In the dynamic realm of cryptocurrencies, Avalanche (AVAX) is causing a stir, riding the waves of a recovery rally that commenced last month. As the broader spectrum of alternative coins experiences a resurgence, AVAX stands at the forefront, ready to extend its ascent, with whispers in the market hinting at a potential surge towards the coveted $50 mark.

Avalanche Booms: Durango Upgrade Ushers Growth

Presently, the AVAX price confidently stands above the 50% retracement level at $39.91, signaling a robust support level within the market range spanning from $28.00 to $49. Technical indicators add to the positive sentiment, with the Simple Moving Averages (SMA) gracefully trending upwards. This suggests that the path of least resistance favors continued price appreciation, creating an optimistic atmosphere among market observers.

This is a big opportunity for Avalanche builders and validators to learn all the ins and outs of Durango

Going live right here on X or on YouTube this Wed. at 12pm ET

https://t.co/811uVwOIg9

— Avalanche

(@avax) February 12, 2024

The buzz surrounding AVAX reaches a crescendo as the eagerly anticipated AVAX Durango upgrade gears up for implementation on the 13th of February. The community’s anticipation has been steadily building since the pre-release of the upgrade’s code on February 2.

This upgrade brings forth a suite of exciting features, including the Avalanche Warp Messaging (AWM) functionality. The AWM is poised to revolutionize communication capabilities on-chain and across chains, promising a more interconnected and resilient network. This enhancement is set to facilitate seamless interoperability of protocols on the ever-evolving Avalanche platform.

Market analysts, fueled by the palpable excitement, predict that the mounting buying pressure could propel a substantial 20% surge, potentially propelling AVAX to $49.95, effectively filling the current market range.

In a more bullish scenario, the gains might extend to $54.92, marking levels not witnessed since the bloom of May 2022 and showcasing an impressive 35% climb from current valuation.

AVAX: On-Chain Metrics Signal Sustained Growth

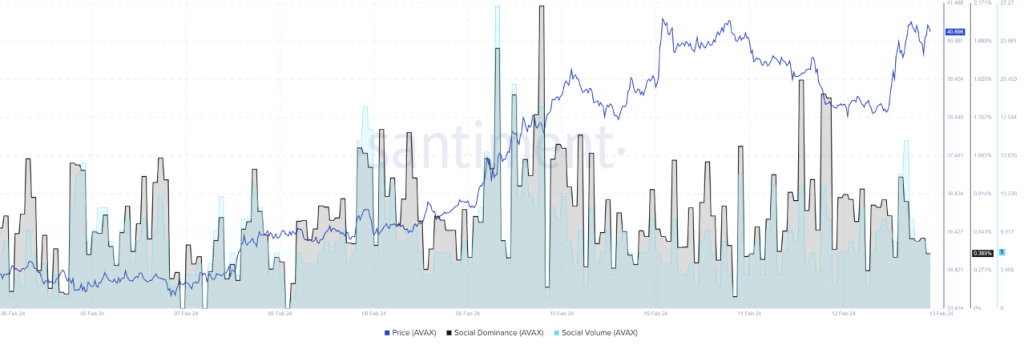

Examining the coin’s on-chain metrics, an additional layer of support for this positive outlook can be seen. Both social dominance and social volume metrics for AVAX have gracefully eased, painting a picture of serenity in the market. This tranquility often lays the foundation for sustained price growth, steering clear of premature topping out fueled by heightened volatility from mainstream attention.

As the imminent AVAX Durango upgrade takes center stage, traders and investors are on the edge of their seats, eagerly awaiting the potential surge that might unfold. With technical indicators, on-chain metrics, and market sentiment aligning favorably for AVAX, the cryptocurrency seems poised to continue its upward trajectory, potentially scaling new heights in the unfolding weeks.

Featured image from Pixabay, chart from TradingView