Quick Take

Between Oct. 2023 and Jan. 2024, Bitcoin’s market saw significant price appreciation, heavily influenced by anticipation around the approval of a Bitcoin spot ETF. The market’s spot prices surged from roughly $25,000 to $45,000. This potential catalyst for institutional adoption was predicted to enhance the digital assets market’s liquidity and maturity. Meanwhile, the futures market painted a picture of bullish confidence.

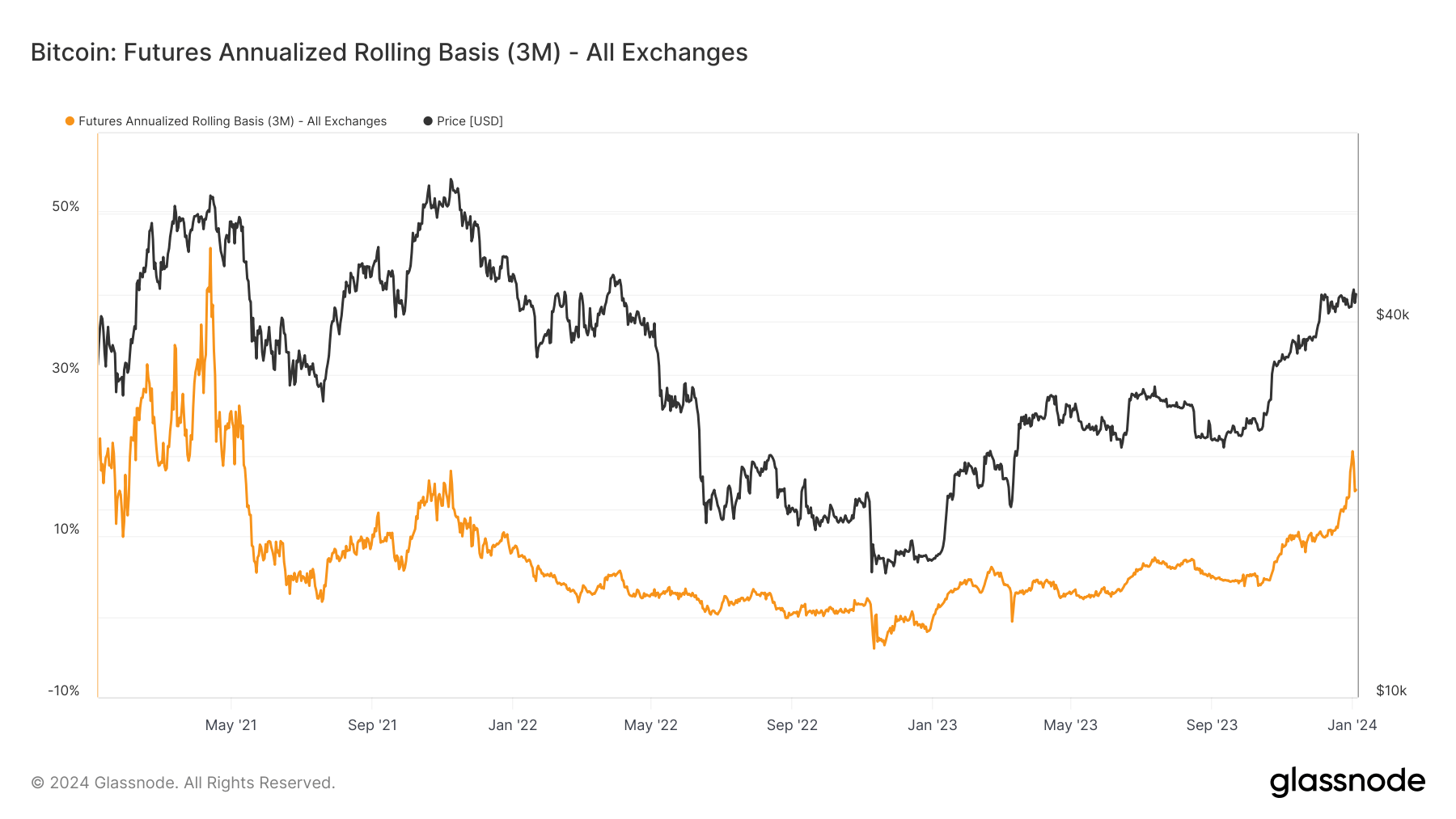

The futures’ annualized rolling basis, a metric for the yield from buying spot and selling futures, climbed to an impressive 20%. This beat the enthusiasm seen during the Nov. 2021 bull run and indicated traders’ positioning for further market gains. However, this bullish sentiment spilled into overdrive, overheating the derivatives market.

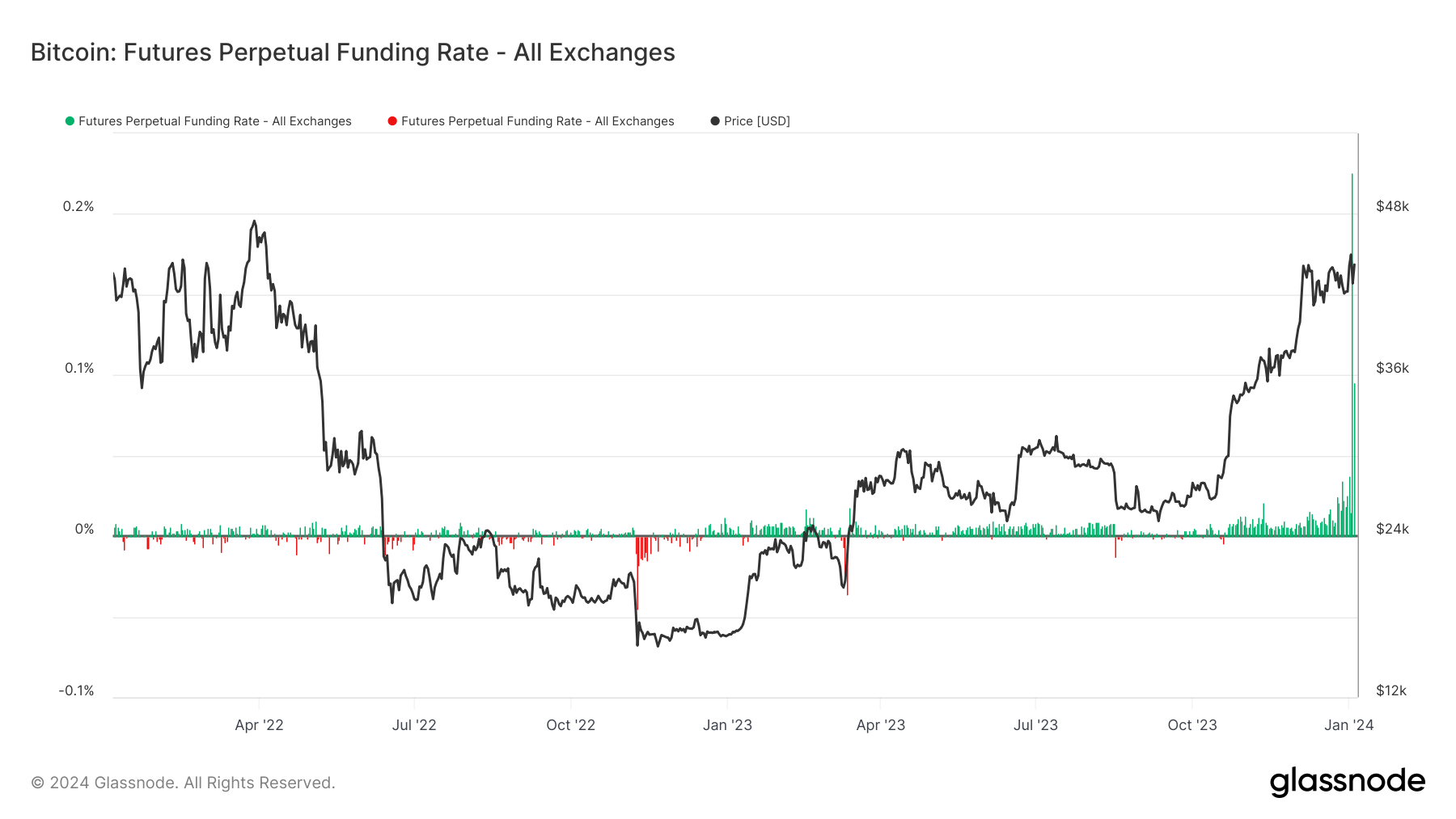

This was evident as the perpetual funding rates on futures contracts hit unusually high levels, indicating a market skewed towards buyers. This over-leverage found its tipping point when Bitcoin experienced a sharp correction, crashing from $45,000 to $40,000.

This triggered the largest long liquidation event in a year, a discernable sign of the rapid unwinding of leveraged positions and the market’s susceptibility to sentiment shifts.

This period was marked by rampant speculations fueled by ETF optimism, which caused a highly leveraged market.

The post Bitcoin ETF hype drove futures market to fever pitch before correction appeared first on CryptoSlate.