The head of research at CryptoQuant has explained that Bitcoin on-chain data already showed signs of overheating a while before the crash.

Bitcoin Short-Term Holder Profit/Loss Margin Spiked Before Crash

Not even a couple of days after Bitcoin registered its sharp rally above the $45,000 mark, the coin has already crashed and has retraced the gains made during the move.

There has been a lot of speculation in the market regarding why the cryptocurrency has witnessed this sudden plunge. Some believe the reason to be the rumor that the US SEC is going to reject all BTC ETFs.

The head of research at analytics firm CryptoQuant, Julio Moreno, though, has hinted at a different possibility. “People will look at everything for an explanation instead of just looking at the On-chain data,” said Moreno in a post on X.

Last month, when Bitcoin had broken past the $40,000 barrier, the analyst had pointed out how the profit level of the short-term holders had spiked to high values.

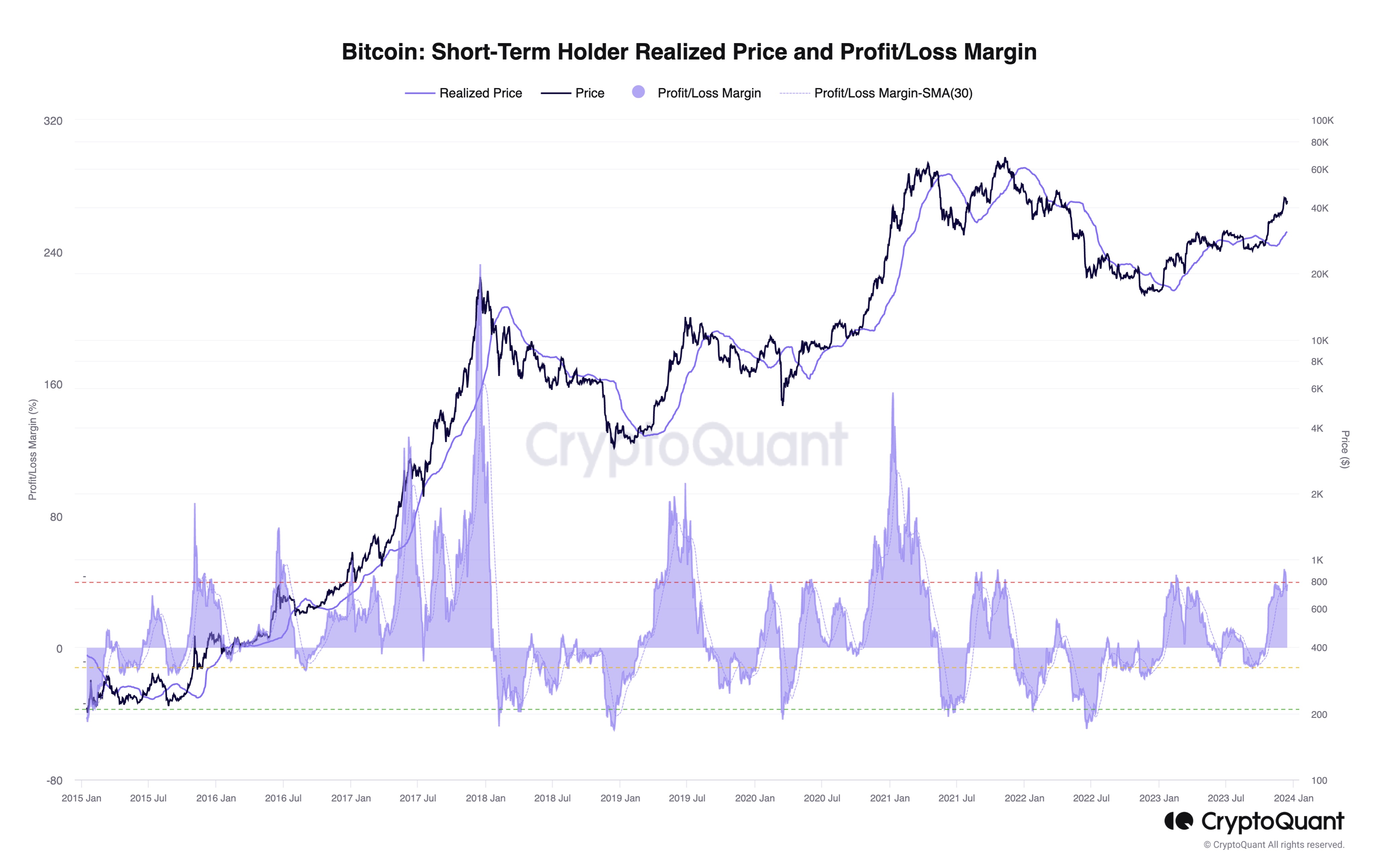

Below is the chart that the CryptoQuant head had shared back then.

The “short-term holders” (STH) refer to the Bitcoin investors who bought their coins within the last 155 days. The members of this cohort are generally fickle-minded and they easily sell at the first sight of any major FUD or profit-taking opportunity.

In the above graph, the data for the profit/loss margin of these weak hands is shown. The profit/loss margin here is the gap between the Bitcoin spot price and the realized price for this cohort (that is, the average cost basis of the group).

From the chart, it’s visible that as Bitcoin had rallied last month, it had pulled away from the realized price of the STHs, leading to them holding a large amount of unrealized profit.

The level that the profit/loss margin of this group had hit back then was interestingly the same as when the cryptocurrency had hit some notable local tops during the past.

In this post from last month, Moreno had also pointed out that such a pattern had been especially true for the pre-bull run phase of the cycle that BTC is potentially in right now.

The explanation behind this pattern could be the fact that as the gains held by these investors go up, they become more likely to fall into the temptation of profit-taking. When such selloffs end up taking place, they naturally cause impedance to the price.

“There were signs of price being overheated since it first reached $40K,” notes the analyst. As such, it’s possible that the latest cooldown in the cryptocurrency was inevitable and something that had already been brewing from an on-chain perspective.

As for why the correction has only come now and not when the market had first started becoming overheated, the CryptoQuant head says, “sometimes it just takes time to play out.”

BTC Price

Bitcoin has made some recovery since its plummet as the asset’s price is now floating around the $43,400 level.