Token unlocks for cryptocurrencies such as AVAX are not new but that does not negate the kind of impact that these unlocks can have on the price. Depending on the size of the unlock, it could trigger a market crash as millions of new coins roll into circulation and are dumped on retail. This could certainly be the case for AVAX today given the size of the upcoming unlock.

AVAX Unlock At $204 Million

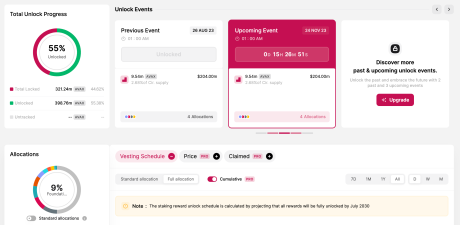

AVAX’s most recent unlock is about to see a total of 9.5 million tokens being brought into the open market. With the price of the altcoin trending above $21, this puts the total value of the unlock at approximately $204 million.

According to data from the Token Unlocks website, this unlock will see another 2.68% of the total token supply added to the circulating supply. This will take the percentage of the total supply already unlocked from 55% to 57.68%. This cliff unlock will continue to inflate the AVAX supply, posing a potential roadblock for rallies as the supply increases.

The standard allocation for this cliff unlock is spread across multiple spheres, with the largest portion going to staking rewards. 50% of the total unlocked tokens usually go to these stakes. Then the team portion is 10%, while the foundation gets 9.3%.

Implications For Token Price

Naturally, an inflation in supply is not good for the token price and this will likely be reflected in the AVAX price soon after. However, taking a look at the last unlock event carrying the same number of coins which took place on August 23, 2023, the chart shows only a small dip in price, suggesting that the unlock event had already been priced in.

If this were to repeat, then it’s possible that the AVAX price could maintain its momentum. But the difference between the current trend and that of August is that the token’s price has risen quickly in the last day. This could trigger selling as investors try to take advantage of the price recovery and secure their gains.

As data from IntoTheBlock shows, the percentage of AVAX holders that are currently sitting in profit has reached a new 20-month high. A total of 4.02 million holders are sitting in profit, which makes up 66% of the total holder base.

The last time that the holder profitability was this high was back in April 2022 when the price was at $94.93. What followed was aggressive profit-taking that would send the price falling more than 70% in a few months. So a repeat of this could see the AVAX price return toward $10.