Quick Take

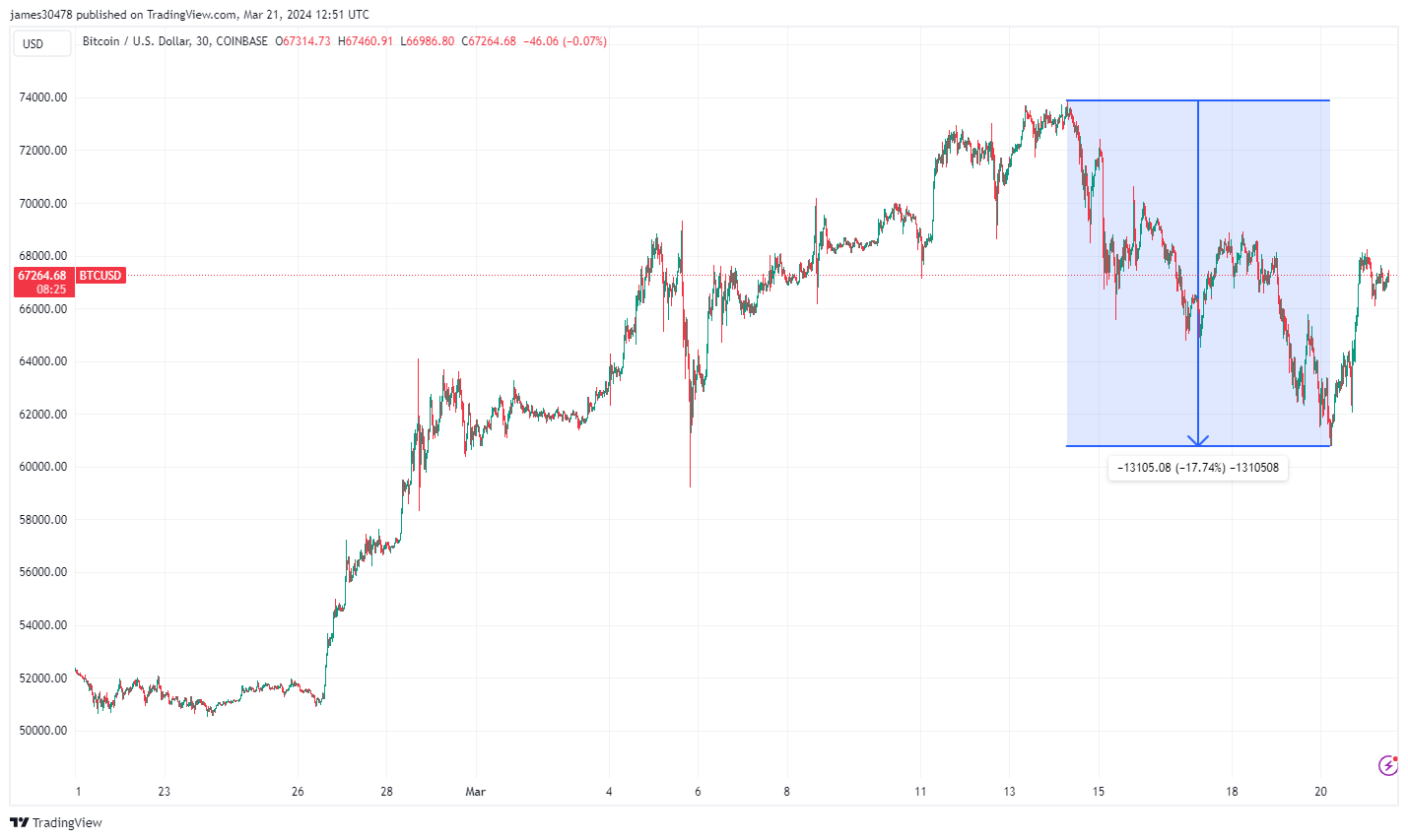

March has proven to be a tumultuous month for Bitcoin, showcasing fluctuations from an opening at roughly $61,000 to a steady rise above $67,000. Despite this progress, the path was not without its challenges. On March 20, Bitcoin experienced a notable decline to $60,700, marking an 18% fall from its peak above $73,000 on March 14.

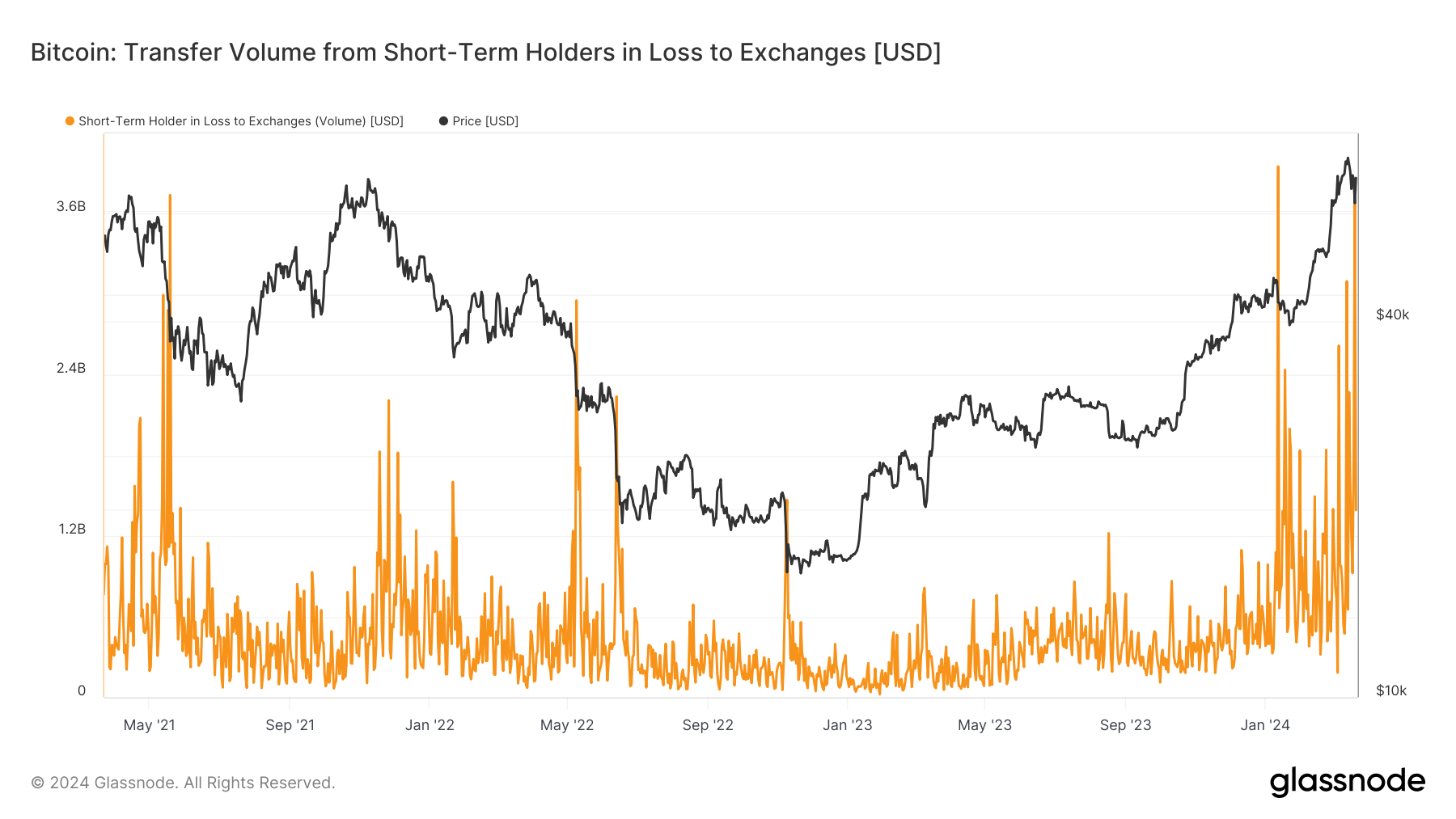

Interestingly, this volatility spotlighted the behavior of short-term holders, defined as investors retaining Bitcoin for fewer than 155 days. They are particularly sensitive to market fluctuations, often buying Bitcoin at higher prices driven by fear of missing out (FOMO), and tend to sell during price declines.

A remarkable instance was on March 19, when this cohort transferred over 57,000 Bitcoin to exchanges, totaling a loss to exchanges of approximately $3.7 billion. This figure trails closely behind the record $4 billion loss experienced subsequent to the ETF launch in January 2024 that nudged the Bitcoin price down by 20%.

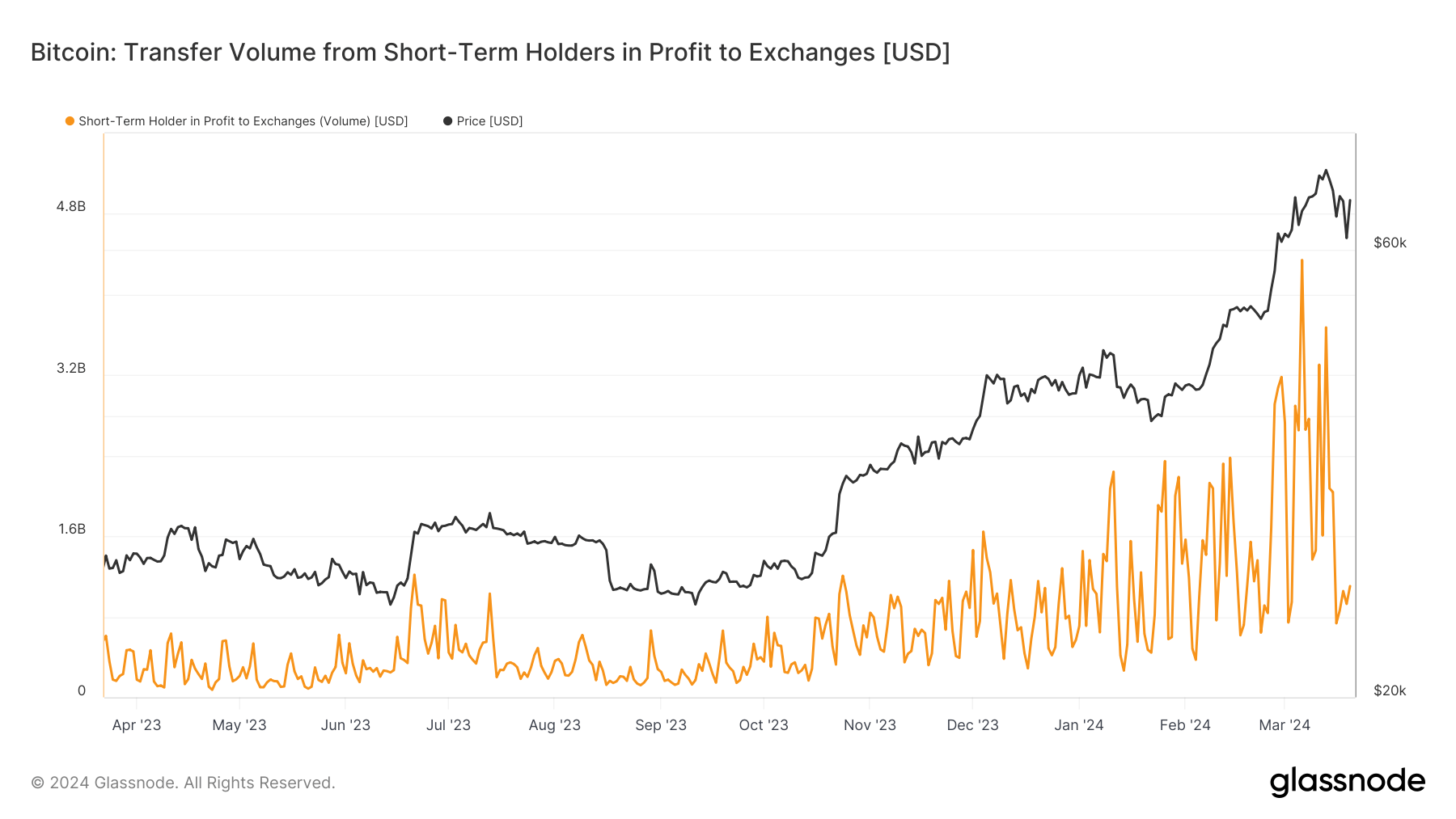

Despite these losses, there is a silver lining. Since Bitcoin’s all-time high on March 14, short-term holders have considerably reduced profit-taking to exchanges, indicative of their dissatisfaction with Bitcoin’s current price range and potential anticipation of higher valuations for profitable exits.

The post Bitcoin’s March madness: Short-term holders bear the brunt of volatility appeared first on CryptoSlate.