Quick Take

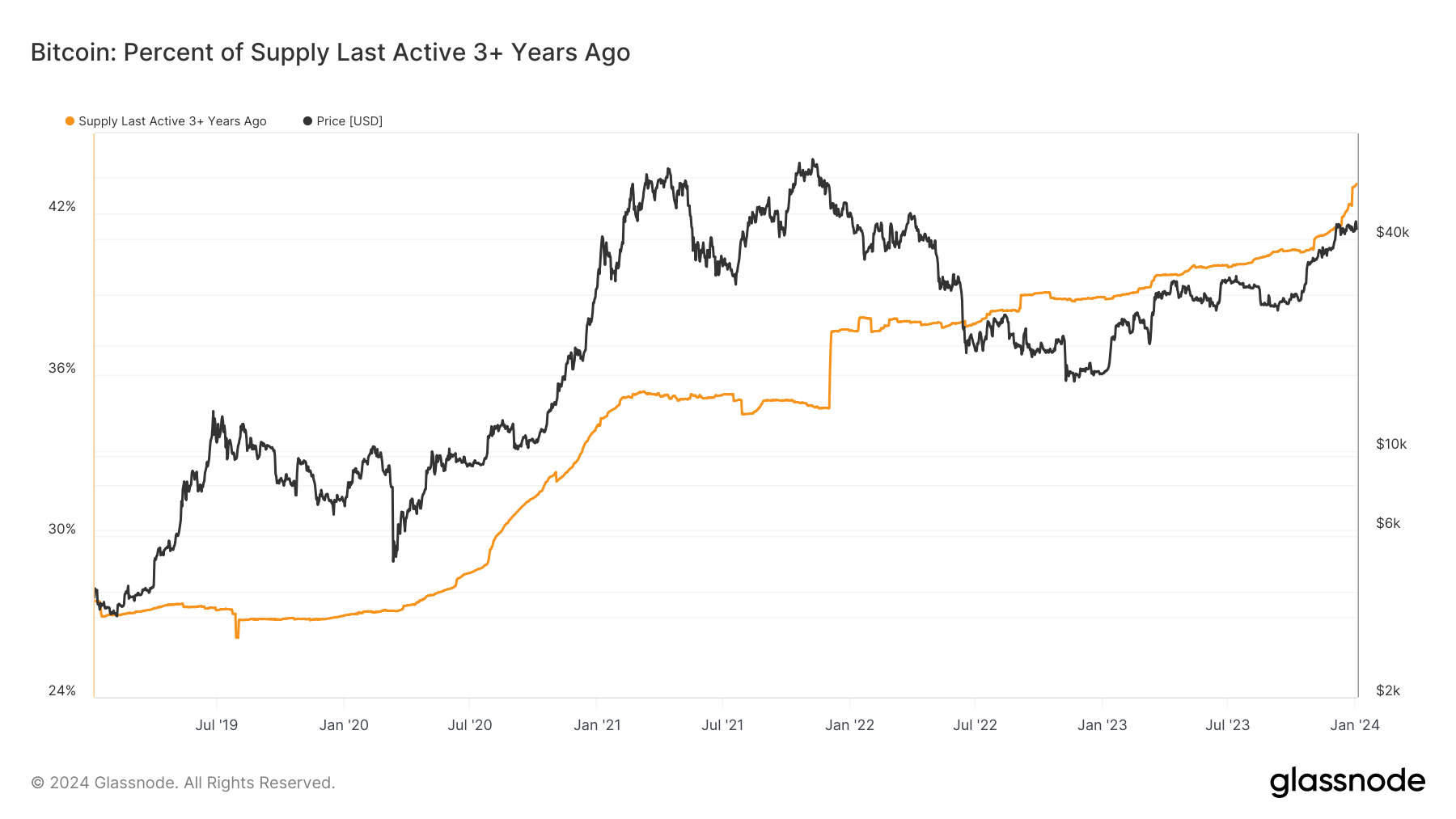

Recent data analysis reveals a striking trend in the Bitcoin market: the percentage of Bitcoin’s circulating supply that has remained static for at least three years has surged to 43.11%, marking a 3% increase in just a few short months. This surge can be traced back to the Bitcoin bull run three years ago, from September 2020 to January 2021, when Bitcoin prices soared from $10,000 to $60,000.

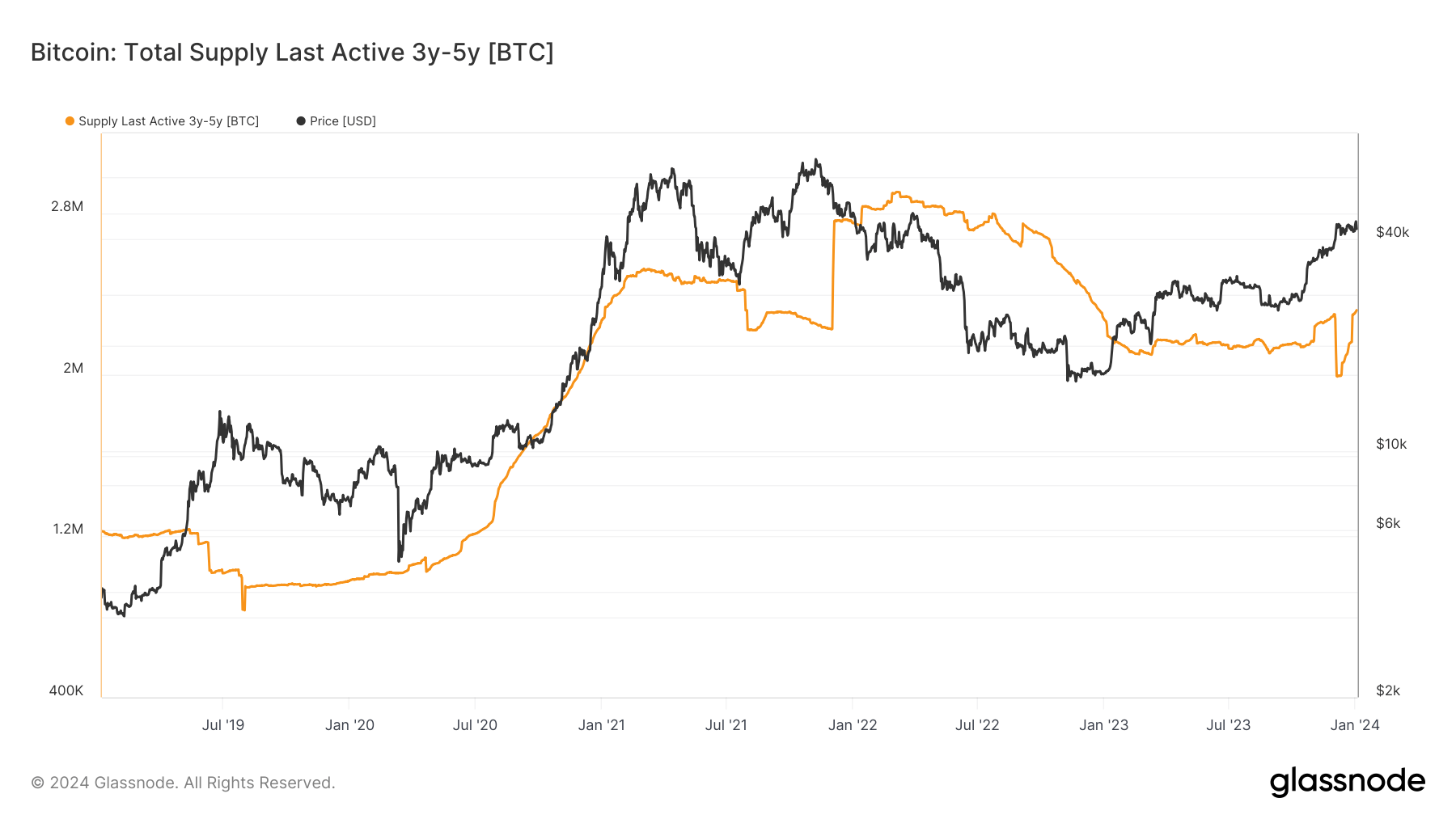

Interestingly, the data indicates that Bitcoin buyers during this period have largely held onto their Bitcoin, choosing not to liquidate even when trading within this high price range. Furthermore, the amount of circulating supply last moved between 3 to 5 years ago now holds over 2.3 million BTC, reflecting a substantial increase of 300,000 BTC in the last month alone.

This trend lends to one key inference: investors who purchased Bitcoin during the previous cycle run-up demonstrate a strong propensity to hold.

The post Bitcoin investors show staying power with 43% of supply untouched for over three years appeared first on CryptoSlate.