Fred Krueger, an investor and crypto analyst, is predicting a “vicious” Bitcoin (BTC) rally shortly. He cites the recent unprecedented accumulation of the coin by Wall Street heavyweights.

This surge in institutional interest coincides with the recent approval of the first spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC).

Wall Street Ramping Up Bitcoin Purchase

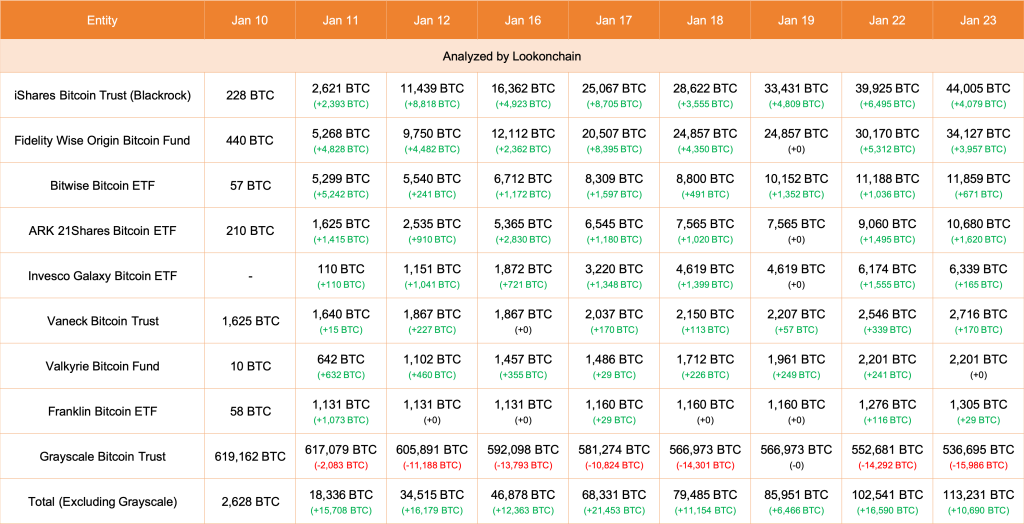

In a post on X, Krueger pointed to the substantial Bitcoin purchases by major financial institutions, including Fidelity Investments, BlackRock, and Ark Invest. To illustrate, the analyst noted that Fidelity was buying approximately 4,000 BTC every day.

Related Reading: Bitcoin Goes To The Doctor: 5 Key Metrics For BTC In 2024

On the other hand, Ark, Krueger continues, has been gobbling upwards of 1,500 BTC daily. BlackRock, the world’s largest asset manager, has yet to release its Bitcoin holdings. However, based on the pace of Ark Invest and Fidelity Investment’s accumulation rate, BlackRock is likely buying coins at a faster pace. So far, Lookonchain data places BlackRock’s IBIT holdings of BTC at over 44,000.

If anything, the rate at which these Wall Street institutions are doubling down on Bitcoin is a net bullish for price. Notably, BTC demands remain high more than a week after the United States SEC authorized the first spot of Bitcoin ETFs. That they are steadily buying suggests that institutions are bullish about Bitcoin’s potential.

The heightened pace of BTC accumulation is less than three months before the network halves its miner rewards. The Bitcoin halving event in early April will reduce miner rewards from 6.25 BTC to 3.125 BTC. If past price performance guides, the resulting supply shock might trigger another wave of higher highs, even lifting prices above 2021’s peaks of $69,000.

BTC Falls, FTX Unloads Millions Of GBTC Shares

Even amid the overall optimism, BTC is still struggling. Days after the approval of spot Bitcoin ETFs, BTC has been trending lower, shedding double digits. It even temporarily fell below $40,000 on January 23 before recovering to spot rates.

Analysts pin the sell-off to FTX, the defunct crypto exchange, off-loading an estimated $1 billion of Grayscale Bitcoin Trust (GBTC). With the FTX estate selling their stake in GBTC, prices are expected to stabilize as the unique selling event is alleviated and institutions double down, buying more BTC at spot rates.

Observers also note that GBTC outflows were matched or surpassed by the spike in inflow to other funds, mostly BlackRock’s ETF product.