Quick Take

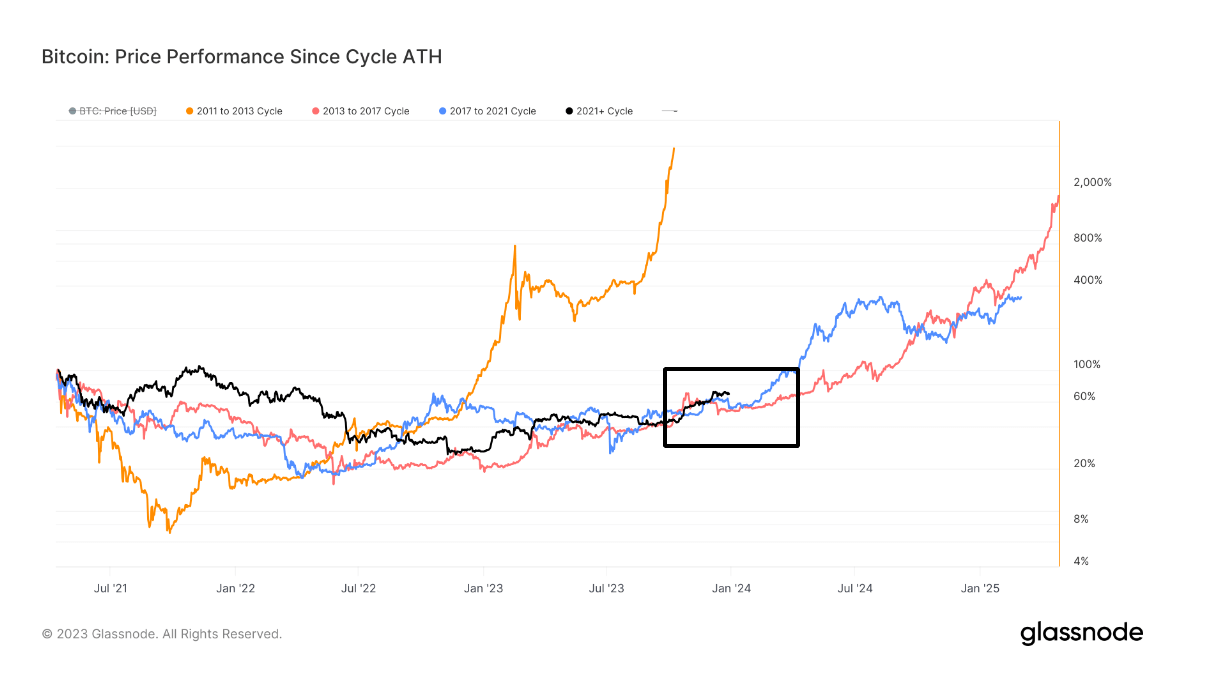

Analyzing Bitcoin’s previous market cycles, it’s evident that the current cycle is demonstrating a robust performance despite being approximately 32% below the cycle’s first peak in April 2021 at $64,900. Notably, the subsequent new all-time high of $69,100, which came in Nov. 2021, was driven predominantly by leverage, with numerous on-chain indicators suggesting a bear market actually began in May 2021.

Contrasting with historical trends, the present cycle outstrips its two predecessors from 2013 to 2017 and 2017 to 2021. Despite this, it is important to note that both prior cycles experienced pullbacks at this juncture of approximately 10%. Currently, Bitcoin is only 5% down from its year-to-date high, aligning with CryptoSlate’s previous discussions of a bull market interspersed with periodic corrections.

While the data paints a positive picture, a potential pullback, as seen in former cycles, should not be ruled out. Thus, the current cycle’s performance holds significance, but this analysis also underscores the relevance of historical patterns in anticipating future possibilities.

The post Current Bitcoin cycle outpaces previous market trends while cautiously eyeing historical retracement risks appeared first on CryptoSlate.