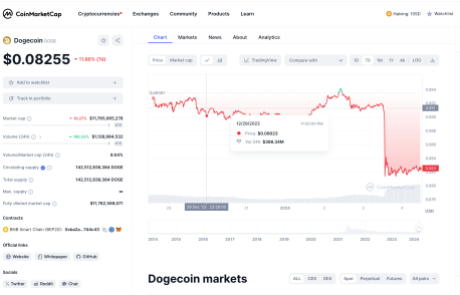

Dogecoin has had a hard time recovering from the flash crash that rocked the crypto market on Wednesday. After losing its hold on $0.09, the DOGE price has since been relegated back to the low $0.08 level where it continues to trade at the time of writing. Interestingly, this is happening at a time when the meme coin’s volume is seeing a significant rise, so what’s going on?

Dogecoin Volume Rises Over 190%

The Dogecoin daily trading volume has seen one of the most significant spikes in the last day after its price fell. As interest in the coin grew, so did the trading volume and in the end, there has been a more than 190% increase in the daily DOGE trading volume.

According to CoinMarketCap, this rise in the trading volume has brought the figure to more than $1.12 billion in a single day. This works out to around 9% of a trading volume to market cap ratio, something that is very good for the asset.

However, even with this rise in interest, DOGE is not enjoying any recoveries. Instead, its price is still trailing $0.082 at the time of this writing. It has also recorded a more than 10% decrease in price in the same time frame, while also completely eliminating its weekly gains.

Why Is DOGE Price Struggling?

It would seem the reason that the DOGE price is not moving is more sell pressure being mounted on the asset, especially by the large investors. These whales who hold significant amounts of Dogecoin seem to be selling off their holdings.

An example of this is a transaction that was reported by the on-chain whale tracker Whale Alert. The transaction which was carrying 300 million DOGE worth a little over $29.6 million at the time was being sent to the Binance exchange.

300,000,000 #DOGE (24,629,096 USD) transferred from unknown wallet to #Binancehttps://t.co/M3WBb9bPOW

— Whale Alert (@whale_alert) January 4, 2024

Now, transactions like these can be bearish for a crypto’s price because sending coins to exchanges can often mean that the holder is deciding to sell their coins. Given this, it can put a lot of sell pressure on the price, keeping it down like in the case of Dogecoin.

There have also been multiple large Dogecoin transactions that have been headed for exchanges over the last day. An initial transaction of 82 million DOGE worth $6.74 million was flagged headed for the Robinhood trading platform. An hour later, another large transaction was flagged by Whale Alert, this time around, carrying 102.27 million DOGE worth $8.4 million to Robinhood as well. If all of these transactions were made with the intention to sell, it would explain why the DOGE price continues to struggle even amid market recovery.

However, not all transitions have been bearish, especially from these large investors. One transaction reported by the whale tracker saw over 151.68 million DOGE worth $12.49 million moved from Robinhood to an unknown wallet. Such a transaction is more bullish because it suggests the owner could be moving the coins to a private wallet with the intention of holding them for better prices.