As the crypto market holds its breath for the U.S. Securities and Exchange Commission’s (SEC) impending decision on the first spot Bitcoin Exchange-Traded Fund (ETF), a close analysis of Bitcoin’s on-chain data reveals a market in a state of cautious anticipation.

Between Jan. 4 and Jan. 8, 2024, Bitcoin’s price increased from $44,230 to $46,944 after weeks of sideways and choppy movement. This increase, marked by a peak on Jan. 8, indicates an optimistic but pent-up market. Such price behavior could be attributed to speculative positioning in response to the upcoming SEC decision, as the market seems to be leaning towards a positive outcome.

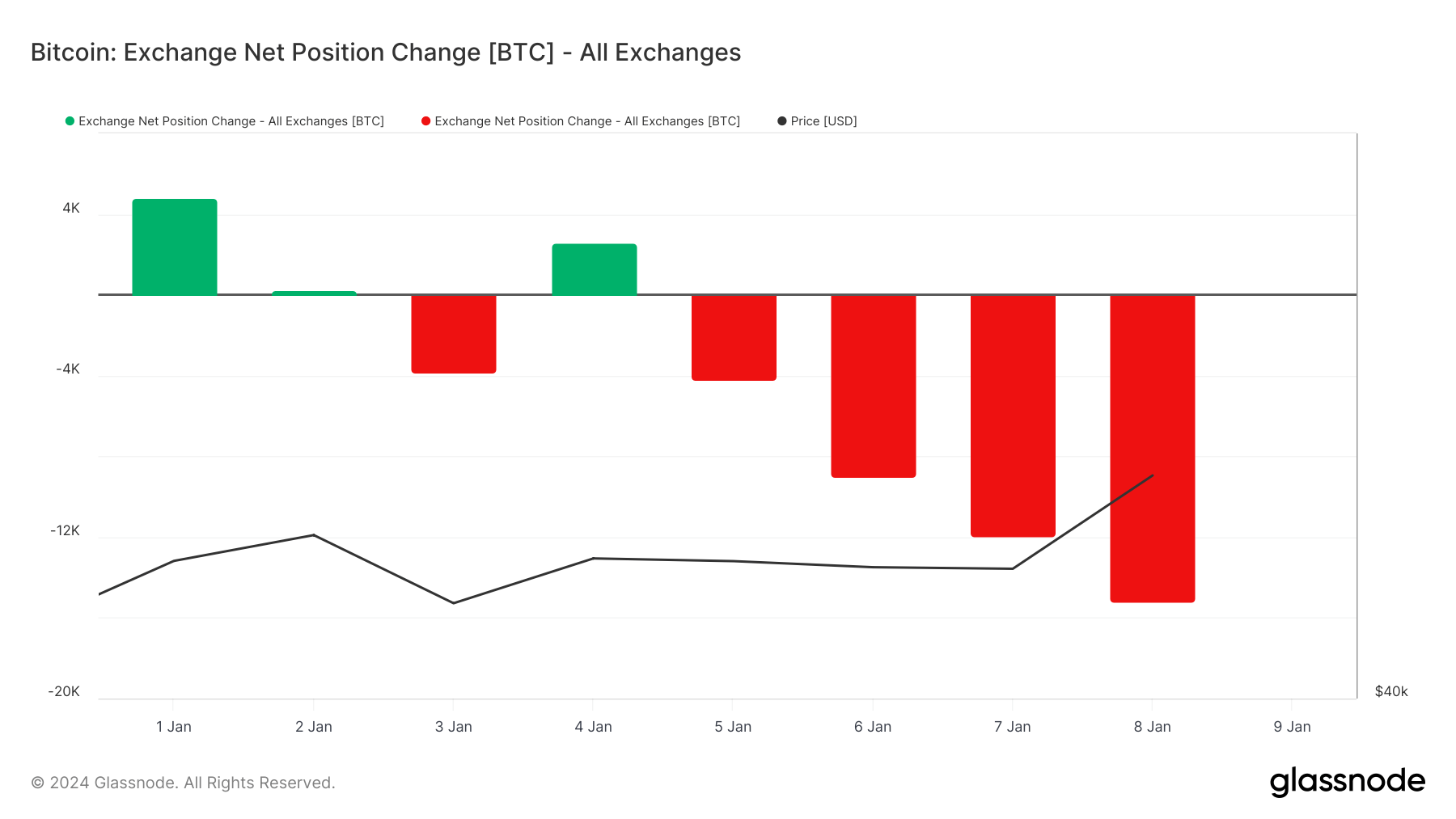

The 30-day change in Bitcoin supply held in exchange wallets shows that most of the market isn’t looking to sell. Starting at 2,571 BTC on Jan. 4, the balance shifted to a negative 15,183 BTC by Jan. 8. This consistent decrease in exchange-held Bitcoin suggests a growing preference among holders to withdraw their assets. This behavior often indicates a preparation for long-term holding, possibly in anticipation of a post-ETF approval surge in Bitcoin’s value.

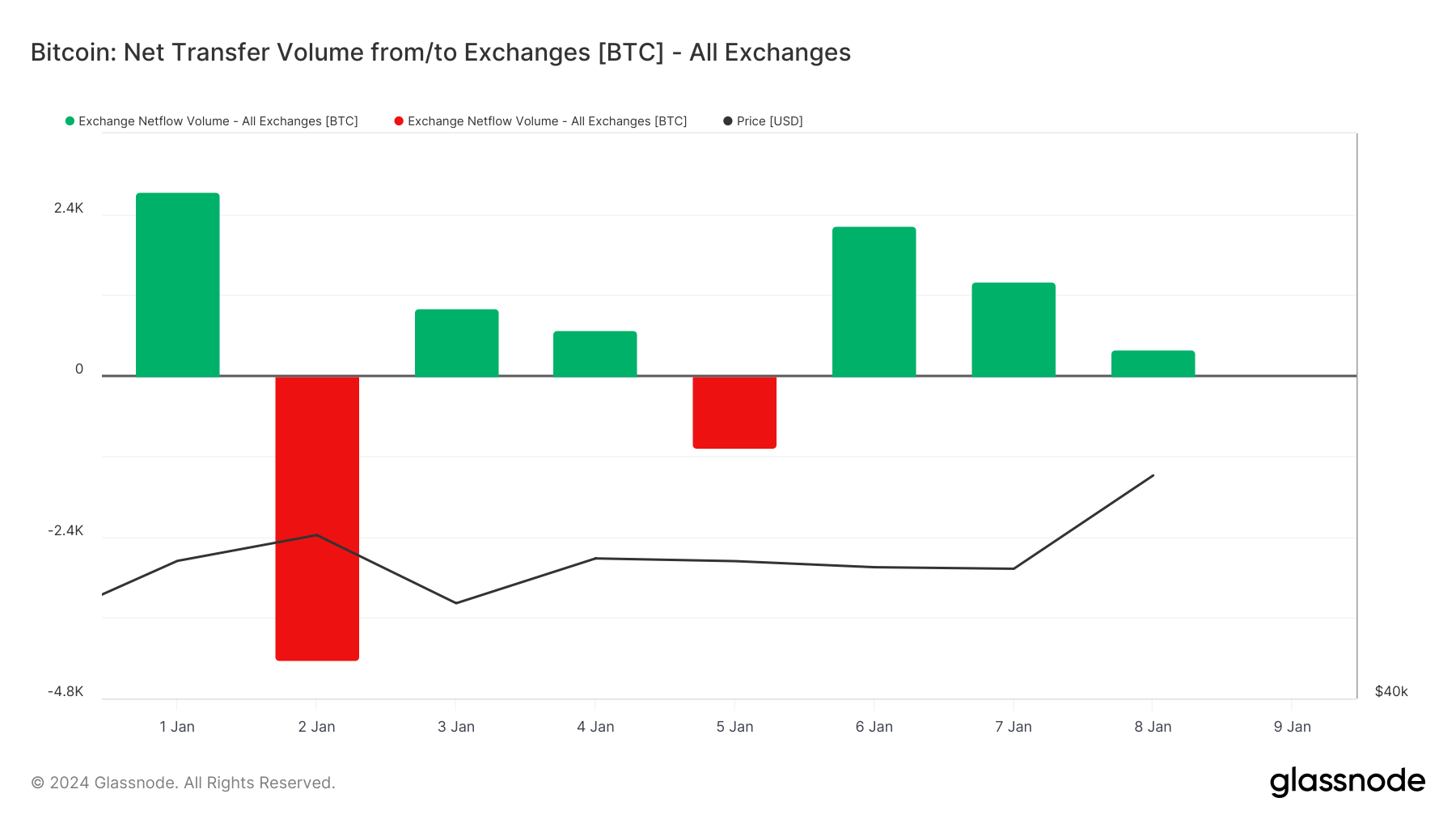

The total amount of BTC transferred to and from exchange addresses between Jan. 4 and Jan. 8 indicates consolidation. The high volume observed on Jan. 4 (52,116 BTC to exchanges and 51,432 BTC from exchanges) tapered off mid-week, only to spike again on Jan. 8 (53,196 BTC to exchanges and 52,798 BTC from exchanges). Such a pattern is characteristic of investors repositioning their portfolios in anticipation of significant market movements.

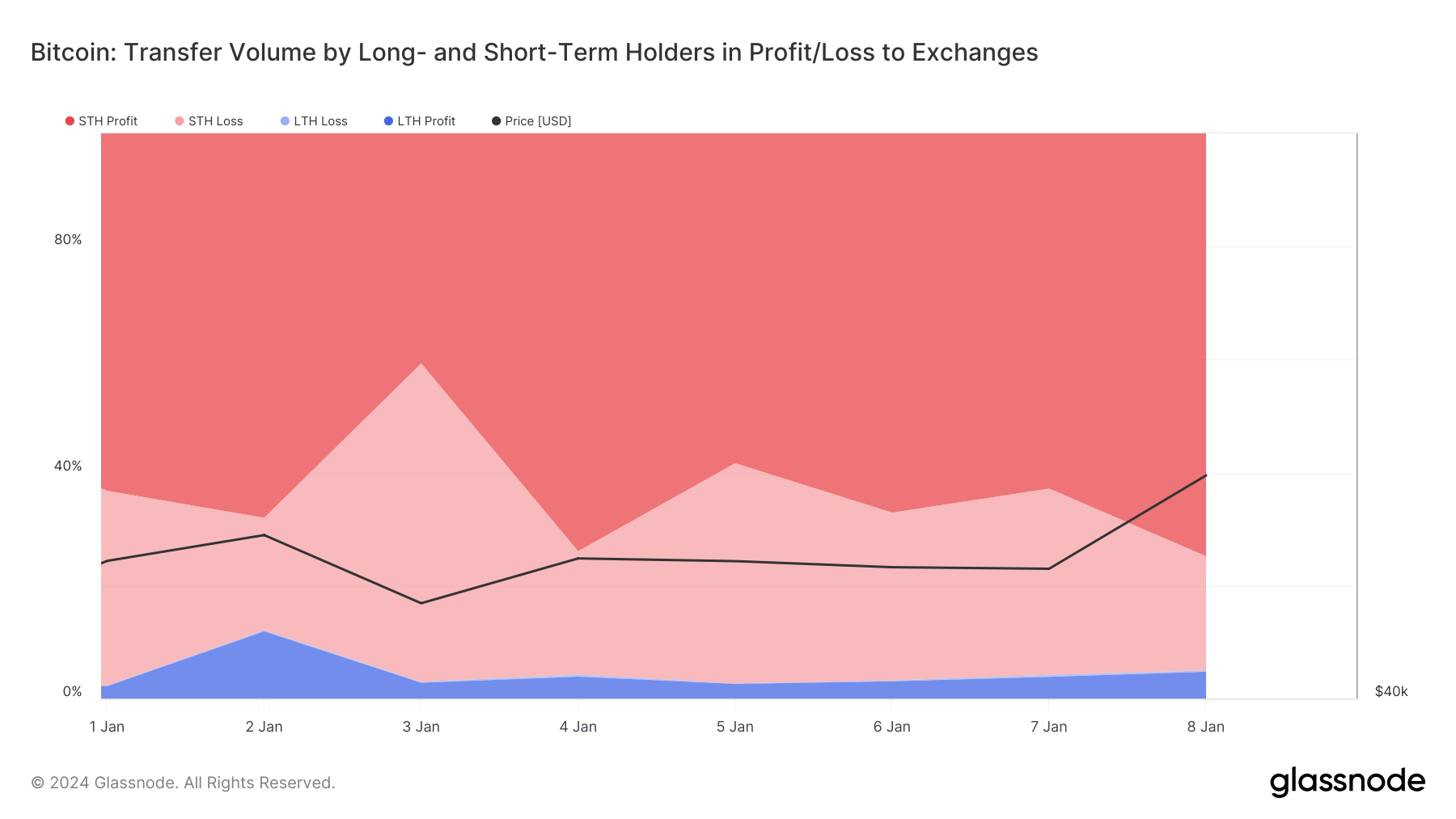

The movement of coins by short-term (STH) and long-term holders (LTH) shows where the selling pressure could come from. On Jan. 8, 74.82% of all coins moved to exchanges came from short-term holders, likely capitalizing on the recent price increase to realize gains. This behavior suggests a preparatory stance for expected short-term volatility or a price correction post-ETF decision. In stark contrast, long-term holders in profit made up only 4.73% of the total exchange inflows. This indicates long-term holders’ belief in the cryptocurrency’s resilience irrespective of short-term regulatory outcomes.

The decreasing Bitcoin balances on exchanges and the trading behaviors of short-term and long-term holders reflect a market at a crossroads. While the general sentiment leans towards a bullish outlook, the readiness for potential short-term fluctuations is evident.

If the ETF is approved and Bitcoin’s price increases, the already decreasing supply of Bitcoin on exchanges could lead to a supply squeeze. This scarcity, coupled with heightened demand, has the potential to drive prices even higher.

The post Exchange flows show short term buyers preparing for volatility while long term hodl appeared first on CryptoSlate.