Quick Take

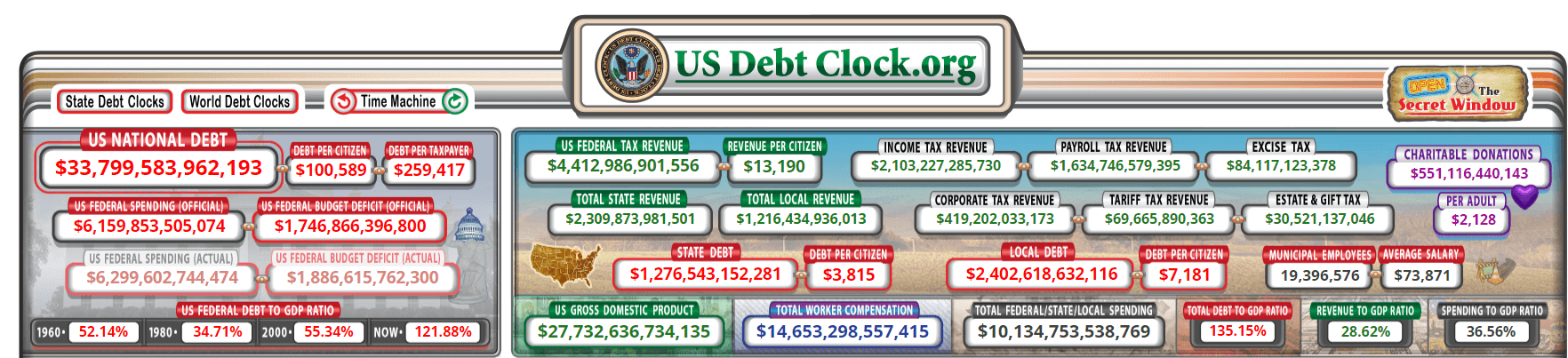

In the current economic climate characterized by the worst inflation over four decades and skyrocketing US government debt exceeding $33 trillion, attention gravitates toward hard assets such as Gold, Silver, and Bitcoin.

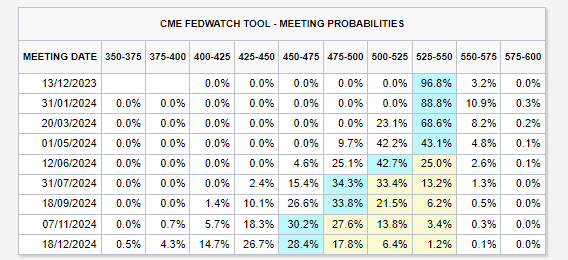

With rate cuts anticipated in 2024 and the DXY recording its second-worst month since 2021, the DXY is under an enhanced spotlight.

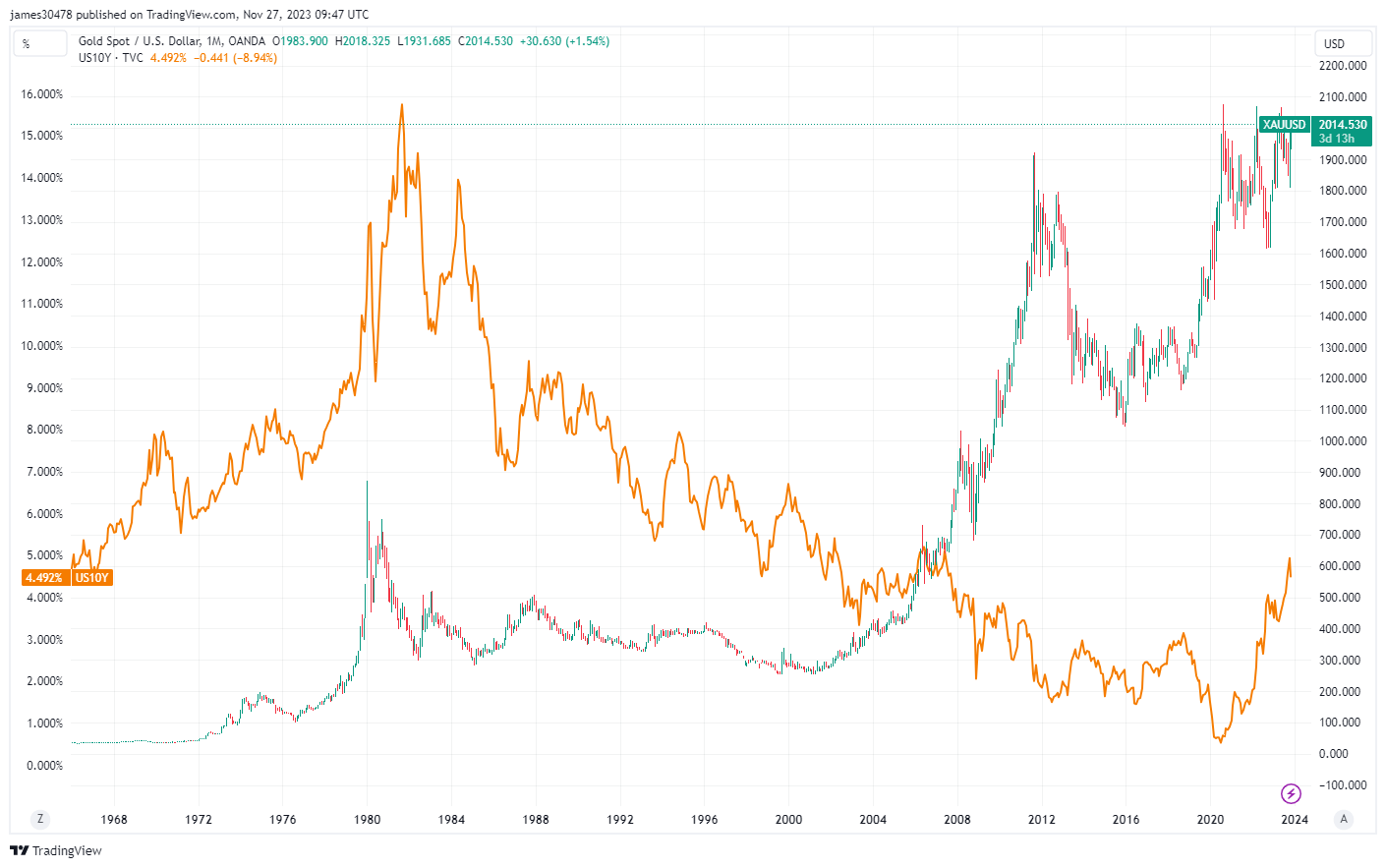

Gold is not only holding firmly above $2,000 but is also striving for all-time highs, a phenomenon accompanied by an unusual trend of rising alongside US yields, a pattern unseen since the 70s and 80s.

Bitcoin, often called ‘digital gold,’ is likewise experiencing substantial growth, up 120% year-to-date. Such patterns suggest a potential shift toward alternative asset classes in the face of prolonged economic uncertainty.

The post Gold and Bitcoin rally as traditional economic indicators falter appeared first on CryptoSlate.