MATIC, the native token of the Polygon network, has been on an exciting run in the past few weeks, like several other altcoins in the market. Despite the positive price performance, the cryptocurrency has not been able to return above the $1 mark, seemingly facing rejection at the $0.9 zone.

However, it appears that the tides might be changing for MATIC following a crypto analyst’s projection.

Will MATIC Price Skyrocket 100% If This Happens?

Prominent crypto analyst Ali Martinez has put forward their bullish projection for the MATIC price in the near future. In a post on the X platform, the analyst revealed that the altcoin could be set for a bullish breakout that could catapult its price to double its current value.

Martinez’s prediction revolves around the symmetrical triangle pattern forming on the Polygon weekly price chart. Interestingly, the MATIC triangular formation is around the $0.96 price point, intersecting with the 50% Fibonacci retracement level.

Keep your eyes on #Polygon! A daily or weekly candlestick close above $0.96 could be the spark for a bullish $MATIC breakout.

If this key level is breached, we might witness #MATIC surging toward $1.82! pic.twitter.com/M9bz3myRVi

— Ali (@ali_charts) December 9, 2023

This pattern forms a basis of Martinez’s projection, as the analyst believes “a daily or weekly candlestick close above $0.96 could be the spark for a bullish MATIC breakout.” According to the analyst, a break through this critical price level could send the altcoin to $1.82.

This projection represents an approximately 100% rally from the current price point. As of this writing, the Polygon token is valued at $0.905165, reflecting a nearly 2% price decline in the past 24 hours. Nevertheless, MATIC ranks as the 15th-largest cryptocurrency, with a market capitalization of roughly $8.42 billion.

On-Chain Data Reveals Minimal Resistance Ahead

A particular on-chain data revelation adds even more strength to Martinez’s $1.82 projection for MATIC price. In an earlier post on X, Martinez revealed that the Polygon token might be set to go on a bullish run.

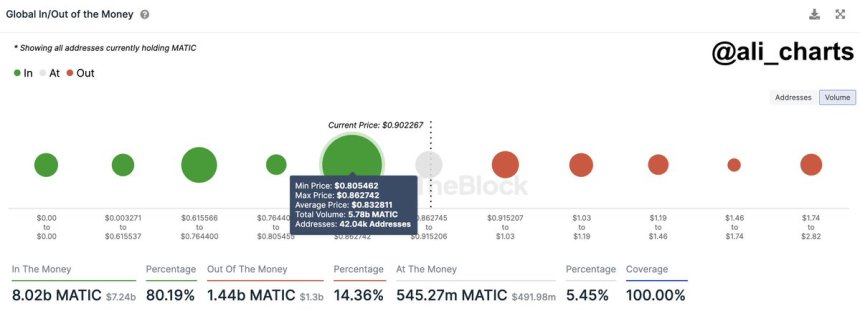

This theory is based on price data from the analytics platform IntoTheBlock. According to the blockchain platform, about 42,000 addresses purchased 5.8 billion tokens between $0.80 and $0.86, making the price range a “key” support zone.

As displayed in the chart above, the small size of the dots indicates the low density of investors and no major on-chain resistance above the current MATIC price. “Given the minimal resistance ahead, Polygon seems primed for a bull run as long as this level holds,” according to the analyst.