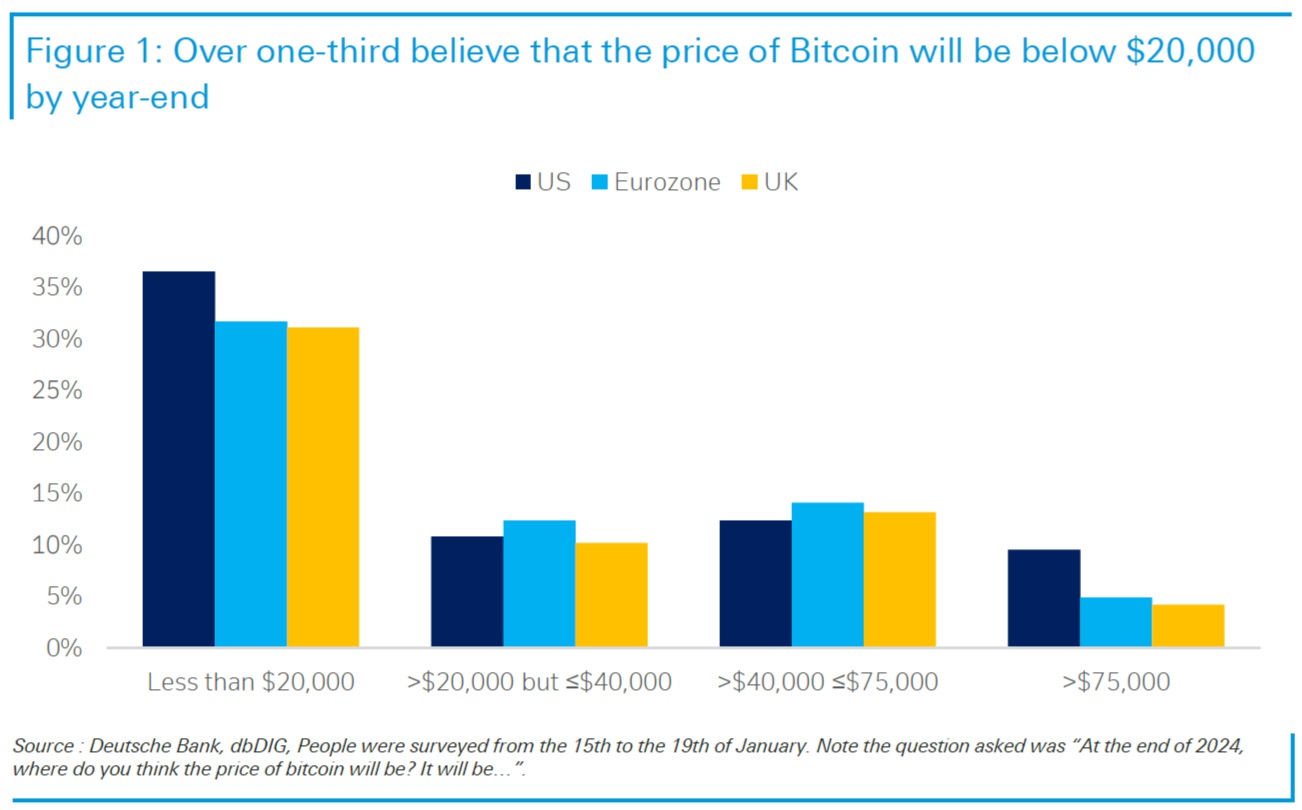

A Deutsche Bank survey has revealed that over one-third of 2,000 respondents anticipate bitcoin’s price to drop below $20,000. Moreover, around 15% of those surveyed predict the cryptocurrency’s price to range between $40,000 and $75,000 by the end of the year.

Respondents Expect Bitcoin to Fall Below $20K

According to a Deutsche Bank research report which includes a survey conducted from Jan. 15 to Jan. 19, the majority of respondents anticipate a further decline in bitcoin’s price, Bloomberg reported. The survey, which questioned 2,000 individuals in the U.S., U.K., and the Eurozone, focused on their perspectives on bitcoin’s price and volatility.

The survey showed that over one-third of respondents believe bitcoin will drop below $20,000 by January next year. Meanwhile, approximately 15% of survey participants expect BTC’s price to range between $40,000 and $75,000 by the end of the year.

Deutsche Bank analysts Marion Laboure and Cassidy Ainsworth-Grace explained in the report that new spot bitcoin exchange-traded funds (ETFs) are expected to expand the institutionalization of the bitcoin. However, they noted that the majority of ETF flows have come from retail investors.

The price of bitcoin pushed above $47K in anticipation of the approval of spot bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) on Jan. 10. However, following the approval, BTC dropped below $40K on Monday and $39K on Tuesday. The crypto has since recovered slightly. At the time of writing, BTC is trading at $41,815.

Many people believe that the approval of spot bitcoin ETFs along with the halving in April will significantly boost the price of bitcoin. Ark Invest sees a higher probability of bitcoin soaring to $1.5 million. Fundstrat says bitcoin is headed for $150K and could hit $500K in five years. Standard Chartered Bank said earlier this month that BTC could rise to $200K next year. Moreover, asset management firm Vaneck expects bitcoin to achieve record highs if Donald Trump is elected president of the U.S. in the November presidential election. Meanwhile, crypto adoption continues to grow. A recent report found that the number of crypto owners globally reached 580 million at the end of last year.

Do you think the price of bitcoin will fall to $20K? Let us know in the comments section below.