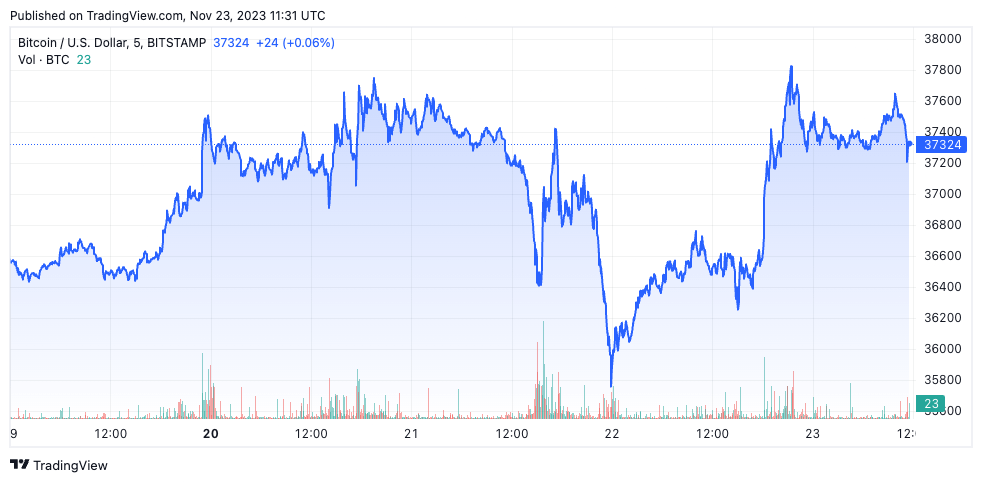

The SEC’s $4 billion fine on Binance and the subsequent stepping down of the exchange’s CEO, Changpeng Zhao, significantly impacted the market. While Bitcoin’s price dipped slightly on Nov. 21, it experienced a significant drop to $35,740 in the early hours of Nov. 22, showing an immediate and aggressive market reaction to the news.

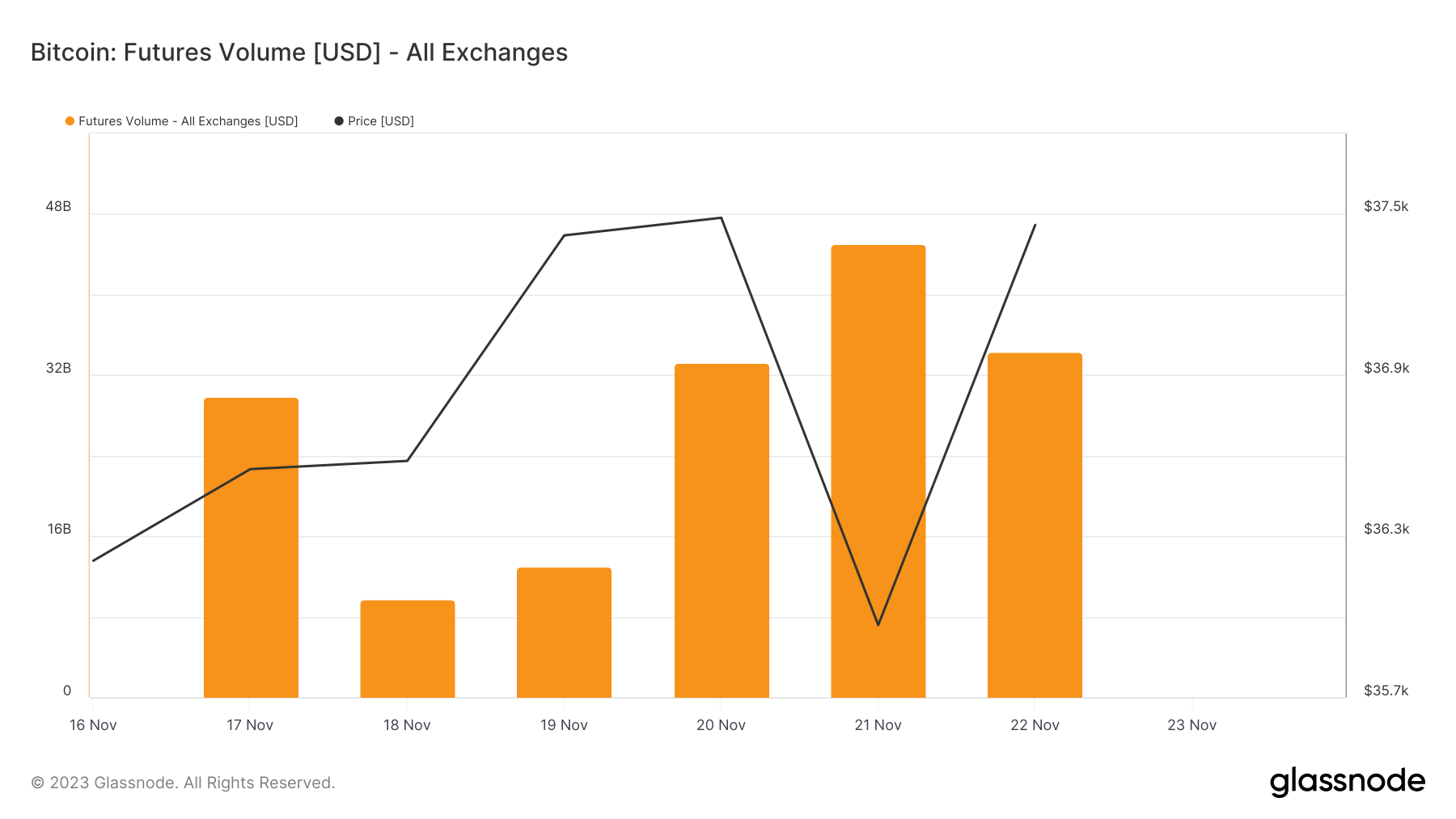

The futures market wasn’t spared from the volatility, experiencing an equally sharp spike in activity. The total volume traded in Bitcoin futures contracts surged to $45.05 billion by Nov. 21, up from $9.79 billion on Nov. 18. This spike, more than quadrupling in a matter of days, shows a flurry of trading activity in the futures market. It likely reflects a mix of speculative trading, hedging strategies, and rapid adjustments by traders in response to the uncertainty and volatility introduced by the news from Binance. The subsequent decrease to $34.3 billion on Nov. 2 indicates a partial normalization but still reflects heightened activity compared to the period before the SEC’s announcement.

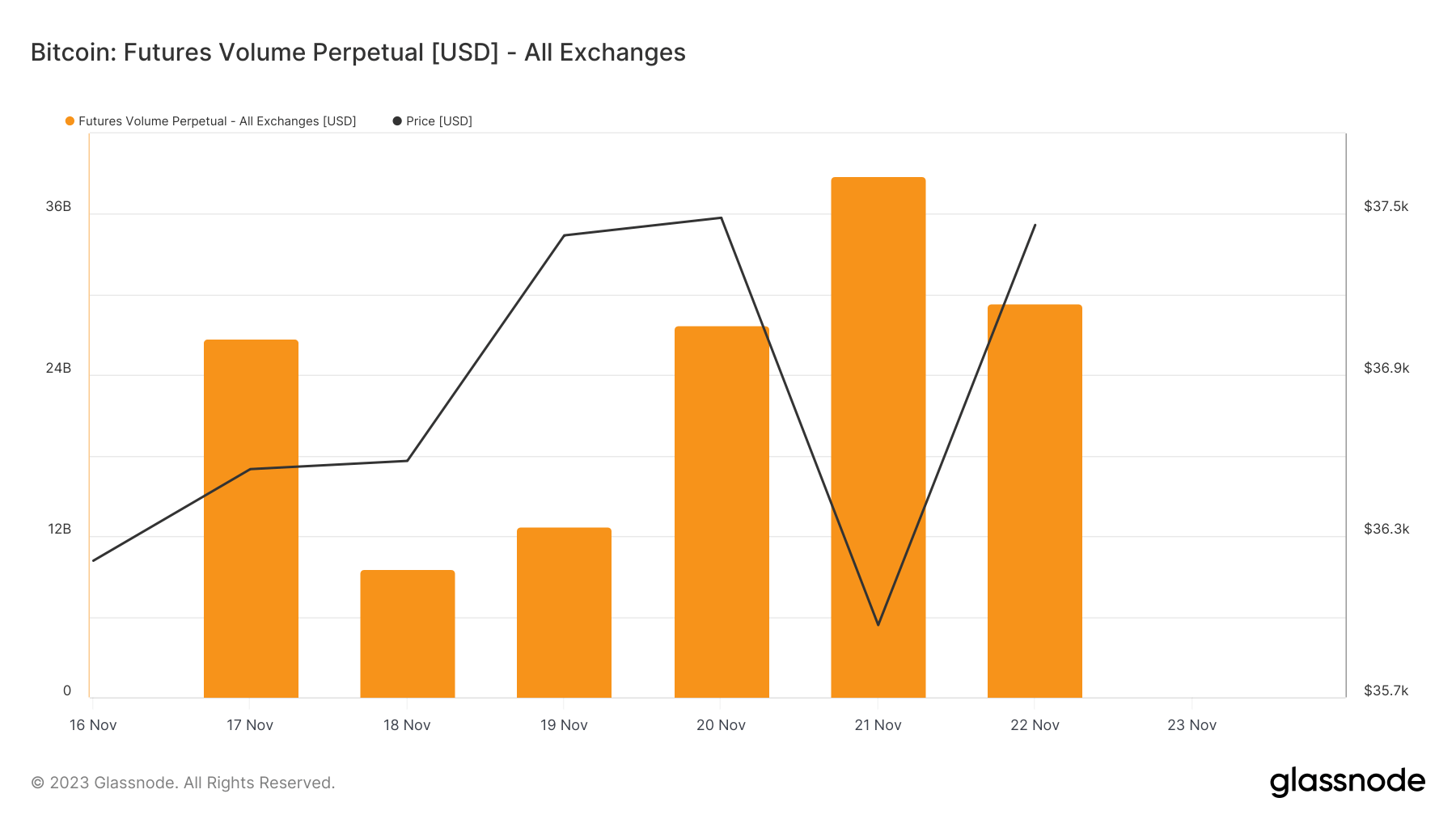

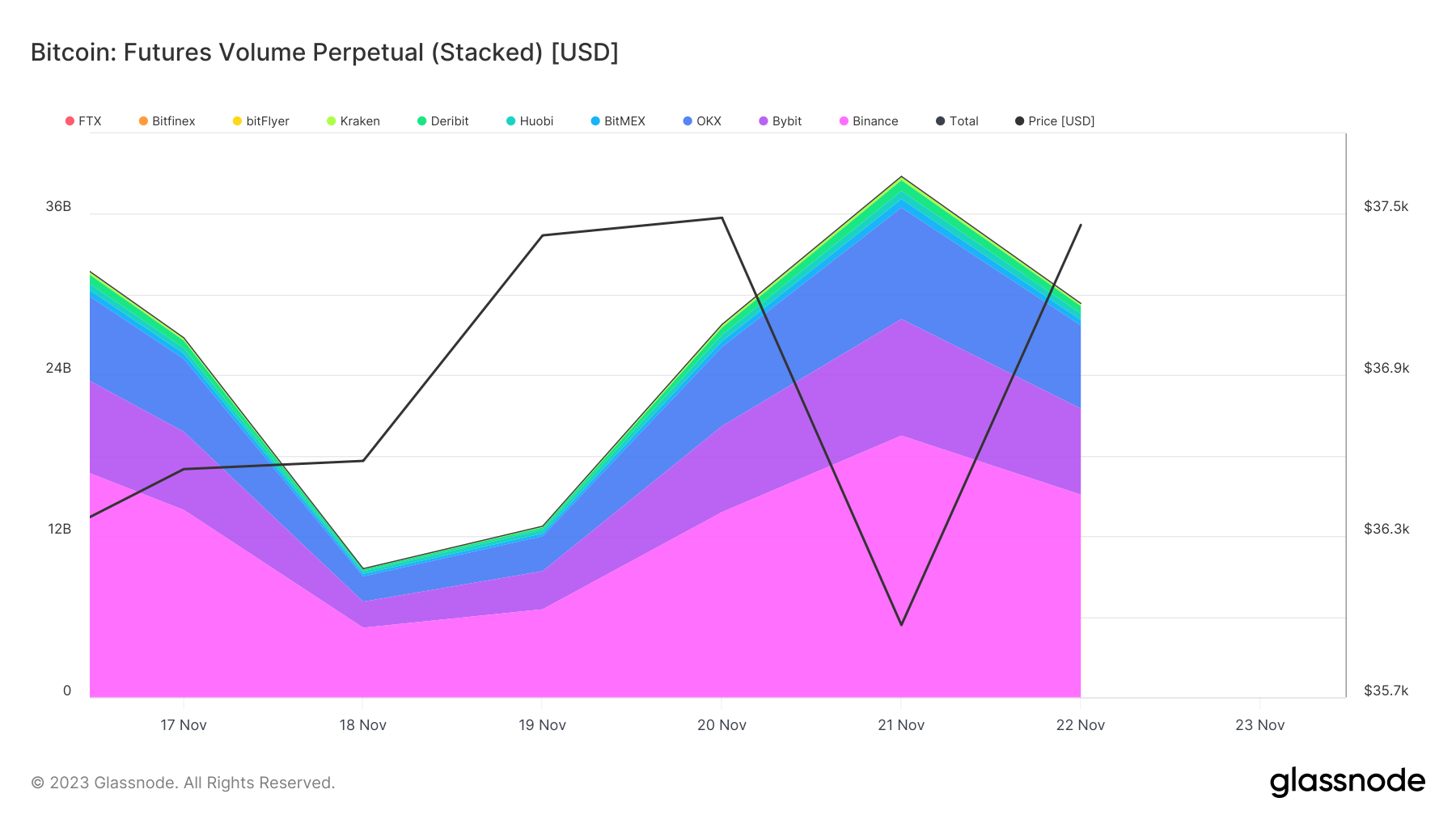

Parallel trends were seen in the perpetual futures market as well. Here, the volume increased from $9.58 billion on Nov. 18 to $38.79 billion on Nov. 21 before reducing to $29.33 billion on Nov. 22. Perpetual futures, being non-expiring contracts, are often favored for long-term positions. The increased volume in this segment shows just how reactive the market is to changes in the industry.

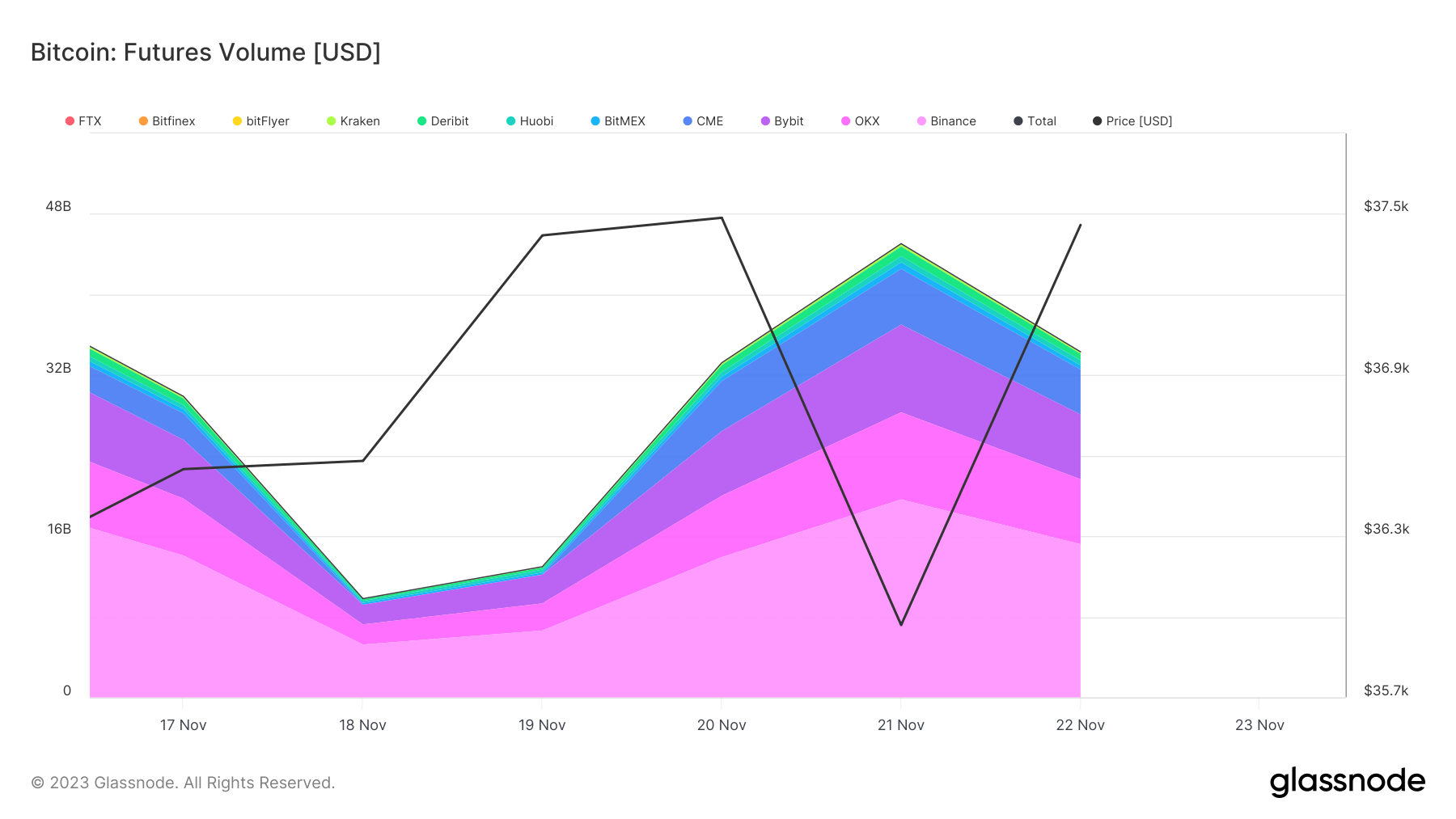

The distribution of volumes across exchanges shows where most of the trading occurred. Binance, directly impacted by the news, saw its futures trading volume jump from $5.24 billion on Nov. 18 to $19.65 billion on Nov. 21. despite the negative news, this increase might indicate traders’ attempts to liquidate positions or capitalize on expected market movements. The similar, though less pronounced, growth in trading volumes on other exchanges like OKX and Bybit, from $2 billion and $1.94 billion, respectively, on Nov. 18 to $8.65 billion and $8.71 billion on Nov. 21, shows a broader market reaction not limited to Binance.

In the perpetual futures segment, Binance’s volume increased from $5.18 billion to $19.48 during the same period, again showing significant trader activity on the platform. The similar increases in volumes on Bybit and OKX show a market-wide response for perpetual futures as well.

The data shows an aggressive but short-lived market reaction to the news of Changpeng Zhao’s stepping down and the SEC fine. A brief dip in Bitcoin’s price below the seemingly-established $36,000 level caused a significant spike in trading volumes across major exchanges. This response highlights the sensitivity of the crypto market to regulatory news and leadership changes in major industry players.

The post Binance turmoil leads to record futures activity – analyzing the impact appeared first on CryptoSlate.