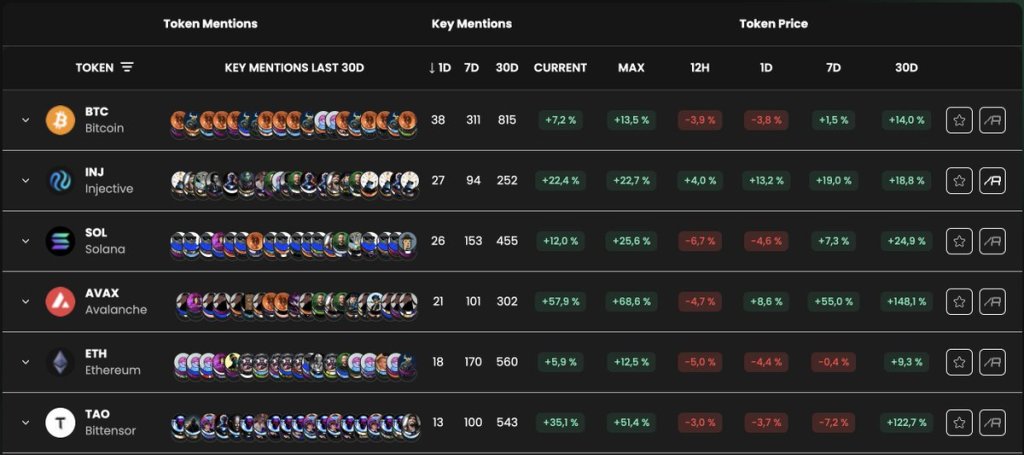

According to AlphaScan data on December 12, social media activity on Injective Protocol (INJ) has steadily increased in the past day and week. This surge in interest has propelled INJ to the second-most mentioned token on social media, trailing only Bitcoin (BTC).

Injective Social Media Activity Rising

Specifically, data reveals that INJ received nearly 30% of its weekly mentions in the past 24 hours alone. Furthermore, 37% of all monthly mentions of INJ occurred in the past seven days, further highlighting the growing attention surrounding the project.

While this is impressive for the project, it seems like INJ is also popular, looking at the very short-term data over the past trading day. Looking at weekly and monthly mentions, Solana, Avalanche, and Ethereum are ahead.

The uptick in Injective Protocol’s social activity also coincides with expanding prices. Based on Alpha Scan data, INJ has outpaced Bitcoin and other top 10 crypto assets in the last data. If the spike in social activity is behind rising prices, INJ may likely extend gains in subsequent sessions.

From the INJ daily chart, the coin is at 2023 highs, ripping even higher. As it is, the coin is within a bullish breakout formation, comprehensively easing past November 2023 resistance levels. Of note, the rally is with expanding trading volumes, meaning the leg up is supported and could continue, further drawing more social activity to the project.

Injective Protocol is a decentralized exchange (DEX) platform that operates on a layer-2 solution, allowing faster and more scalable trading than traditional DEXs. It supports various decentralized finance (DeFi) applications, including derivatives trading and synthetic asset issuance.

Is INJ On The Cusp Of Exploding Above $25?

The growing interest in Injective Protocol is likely due to a combination of factors. Beyond the project’s unique features, like near-gasless transactions and growing adoption, improving crypto sentiment and strategic partnerships might have supported prices and revived social media activity.

To illustrate, Injective recently joined Google Cloud, encouraging developers to build on the platform.

Despite the current optimism, it is not immediately clear whether the spike in social media activity could be a precursor to more price gains for INJ. Even so, with the coin trending at new 2023 highs and trading volumes expanding amid a broader recovery across the crypto scene, it is likely that INJ may explode to record new all-time highs above $25.