The insolvent cryptocurrency lender, Genesis, has reached an agreement with Digital Currency Group (DCG), its parent firm, to settle their $620 million lawsuit.

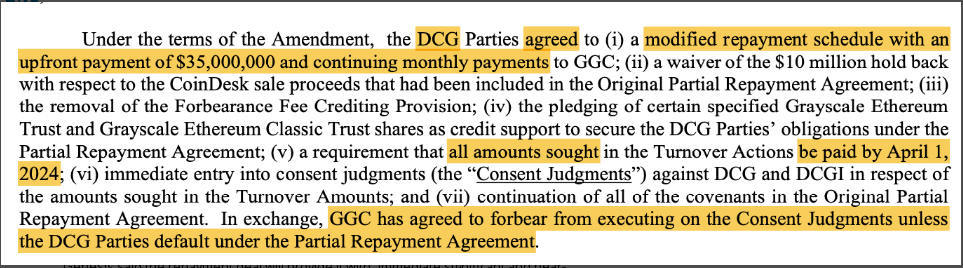

A court document dated November 28 states that DCG settled part of the issue by pledging to reimburse $324.5 million by April 2024. By entering into this arrangement, Genesis is able to avoid the significant expenses and disruptions associated with protracted litigation.

According to court filings, Genesis is free to seek the collection of any outstanding debt in the event that DCG defaults on this arrangement.

Genesis Makes Strides In Bankruptcy Proceedings

Amidst its ongoing bankruptcy procedures, Genesis filed a complaint against DCG in September, alleging improper possession of approximately $620 million in loans and demanding repayment, interest, and fees. Of the $620 million it owes, DCG has paid about $227.3 million so far.

This action, subject to Judge Sean Lean’s approval and the creditors’ vote, represents a significant milestone in Genesis’ efforts to pay back creditors. Genesis attempted to downsize its claim from $1 billion to $33 million against Three Arrows Capital in order to emphasize a more comprehensive reorganization plan.

Both businesses decided to settle Genesis’s bankruptcy claims in August, with DCG agreeing to swap its current $630 million loans. According to the document, Genesis will receive “substantial and near-term benefits” from the payment, which will assist with the “risk, expense, and diversion of resources” needed for litigation.

While the agreement covers certain parts of repayment, Genesis attorney Sean O’Neal made it clear that it does not provide a comprehensive resolution for other disagreements between Genesis and DCG. These outstanding issues mostly concern Genesis’s overall approach to handling its bankruptcy procedures.

Entangled In Legal Battles

Genesis is currently engaged in a legal dispute with its former business partner, Gemini Trust Co., and both parties are simultaneously being sued by the US Securities and Exchange Commission. At the same time, the state of New York initiated legal proceedings against both them and DCG.

Gemini Trust, headed by Cameron and Tyler Winklevoss, has been involved in a legal conflict with Genesis and its parent firm DCG, specifically about the Gemini Earn program.

Recent developments have led Gemini to file a lawsuit against the bankrupt lender, concentrating on the Grayscale Bitcoin Trust (GBTC). As collateral for customers of its Earn program, Genesis had previously pledged to holding about 60 million shares of GBTC.

Featured image from Shutterstock