Quick Take

A data analysis snapshot from Bitcoin Munger presents an interesting nuance in the financial landscape.

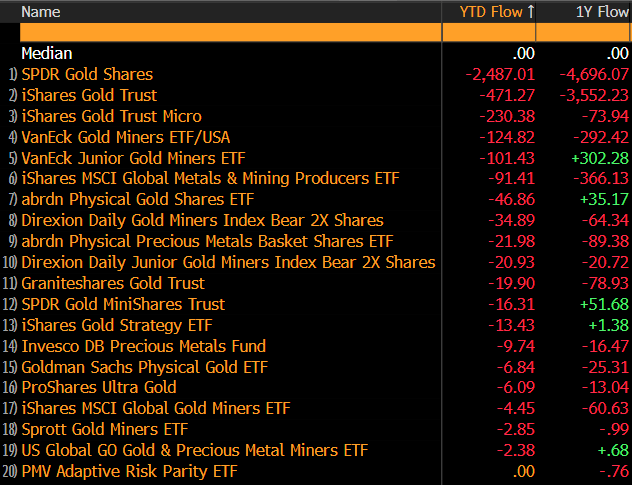

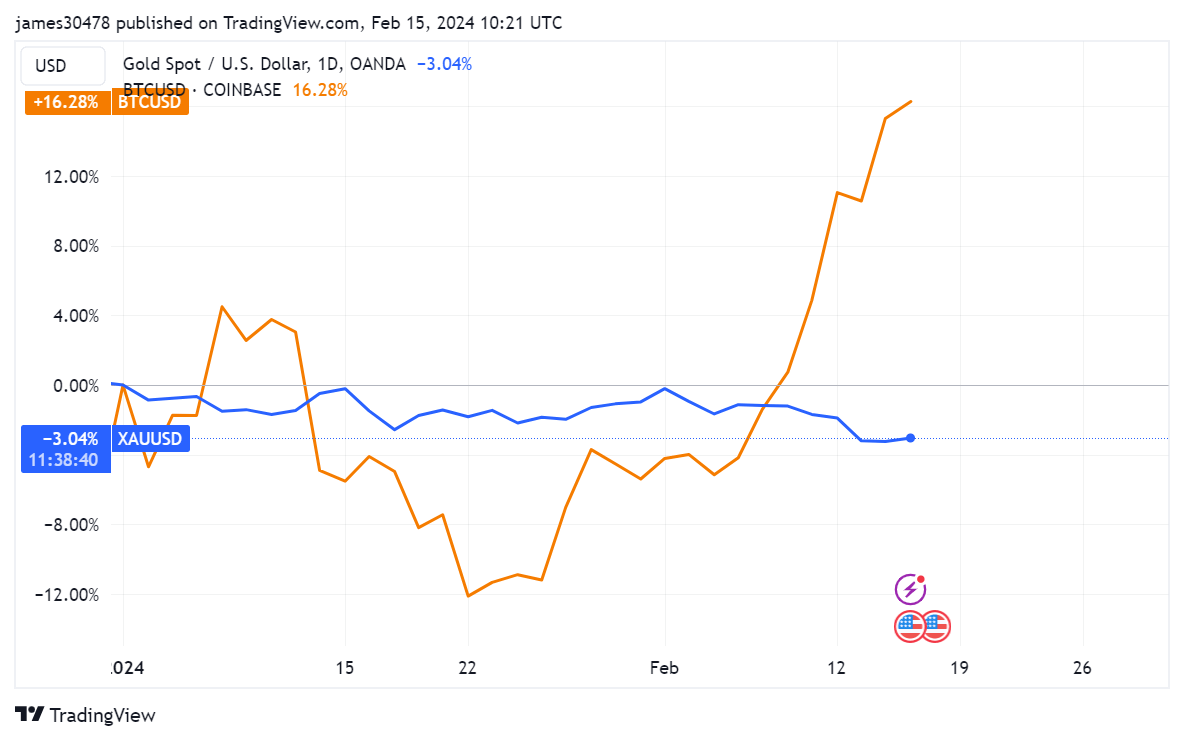

Historically considered a safe haven asset, Gold has experienced significant outflows from its ETFs. Bloomberg’s chart shows a downward trend, with roughly $3 billion outflows from various gold ETFs YTD and approximately $9 billion over the past year. Specifically, SPDR Gold shares and iShares Gold Trust witnessed about $2.5 billion and $500 million outflows YTD, respectively, with gold prices dropping 3% YTD.

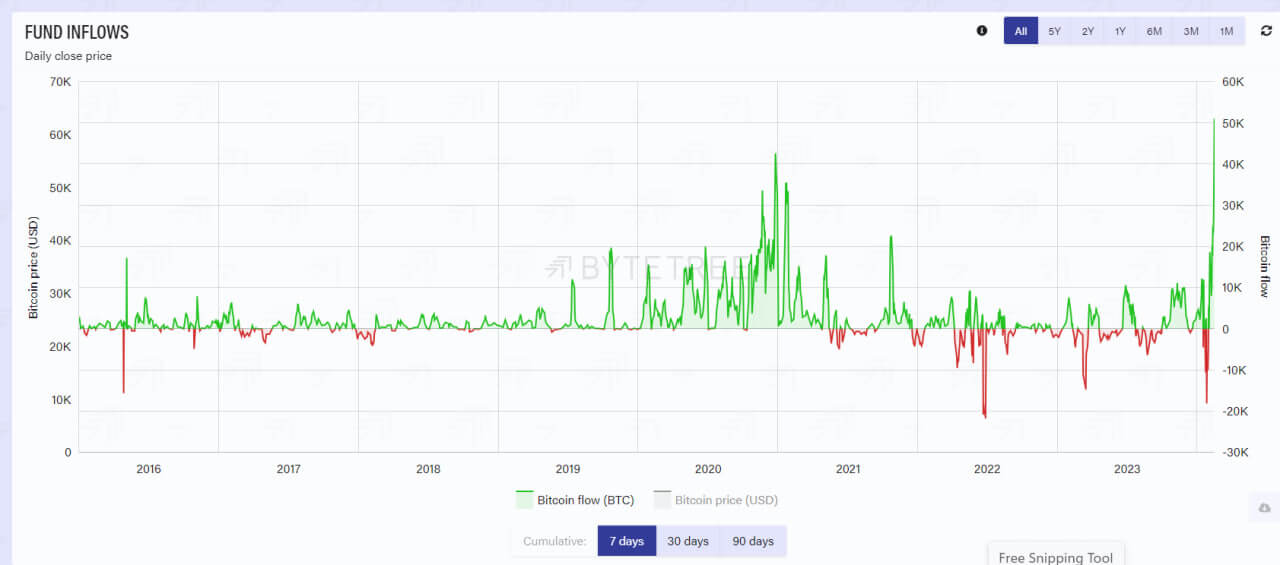

On the other end of the spectrum, Bitcoin’s performance stands out. Recording an upswing of 16% YTD, the digital asset has seen an inflow of $4.1 billion from ETFs, a remarkable feat considering these ETFs only started trading on Jan. 11.

Further supporting Bitcoin’s bullish run, the past week saw a record addition of 51,000 Bitcoin to global ETPs. Although these ETPs are around 40,000 BTC from their all-time high, they currently hold 922,000 Bitcoin, according to Byte Tree.

Benchmarking against gold, Bitcoin’s recent crossing of the $1T asset mark is noteworthy, especially against gold’s $13T. This trend could suggest a shifting preference among investors, reinforcing the narrative of Bitcoin as ‘digital gold.’

The post Bitcoin ETFs attract $4.1 billion amid $3 billion gold outflows appeared first on CryptoSlate.