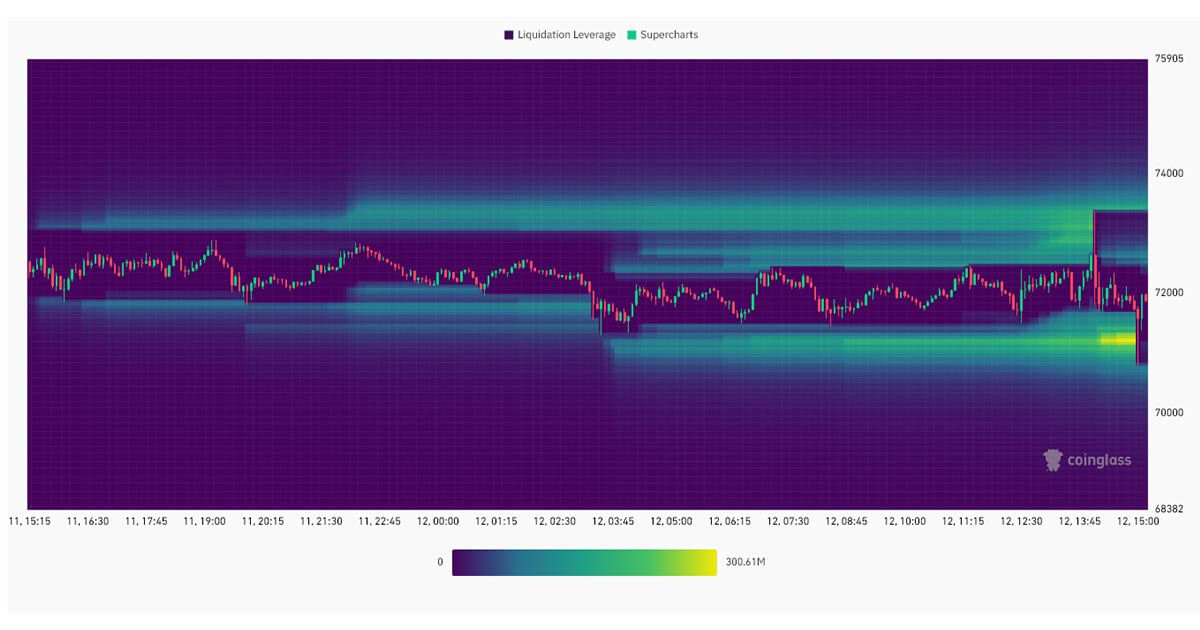

In the wake of new inflation data, the crypto market experienced $164.52M in liquidations over the past 12 hours, with $119.88M in long positions and $44.64M in short positions being flushed out. Bitcoin accounted for $48.31M of the total liquidations.

The US Market Open again seemed to be a bigger catalyst than inflation data as the open saw another leverage sweep, aligning with yesterday’s analysis of crypto leverage. Bitcoin rose by 1 % to create a new all-time high of $72,940, followed by a decline to $70,900 before returning to around $71,880 as of press time.

The US annual inflation rate unexpectedly increased to 3.2% in February, surpassing forecasts of 3.1% and rising from January’s 3.1%, per the US Bureau of Labor Statistics. The monthly inflation rate also rose to 0.4% from 0.3%, with shelter and gasoline prices contributing over 60% of the increase.

Despite the higher-than-expected inflation figures, core inflation eased slightly to 3.8% from 3.9%, compared to forecasts of 3.7%. The monthly core inflation rate remained steady at 0.4% instead of the predicted 0.3%.

| Calendar | GMT | Reference | Actual | Previous | Consensus | TEForecast |

|---|---|---|---|---|---|---|

| 2024-02-13 | 01:30 PM | Jan | 3.1% | 3.4% | 2.9% | 3.1% |

| 2024-03-12 | 12:30 PM | Feb | 3.2% | 3.1% | 3.1% | 3.2% |

| 2024-04-10 | 12:30 PM | Mar | 2.6% |

(Source: Trading Economics)

However, Aurelie Barthere, Principal Research Analyst at Nansen.ai, does not expect the US CPI release to end the crypto bull market or significantly impact prices in the coming weeks, according to comments made to CryptoSlate. She attributes this to the strong bullish momentum in the crypto space, citing recent announcements such as BlackRock allocating its own BTC ETF to two of its asset management funds.

Barthere anticipates a repricing of expected Fed rate cuts, with future markets likely to adjust from four rate cuts to two or three by December 2024. She said,

“We do not expect a significant sell-off for crypto as this repricing has happened in the past few months without questioning the bull market “

The post Bitcoin leverage again flushed at US Market Open as inflation rises missing estimates appeared first on CryptoSlate.