The price performance of Bitcoin over the past week has been a source of concern for the majority of the crypto community. This has pretty much been the case for other cryptocurrencies in the market, with several large-cap tokens reversing their recently-accrued profits.

However, some investors are treating the recent price decline as a rare opportunity in the bull market as they continue to load their bags with assets of their choice. Specifically, the latest on-chain data shows significant buying activity amongst a certain class of investors.

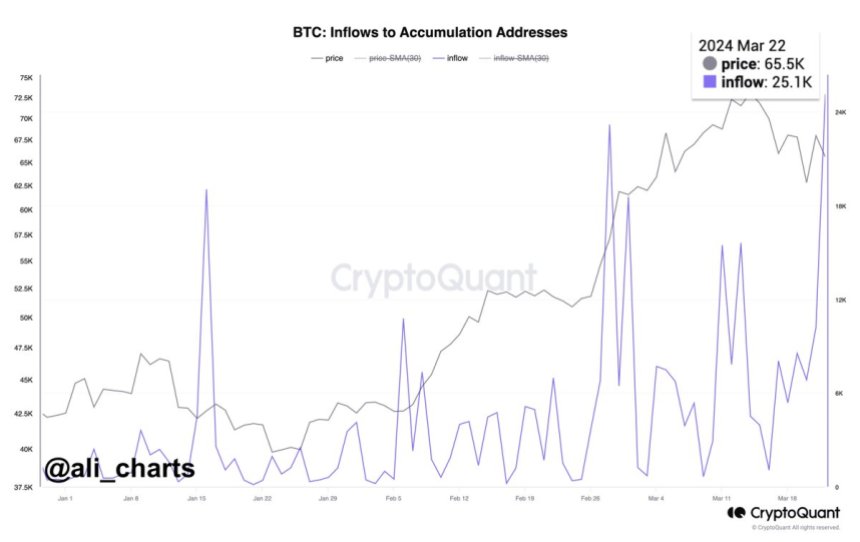

25,000 BTC Flow Into Accumulation Addresses In One Day

Prominent crypto pundit Ali Martinez revealed, via a post on X, that more than 25,000 BTC (valued at approximately $1.6 billion) was moved to accumulation addresses on Friday, March 22. This figure represents the highest amount transferred to these wallets in a single day so far in 2023.

The metric of interest here is the Inflow to Accumulation Addresses on the Bitcoin blockchain. For context, a Bitcoin accumulation address refers to an address that has zero outgoing transactions and maintains a balance of at least 10 BTC.

This classification, however, excludes digital wallets linked to centralized exchanges and miners and has less than 2 non-dust incoming transfers. Also, it doesn’t include addresses that have not seen any activity in more than seven years.

The increased flow of coins into this class of wallet addresses is evidence of substantial BTC accumulation by entities who view the crypto as a long-term investment. It signals that certain big-money players are amassing Bitcoin in anticipation of potential value appreciation.

What’s more, this significant acquisition by long-term investors emphasizes the increasing adoption of Bitcoin as a store of value. Meanwhile, it might be an indicator of bullish price movement in the short term.

Bitcoin Price Overview

As of this writing, Bitcoin is valued at $64,636, reflecting a mere 1% price increase in the past 24 hours. This price change is somewhat negligible, considering the deep retracement of the premier cryptocurrency earlier in the week.

According to data from CoinGecko, the price of BTC is down by 2.4% over the past week. Meanwhile, the market leader is currently about 13% from its record high of $73,798.

However, it has been an overall positive performance for the Bitcoin price in March, having surpassed this previous all-time high of $69,000 a little over a week ago. And, with a market cap of $1.26 trillion, BTC retains its position as the largest cryptocurrency in the sector.