Quick Take

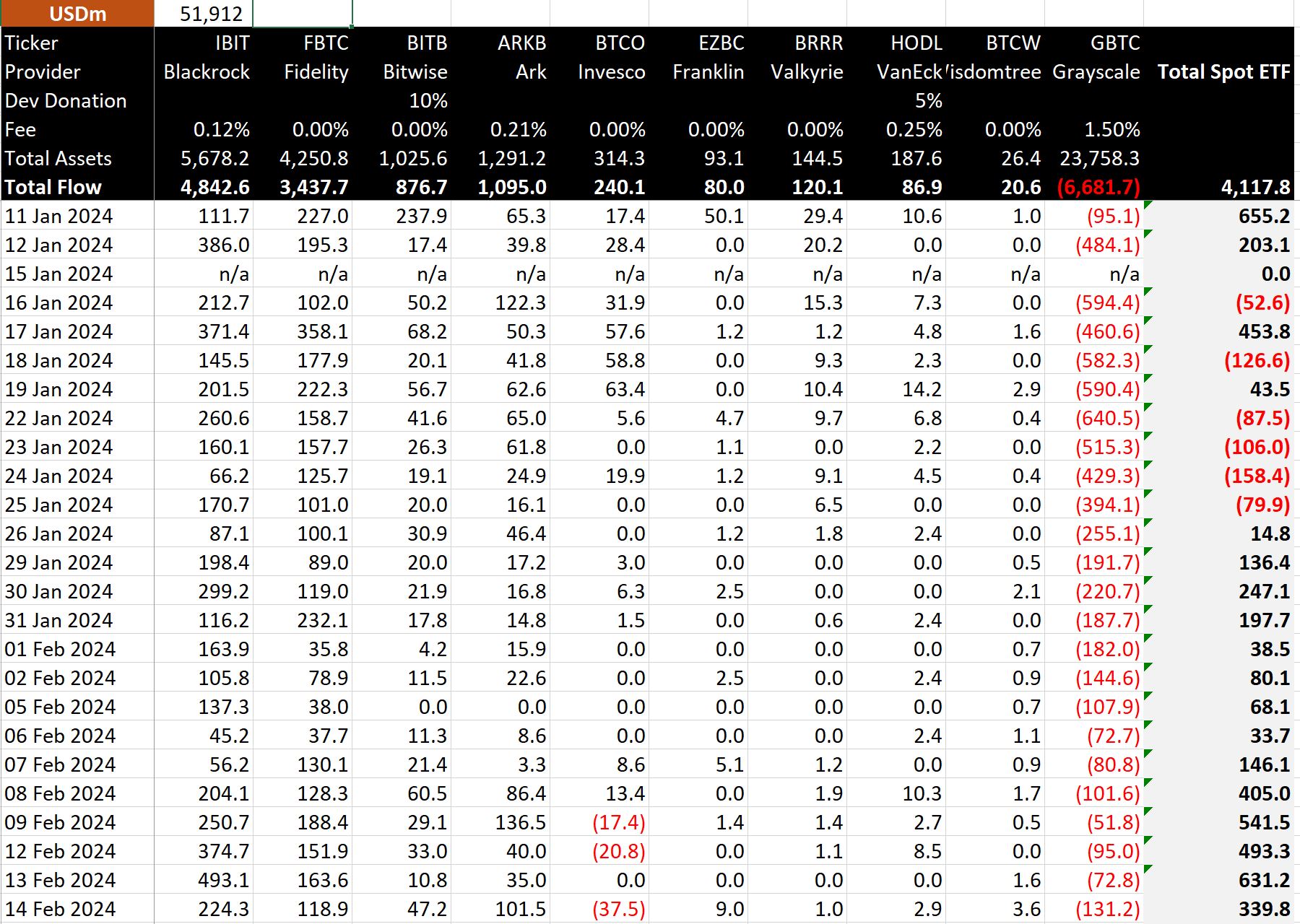

Feb. 14 proved to be another day of impressive inflows for Bitcoin ETFs, recording a net increase of $340 million, according to BitMEX Research.

BitMEX data shows that BlackRock IBIT leads the charge with a significant influx of $224 million, elevating its total holdings to a staggering $4.8 billion. Close behind, Fidelity’s FBTC ETF observed its sixth successive day of net inflows exceeding $100 million, with a $119 million inflow bolstering its total to $3.4 billion.

Not all ETFs shared in the prosperity, however. BTCO Invesco, on the other hand, experienced its third outflow; a cumulative total of $76 million was withdrawn. ARKB by Ark Invest marked a milestone with net inflows surpassing $1 billion, with a notable $102 million influx on Feb. 14.

As BitMEX reported, the Grayscale Bitcoin Trust (GBTC) observed further outflows amounting to $131 million, reaching a total outflow of $6.7 billion. Despite these outflows, the total net inflow for all Bitcoin ETFs stands at an impressive $4.1 billion, a testament to their growing popularity.

The post BlackRock and Fidelity lead as Bitcoin ETFs capture $340 million in a single day appeared first on CryptoSlate.