Bitcoin put in another positive price performance over the past week, with its price rising by more than 14% in just seven days. However, the price of the premier cryptocurrency and the potential of the starting bull run might be under threat, as investors seem to be cashing in on their profits.

According to the latest on-chain data, significant amounts of Bitcoin have been on the move to cryptocurrency exchanges in the past few days.

BTC Traders Move Massive Amounts To Crypto Exchanges

Crypto analyst Ali Martinez revealed – via a post on X – that massive amounts of Bitcoin have been transferred to centralized exchanges in the past few days. This revelation is based on the “Exchange Inflow” data from the blockchain analytics platform Glassnode.

According to the post on X, around 20,000 BTC worth over $880 million have been sent to known crypto exchange wallets in the past five days. When Bitcoin – and most cryptocurrencies – are transferred to exchanges, it typically means that some investors might be looking to sell their assets.

Around 20,000 $BTC have been sent to known #crypto exchange wallets in the past five days, worth over $880 million! pic.twitter.com/rfeuBSaSv8

— Ali (@ali_charts) December 8, 2023

Massive transfers to exchanges are not particularly promising for crypto assets and their value, as they increase the amount of cryptocurrencies available in the open market. As more Bitcoin gets transferred to exchanges, there is a rise in supply available for sale, potentially putting downward pressure on the price.

However, it is worth noting that there has not been any apparent impact on BTC’s value so far. As of this writing, the Bitcoin price stands at $44,260, reflecting a 2.2% increase in the past 24 hours.

How Is Bitcoin Investors’ Sentiment Shifting?

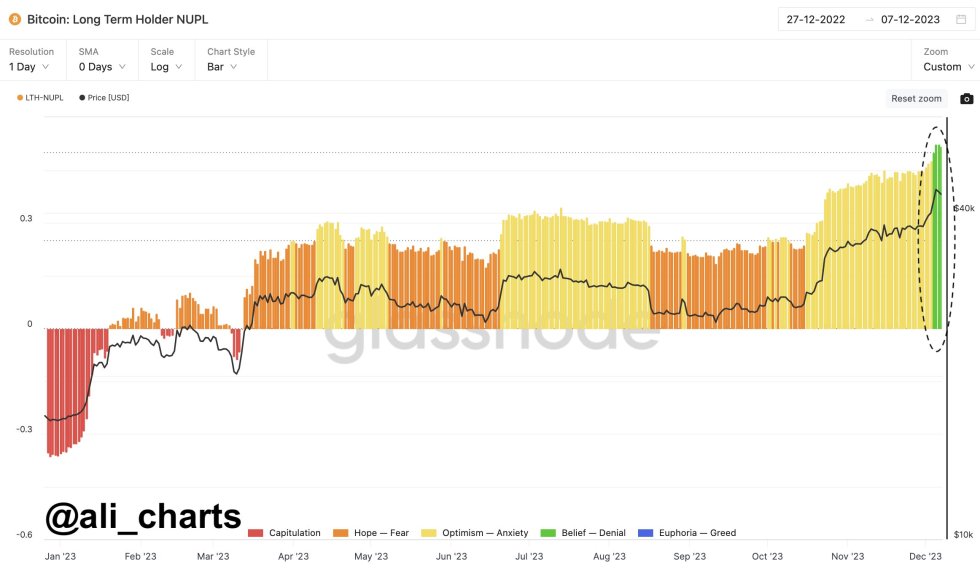

Interestingly, another recent data point from Glassnode dispels the notion that investors may be losing faith in the premier cryptocurrency. The analytics platform revealed that the sentiment of long-term Bitcoin investors has changed to a state of belief. In fact, crypto pundit Ali Martinez noted that this marks “a significant shift in confidence” from investors.

As shown in the graph above, this on-chain data revelation is based on the long-term holder Net Unrealized Profit/Loss (NUPL) metric. This metric takes into account unspent transaction outputs (UTXOs) and serves as an indicator to assess the behavior of long-term investors.

It comes as no surprise that the BTC optimism continues to grow stronger as investors await the greenlight of spot Bitcoin ETF (exchange-traded fund) in the United States. Several spot BTC ETF applications are under the review of the Securities and Exchange Commission (SEC), with many expecting approvals in early 2024.