JPMorgan analysts, while maintaining an overall cautious stance on the cryptocurrency market, foresee Ethereum (ETH) surpassing Bitcoin (BTC) and other digital currencies in market price performance by 2024.

This bullish outlook for Ethereum reflects a distinctive perspective within the institution, suggesting that the analysts see unique potential and favorable prospects for Ethereum relative to other digital assets, even amid an overall cautious sentiment towards the broader crypto landscape.

In a published note on Wednesday, a team of analysts headed by Nikolaos Panigirtzoglou conveyed their expectation that Ethereum (ETH) will reclaim its prominence and regain market share within the cryptocurrency ecosystem in the upcoming year.

Ethereum Will Overtake Bitcoin – JPMorgan

“We believe that next year Ethereum will re-assert itself and recapture market share within the crypto ecosystem,” Panigirtzoglou wrote in a note.

The analysts underscored the pivotal role of the EIP-4844 upgrade, popularly known as Protodanksharding, as the primary catalyst for Ethereum’s anticipated resurgence.

This crucial upgrade, scheduled for implementation in the first half of 2024, is poised to bring about substantial improvements in Ethereum’s network activity.

Danksharding is a more efficient sharding method for Ethereum, and protodanksharding is the first step toward its complete implementation. Danksharding sidesteps the tedious procedure of dividing Ethereum into several shard chains, as contrast to the initially intended sharding method.

Data blobs, which are connected to blocks and can hold more data than blocks but are not permanently stored or accessible by the Ethereum virtual engine, are instead introduced.

Meanwhile, JPMorgan’s optimistic forecast aligns with Standard Chartered’s, as they previously stated in a communication that Ether might experience a 400% surge within a few years, followed by a more sustained upward movement towards $35,000.

Geoff Kendrick, the Head of FX Research, West, and Digital Assets Research, expressed the viewpoint that the upward trajectory for Ether might unfold at a more gradual pace compared to Bitcoin.

Ethereum Price Prediction: 5x Increase

Despite this potentially more extended timeframe, Kendrick envisions Ethereum eventually attaining a higher price multiple than Bitcoin relative to their current levels. Specifically, he anticipates Ethereum reaching a price multiple of 5.0x, surpassing Bitcoin’s expected 3.5x multiple.

Layer 2 networks, such as Optimism (OP) and Arbitrum (ARB), would gain the most from the upgrade, according to the JPMorgan analysts.

Layer 2 networks on Ethereum would benefit from the increased temporary data space, which would increase network throughput and decrease transaction fees. Data blobs improve Layer 2 network efficiency without changing the size of an Ethereum block.

In the meantime, as ether discovers new applications, demand for it will rise, and cryptocurrency-related trends will only grow. For example, the most common Ethereum use case is NFT transactions, which Kendrick believes will grow.

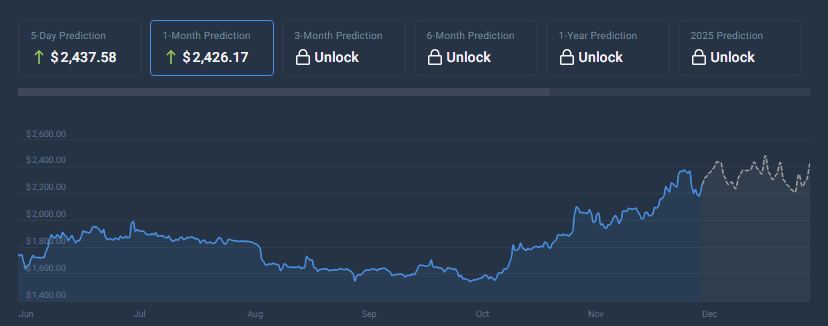

At the time of writing, Ether was trading at $2,281, up 5.0% in the last 24 hours, while Bitcoin was exhanging hands at $42,910, with a 2.3% increase in the same timeframe.

Featured image from Pixabay