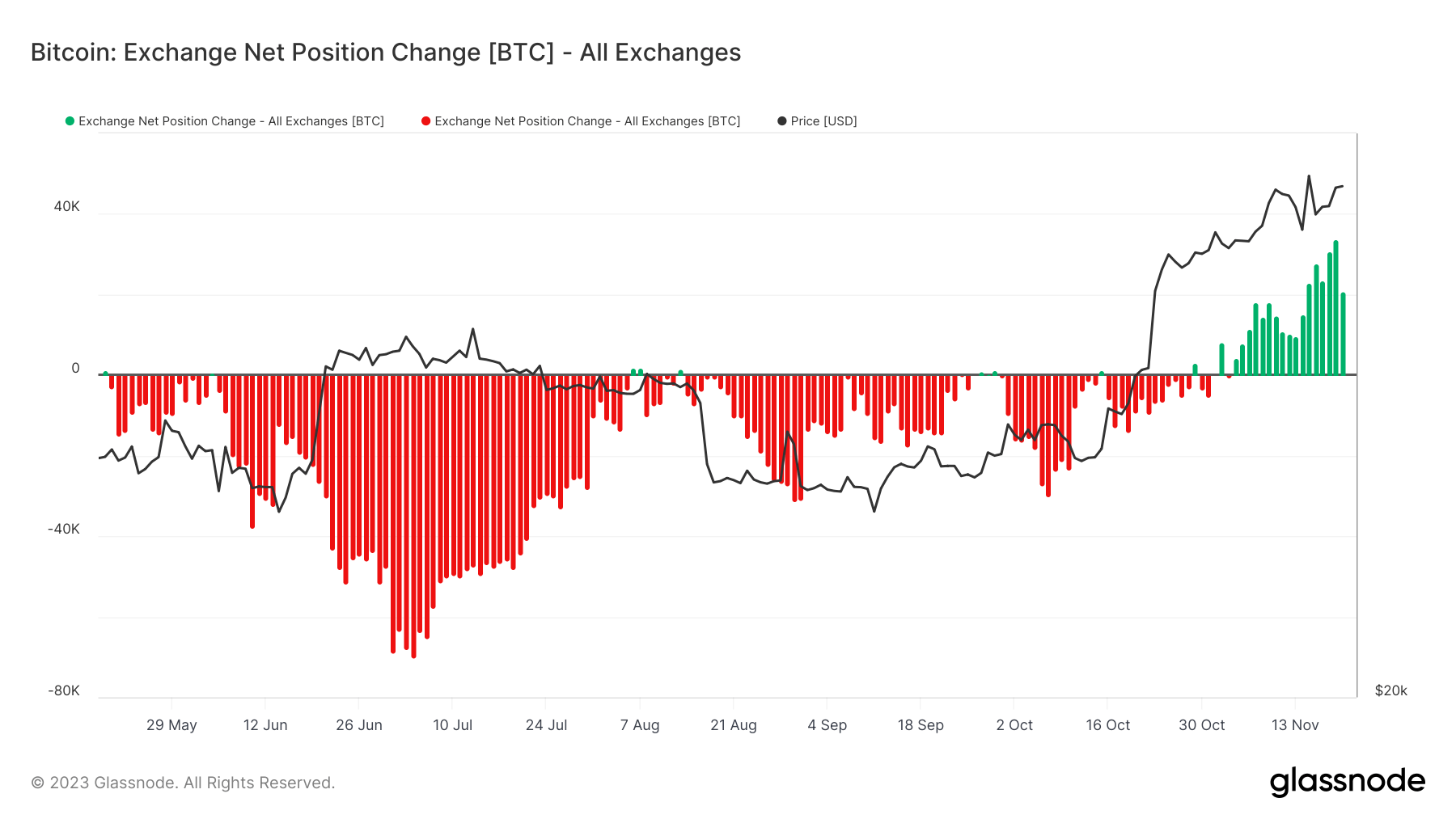

After six months of Bitcoin exchange withdrawals outpacing deposits, a reversal occurred this month, signaling a change in holder behavior.

The exchange net flow, which measures the difference between Bitcoin deposits and withdrawals on exchanges, turned positive at the beginning of November, indicating a renewed interest in exchange activities among Bitcoin holders.

This shift is particularly significant given the negative inflows that persisted from May 20 to Oct. 31, suggesting a period where holders were more inclined to store their Bitcoin off exchanges, possibly for long-term holding or in anticipation of market recovery. However, this trend reversed in November, with the exchange net position change showing a distinct increase in Bitcoin being moved to exchanges. This influx peaked on Nov.19, when a staggering 33,854 BTC were deposited onto exchanges. Such a substantial spike can often be interpreted as a sign of holders preparing to sell or trade their Bitcoin, possibly due to changing market conditions or to capitalize on price movements.

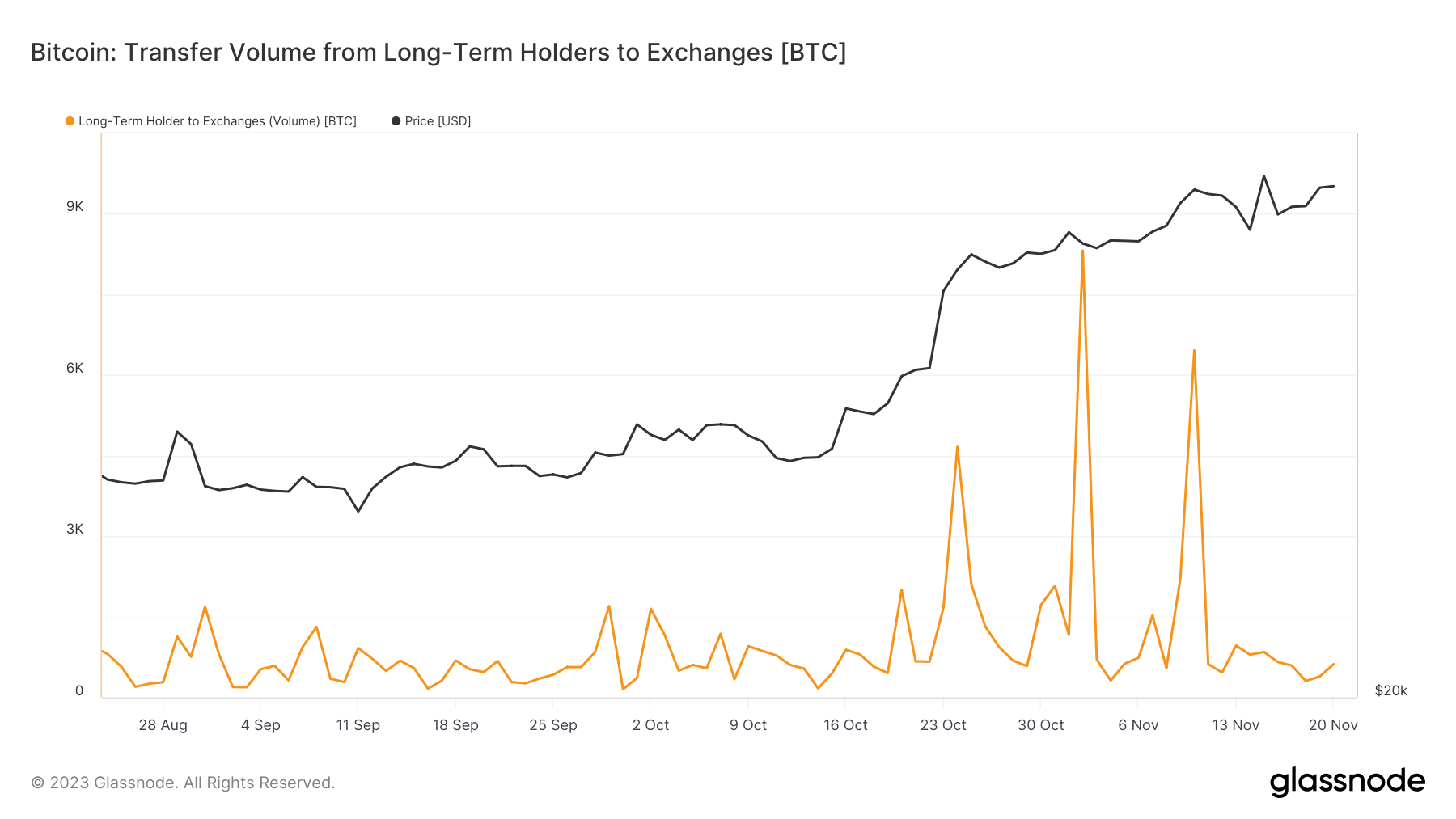

Analyzing the transfer volumes by specific cohorts of holders provides more profound insight. The transfer volume from long-term holders (LTHs) to exchanges is particularly noteworthy, with two significant spikes occurring in November: 1,163 BTC on Nov. 1 and a more significant 8,318 BTC on Nov. 2. These transfers suggest that some LTHs, typically characterized by their tendency to hold assets through various market cycles, chose to move their holdings to exchanges, possibly indicating a shift in their long-term investment strategies or reactions to current market dynamics.

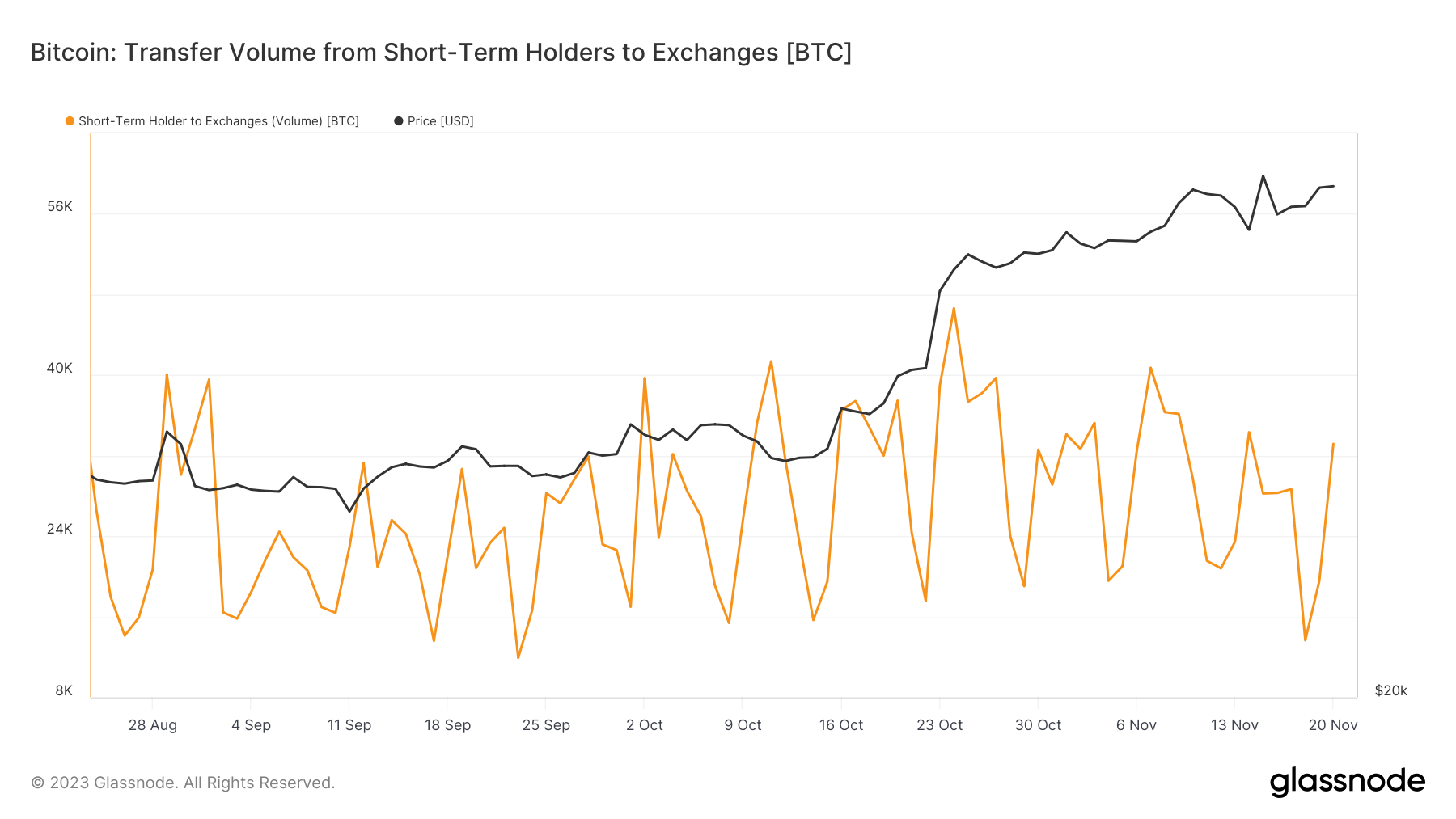

In contrast, the transfer volume from short-term holders (STHs) to exchanges was markedly higher, reflecting their more active and responsive trading behavior. Significant inflows were observed on several days, including 34,111 BTC on Nov. 1 and 33,170 BTC on Nov. 20. These figures align with the year’s average but are indicative of the volatile nature of short-term holding, where investors are more likely to react to immediate market changes.

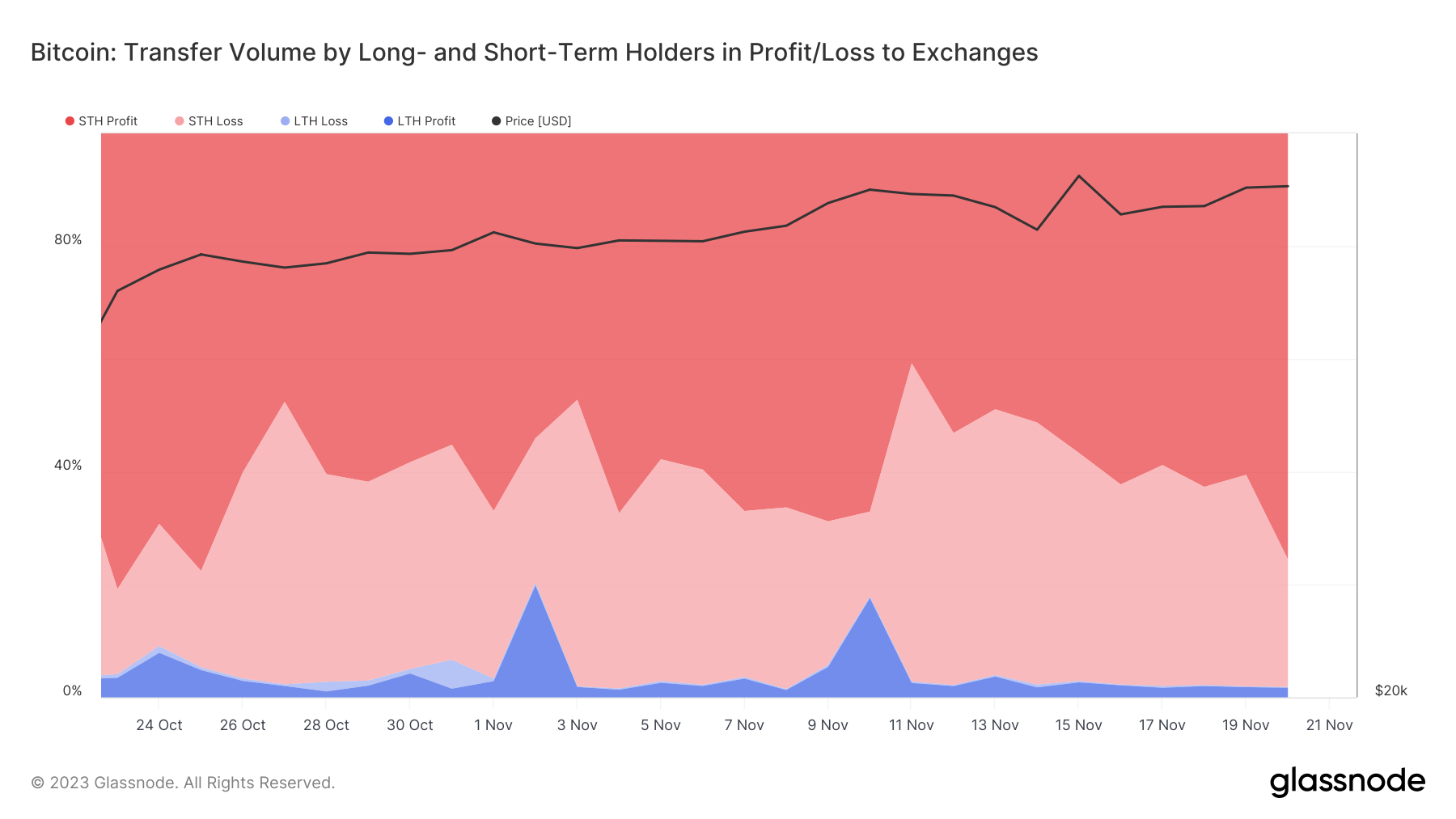

Another critical measure to consider is the amount of Bitcoin moved to exchanges by long-term and short-term holders and whether they are making a profit or loss. This metric reveals the percentage of holders in profit during their transfers. On Nov. 1, 66.9% of STHs and only 2.8% of LTHs were profitable, reflecting these two groups’ different investment horizons and strategies. By Nov. 20, the percentage of profitable STHs increased to 75.5%, while that of LTHs decreased to 1.69%. This trend indicates that more STHs, more attuned to short-term price movements, were capitalizing on their profits.

The increased exchange inflows from STHs and LTHs, particularly with a significant portion of STHs in profit, suggest a market where short-term trading dynamics are increasingly influential. STHs, buoyed by recent profits, are driving this trend, potentially looking to lock in gains amidst fluctuating prices. However, despite these movements, Bitcoin’s price remained relatively stable, rising slightly from $35,421 on Nov. 1 to $37,485 on Nov. 20.

This stability, despite the increased exchange inflows and selling pressure, might suggest a robust underlying demand absorbing the sell-off, or a market still in equilibrium, waiting for a more decisive directional move.

The post Surge in Bitcoin exchange deposits breaks six-month withdrawal streak appeared first on CryptoSlate.