Current market dynamics have seen Shiba Inu (SHIB) shedding off a lot of its gains earlier in the month. SHIB kickstarted a price surge on February 29th at $0.00001178 to reach $0.00004456 for the first time since December 2021, representing a surge of over 278% in the space of three days.

However, it seems investors are now pulling away from the meme cryptocurrency, and the bull frantic earlier in the month seems to be disappearing. Interestingly, on-chain data indicates that a chunk of over 23 trillion SHIB has moved from the hands of long-term holders into the wallets of short-term holders in the past four days. This cohort of addresses is known to hold their SHIB tokens for quick returns instead of holding them long-term.

Shiba Inu Price Downtrend Expected to Extend Beyond 45%

SHIB has been on a general downtrend since March 5 with the formation of lower highs in cases of brief uptrends. Notably, the crypto has dropped by 46% since attaining this two-year high. At the time of writing, SHIB is trading at $0.000024, down by 4.79% and 27% in the past 24 hours and seven days, respectively.

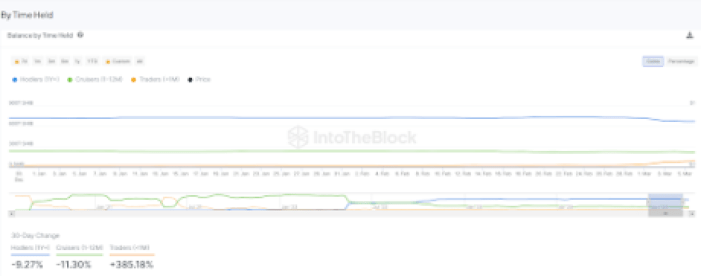

According to data from IntoTheBlock, Short-term Shiba Inu owners have now increased their possession by 23 trillion SHIB in the past four days, signaling lower prices ahead. According to ITB’s “Balance by Time Held” metric, the balance held by traders holding for less than a month has increased by 385% in the last 30 days. At the same time, long-term holders (more than a year) and cruisers (holding for one to 12 months) have reduced their balance by 9.27% and 11.30%, respectively.

This interesting movement demonstrates the current dynamic among the various cohorts of SHIB traders. The decrease in long-term holder balance indicates they might be taking profit after holding for so long. At the same time, so much of the supply is moving into the hands of short-term traders seeking quick profits, making SHIB vulnerable to continued selloffs.

This interesting movement demonstrates the current dynamic among the various cohorts of SHIB traders. The decrease in long-term holder balance indicates they might be taking profit after holding for so long. At the same time, so much of the supply is moving into the hands of short-term traders seeking quick profits, making SHIB vulnerable to continued selloffs.

Technical Analysis: What’s Next For SHIB’s Price?

The overall technical indicators for SHIB point to short-term correction unless there is a change in bullish sentiment. The meme token has now broken below support at the $0.000026 price level and is now moving towards $0.000023, a level that has acted as a major resistance earlier in the month.

On the other hand, several fundamental factors point to a potential price recovery and continued growth for the meme coin. Despite its recent correction, the price of SHIB is still up by 144% in the past 30 days, which shows the uptrend can resume anytime soon.