On-chain data shows Shiba Inu has seen some substantial withdrawals from exchanges recently. Here’s what this could mean for SHIB’s price.

Shiba Inu Balance On Exchange Has Been Falling Since November

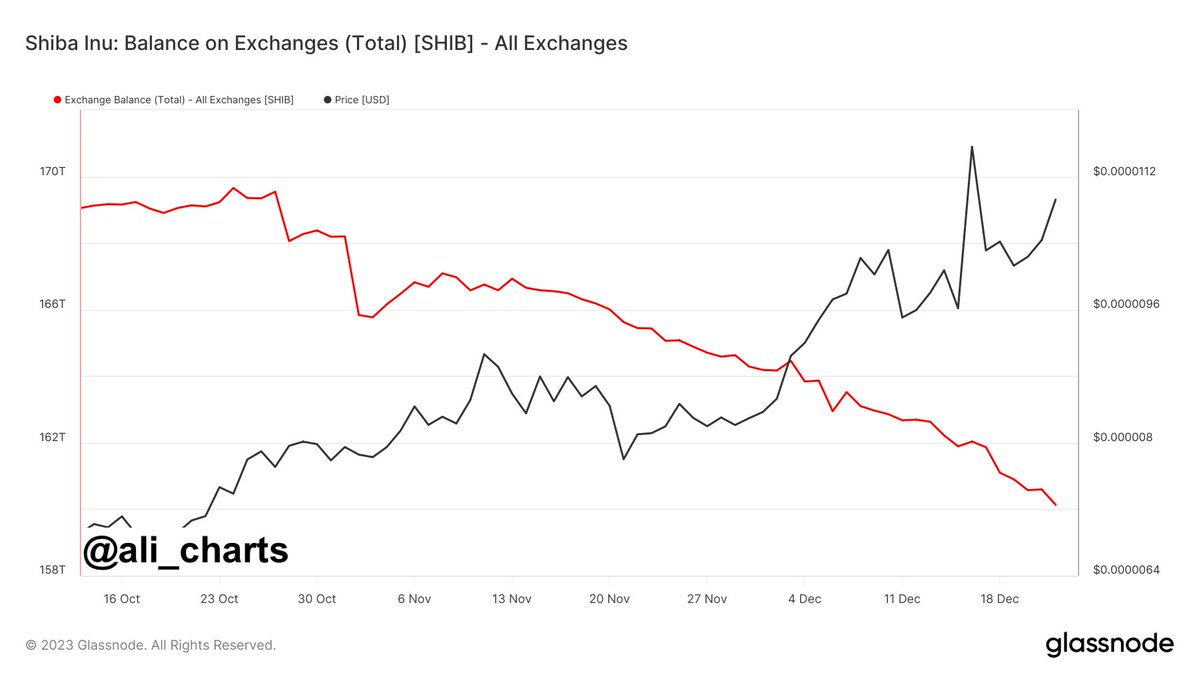

As pointed out by analyst Ali in a new post on X, a large amount of Shiba Inu has left exchanges since November. The relevant metric here is the “Balance on Exchanges,” which keeps track of the total amount of SHIB that’s sitting in the wallets of all centralized exchanges.

When the value of this metric goes up, it means that the investors are depositing a net number of coins to these platforms right now. As one of the main reasons why investors would make such transfers is for selling purposes, this kind of trend can have bearish implications for the asset’s price.

On the other hand, the indicator heading down suggests net withdrawals towards self-custodial wallets have been taking place, a potential sign that the holders are accumulating. Such a trend can prove to be bullish for the cryptocurrency in the long term.

Now, here is a chart that shows the trend in the Balance on Exchanges for Shiba Inu over the past few months:

As displayed in the above graph, the Shiba Inu Balance on Exchanges has gone through some significant decline since the first half of November. In total, investors have withdrawn around 8 trillion SHIB from these platforms, worth around $86 million at the current exchange rate.

Given the large scale of these withdrawals, it’s probable that large entities like the whales have been involved. Therefore, it’s possible that these humongous holders have been accumulating recently.

Something that may add evidence to the fact that these net outflows have indeed been done for fresh buying could be Shiba Inu’s uplift of more than 30% that has taken place since the withdrawals began.

Interestingly, the metric hasn’t reversed its direction even after all this recent uptrend, suggesting that the whales are also not yet ready to sell and harvest their profits, but are rather interested in buying more of the memecoin.

It’s possible that these humongous Shiba Inu investors have been accumulating recently in preparation for a potential bull run next year, as the market keeps its eyes peeled for Bitcoin ETF approvals. This is because many believe could kickstart the next major capital injection into the cryptocurrency sector.

SHIB Price

Shiba Inu had declined towards the $0.0000960 level just a week ago, but the meme coin has seen a 10% jump since then as it has now recovered to the 0.00001083 mark.

A reversal in the Shiba Inu Balance on Exchanges may be something to watch out for, as one taking place could potentially lead to at least a short-term drop for the meme coin.