Only five percent of surveyed South African crypto-asset financial service providers (FSPs) are generating revenue between $8 million and $10 million. The Financial Sector Conduct Authority study found that many of the crypto asset FSPs “earn their revenue from trading fees.”

Only 10% of FSPs Derive Income From Both Regulated and Unregulated Financial Services

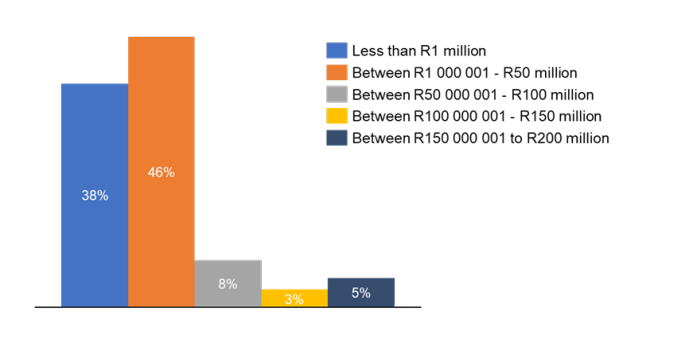

According to findings of a crypto market study conducted by the South African financial services industry watchdog, approximately 46% of the crypto asset financial service providers generated revenues equivalent to between $53,000 and $2.68 million. On the other hand, 38% of the crypto asset FSPs said they received revenue of less than $53,000. Only five percent are generating revenue between $8 million and $10 million.

The data shows that only five per cent of the FSPs generate revenues between $8 million and $10 million. Out of all the FSPs that responded substantively to the regulator’s information request, 10% derived their income from “both regulated and unregulated financial services.”

As noted by the Financial Sector Conduct Authority (FSCA), some 47 crypto asset FSPs participated in the crypto market study. Explaining the rationale behind its decision to conduct the study, the FSCA said the information gathered is expected to support its work by “highlighting consumer exposure to crypto assets.” The information may also help the authority “identify risks that may negatively impact consumer well-being.”

Meanwhile, 49% of the surveyed crypto-asset financial service providers (FSPs) said they run a crypto exchange. Some 19% of the respondents offer advisory services relating to crypto assets, while 15% identified themselves as crypto brokers. Only 2% said they offer custodial services.

93 License Applications Received

The FSCA study also found that most of the crypto asset FSPs “earn their revenue from trading fees” while their remuneration models are largely identical to traditional financial revenue models.

During a Nov. 30 media briefing, the FSCA said it had received 93 license applications from current FSPs and “completely” new applicants. However, according to the FSCA’s Diketso Mashigo, some applicants eventually decided against seeking a South African license.

“Some decided to take their business out of the country and conduct their services elsewhere in other foreign jurisdictions.”

Mashigo also revealed that some applicants submitted their license applications just days before the November 30 deadline.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.