As Bitcoin (BTC) continues its remarkable ascent, reaching a new all-time high (ATH) of $72,300, investors wonder when the current bull market will peak. Considering historical data and the upcoming halving event scheduled for April 2024, crypto analyst Rekt Capital has provided insights into potential timing.

Bitcoin Peak Expected Sooner Than Expected?

By examining previous halving cycles and the “acceleration” observed in the current cycle, Rekt Capital suggests that Bitcoin’s bull market may peak within 266-315 days from breaking its old all-time high, potentially occurring in December 2024 or February 2025.

Rekt Capital’s analysis reveals that Bitcoin has historically peaked in its bull market approximately 518-546 days after a halving event. However, the current cycle demonstrates accelerated growth, reducing approximately 260 days.

According to the analyst, this acceleration has the potential to halve the typical cycle length, indicating that Bitcoin’s peak in the current bull market may occur much sooner than anticipated.

Rekt Capital’s perspective, measuring the bull market peak from when an old all-time high is breached, provides valuable insights. In this cycle, Bitcoin recently broke to new all-time highs, indicating a potential milestone in the market.

If the accelerated perspective holds, the next bull market peak is estimated to occur within 266-315 days from this breakout, landing somewhere between December 2024 and February 2025, according to the analysis provided by Rekt.

Roughly every four years, Bitcoin’s halving events have historically played a crucial role in shaping market cycles. These events reduce the block reward miners receive, thereby reducing the rate of new Bitcoin supply, but this time may be different, according to Rekt, another analyst.

From Four-Year Cycle To New Horizons

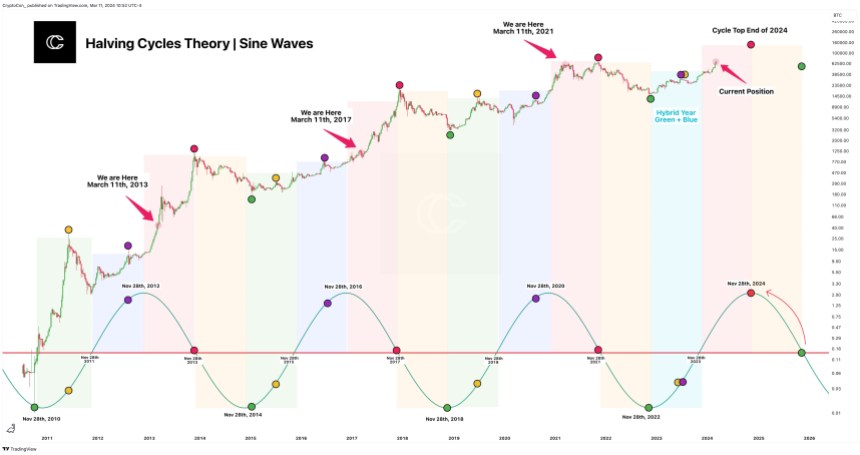

Similar to Rekt’s analysis, market expert Crypto Con suggests that the “conventional four-year cycle” may no longer hold, as Bitcoin is reaching new all-time highs sooner than expected, and as such, Crypto Con believes that the “boundaries of the traditional cycle” are being pushed, potentially signaling a paradigm shift in Bitcoin’s market dynamics.

Historically, Bitcoin’s price cycles have adhered to a four-year pattern, characterized by market peaks around four years after each halving event. However, Crypto Con challenges this notion, arguing that the current cycle deviates from the “traditional timeline.”

Bitcoin’s recent entry into “price discovery mode” and the achievement of new ATHs approximately a year earlier than expected suggest that the four-year cycle may no longer hold its predictive power.

Crypto Con’s analysis indicates that the current market trajectory aligns more closely with the 2017 bull run than with previous cycles. Comparing the first tops of cycles 1 and 3 (2013 and 2021) to the present, both instances were on the verge of forming their initial peaks around April, mirroring the current market conditions.

This observation supports the possibility of Bitcoin’s next bull market peak occurring in late 2024 rather than the previously anticipated late 2025.

Featured image from Shutterstock, chart from TradingView.com