Bitcoin setting a new all-time high and breaking above $72,000 is a significant milestone for the market. Riding the wave of increased institutional interest in spot Bitcoin ETFs, it smashed through the $68,000 ceiling established in November 2021 after a brief correction to $59,000 and seems to be gearing up for more gains this week.

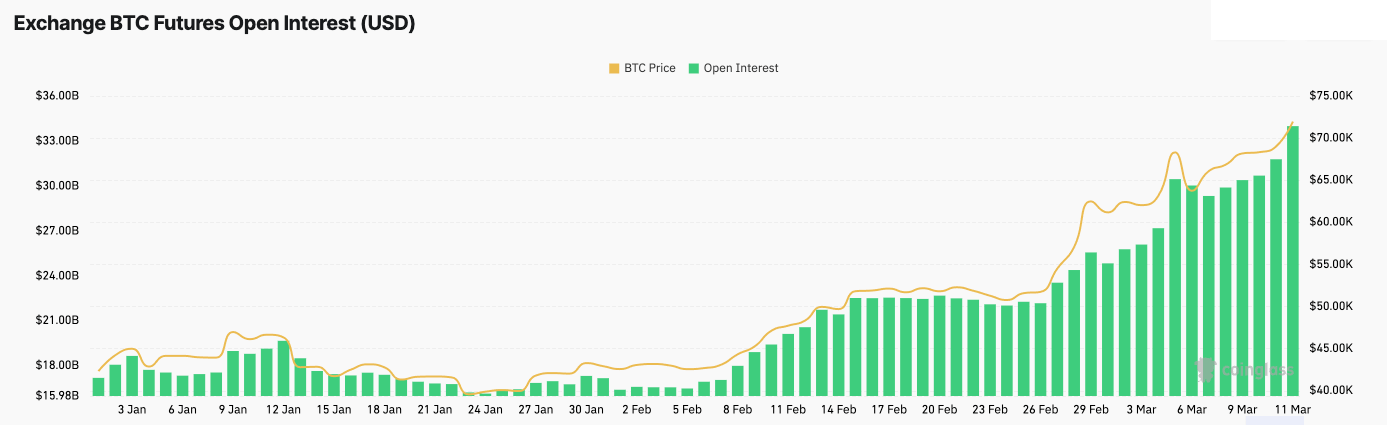

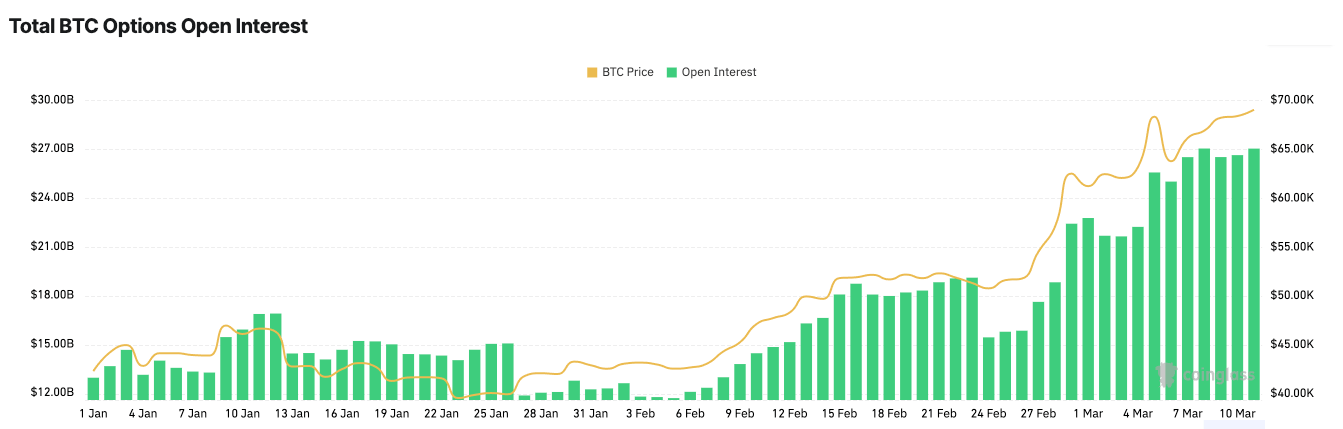

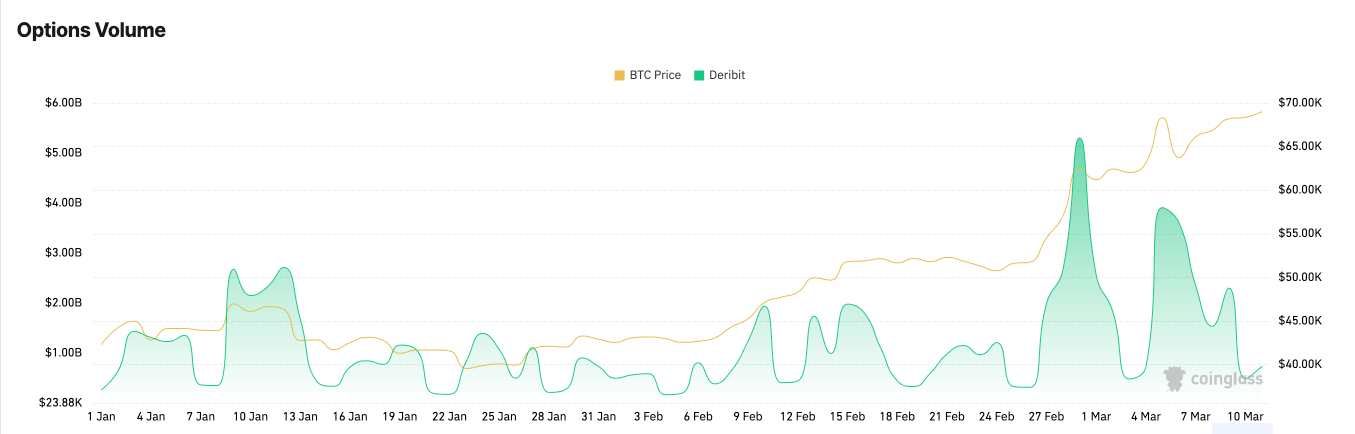

This week, the potential for more volatility is seen in the derivatives market, which peaked as Bitcoin touched $71,400. Since the beginning of the year, Bitcoin futures and options markets have seen unprecedented growth, with open interest reaching new highs on Mar. 11. Analyzing open interest is crucial for understanding market health and trader expectations. While spikes in open interest always follow price volatility, the intensity of the spikes can be a telling sign of just how leveraged the market is.

Futures open interest reached its all-time high of $33.48 billion in the early hours of Mar. 11 — almost double the $17.20 billion it posted on Jan. 1.

Options open interest reached their all-time high on Mar. 8 with $27.02 billion. A foothold seems to have been established at above $27 billion, with open interest remaining stable at $27.01 by Mar. 11. This is a significant increase from the $12.93 billion in open interest at the beginning of the year.

The growth in open interest shows a rapidly increasing appetite for derivatives. Futures and options provide traders with sophisticated strategies that allow them to hedge their positions and speculate on price movements.

The dominance of call options, with open interest and volume percentages consistently favoring calls over puts (61.66% vs. 38.34% for open interest and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that most of the market is speculating on further price increases.

Significant spikes in options volume on Deribit around key dates show the derivative market’s reactive nature to Bitcoin’s price movements. Data from CoinGlass showed notable spikes in volume on Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of intense price volatility.

Bitcoin breaking through important resistance levels played a pivotal role in this spike. Each resistance point crossed market new heights of market optimism and triggered increased trading activity as the market adjusted its positions to capitalize on the bullish momentum or protect against a potential downturn.

The rapid rise in interest in derivatives has led to the convergence of open interest in futures and options. While futures and options OI are yet to reach parity, the difference between the two is currently unprecedently low. Historically, futures open interest has been significantly higher than that of options, as futures provide a direct mechanism for hedging and speculation without the complexity of options strategies.

However, Bitcoin’s performance this year seems to have attracted many advanced traders looking for more versatile trading strategies than futures. Options are considered more sophisticated trading instruments, allowing traders to hedge their positions, speculate on price movements with limited downside risk, and generate income through strategies such as covered calls and protective puts. As investors become more knowledgeable and confident in using options, the demand for these instruments increases, leading to a rise in open interest.

Moreover, the current market conditions—high volatility and record prices—make options particularly appealing. Options can provide leverage similar to futures but with the added advantage of predetermined buyer risk. In a rapidly appreciating market, options allow investors to speculate on continued growth or protect against a potential downturn without committing as much capital as required for a futures position.

The balancing of open interest in futures and options also suggests that the market is at a crossroads, with investors divided in their outlook. While some may view the current price levels as sustainable and indicative of further growth, others might see it as overextended, warranting caution and using options for risk management.

The implications for future price movements are twofold. On the one hand, the robust derivatives activity indicates a healthy market with deep liquidity and sophisticated participants, potentially supporting further price increases. On the other hand, the high degree of leverage drastically increases the risks of market corrections — with tens of billions worth of derivatives on the line, even smaller drawdowns have the potential to turn into massive volatility.

The post Open interest reaches all-time high as Bitcoin touches $72k appeared first on CryptoSlate.