Quick Take

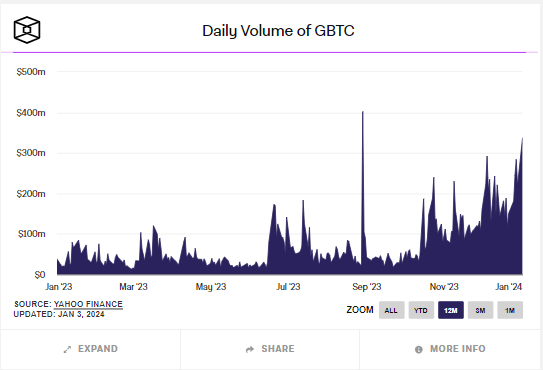

As the digital asset world anticipates the forthcoming approval of Bitcoin ETFs, Grayscale’s Bitcoin Trust (GBTC) is experiencing significant fluctuations in its trading volume. GBTC saw its second-largest trading day volume in the past 12 months on Jan. 2, 2023, registering $338 million. Interestingly, this figure pales compared to the trading volume during the 2021 Bitcoin bull run, which saw figures exceeding $500 million and even reaching the $1 billion mark on occasions.

The most significant trading day volume in the past 12 months for GBTC was recorded on Aug. 29, 2023, with an impressive $400 million.

One notable trend is the narrowing GBTC discount to NAV, which now stands at approximately -5%. This decrease is believed to be a response to the possible approval of a spot ETF.

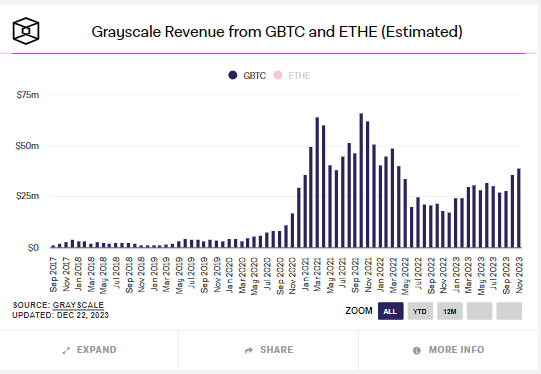

Moreover, Grayscale posted a revenue of $40 million in November, the highest since April 2022. This revenue is primarily derived from Grayscale’s fees, with GBTC charging a 2% annual fee. However, according to Bloomberg ETF analyst Eric Balchunas, it’s important to note that the emerging spot ETFs will charge significantly lower fees, close to 0.4%, creating potential competitive pressure for GBTC.

The post Grayscale’s Bitcoin Trust sees trading surge as spot ETF decision looms appeared first on CryptoSlate.