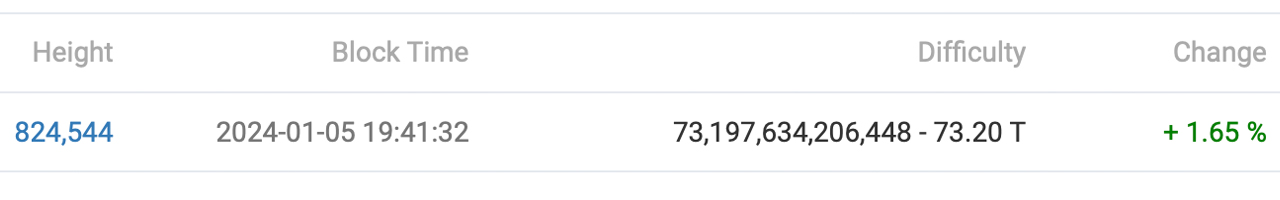

Bitcoin’s network difficulty experienced its first increase of 2024 on Jan. 5, at block height 824,544, rising 1.65% to an unprecedented network peak of 73.2 trillion. This inaugural adjustment of the year succeeds the 27 dynamic shifts witnessed in 2023, including a total of 20 increases.

Bitcoin’s Difficulty Hits 73.2 Trillion

On Jan. 5, 2024, Bitcoin once again broke another record in terms of how difficult it is to discover a bitcoin (BTC) block reward. The network’s difficulty rose to 73.2 trillion after a 1.65% uptick on Friday evening Eastern Time (ET). The change occurred at precisely 7:41 p.m. (ET) at block height 824,544 and it follows the 6.98% increase that took place nearly two weeks ago at block height 822,528.

Fundamentally, Bitcoin’s difficulty represents a metric reflecting the challenge involved in identifying a block subsidy to append a fresh block to the blockchain. The difficulty level changes every two weeks, give or take, to maintain a consistent block time, which for Bitcoin is about 10 minutes per block. The latest figure, 73.2 trillion, is a reflection of the current difficulty target.

This number signifies the upper limit of what the hash of a block must be for it to be considered valid. When the difficulty is 73.2 trillion, it means the hash of a valid block must be less than or equal to a target number that is very low relative to the possible range of hash values. The lower this target is, the less likely a random guess of the hash will be below it, which effectively means it’s harder to find a valid block.

Over the past 12 months, the difficulty target has soared to new records, breaking previous heights consistently. This surge is attributed to the substantial increase in hashrate, now cruising at 545 exahash per second (EH/s) as per Luxor’s hashrateindex.com statistics. Despite the last 20 rises in 2023 and the initial hike in 2024, bitcoin miners and the escalating hashrate remain undeterred. Block times have quickened beyond the usual 10-minute average, leading to a hike after every 2,016 blocks are mined.

Throughout 2023, the network added more than 300 EH/s, maintaining a steadfast pace that significantly accelerated as the year concluded. Application-specific integrated circuit (ASIC) producers have launched next-generation devices boasting elevated terahash capacities and enhanced efficiency, measured in joules per terahash (J/T). Since the close of the previous year, mining enterprises have procured tens of thousands of these advanced units, with a majority slated for 2024 delivery.

Consequently, the hashrate is anticipated to climb in tandem with difficulty hikes, barring unforeseen developments. Nevertheless, Bitcoin’s hash price — the daily expected value per one petahash per second (PH/s) of hashing power — has declined from $102.88 per PH/s on Dec. 31, 2023, to a present rate of $87.60. Bitcoin’s next difficulty retarget is scheduled to take place on or around Jan. 19, 2024.

What do you think about Bitcoin’s mining difficulty rising by 1.65% on Friday? Share your thoughts and opinions about this subject in the comments section below.