Tony “The Bull” Severino, the Head of Research at NewsBTC and a certified CME, has identified an “Evening Star” candlestick pattern on the monthly chart of the Bitcoin CME futures. This formation, which traditionally indicates a potential trend reversal, is forming at a critical point for Bitcoin.

According to Severino, there could be tell-tale signs suggesting that the Bitcoin upswing could end as the momentum fades.

The Evening Star Formation: BTC Bull Run Over?

Though there are concerns that the pattern is forming on the Bitcoin CME futures chart, it is absent from the spot BTCUSD chart on ordinary charts from Binance or Coinbase, for example. Accordingly, the lack of uniformity on charts has also left Severino questioning the reliability of the signal.

While the Evening Star pattern suggests a possible reversal, Severino cautions that Bitcoin could still reach higher highs in the coming months before peaking and reversing. However, the analyst stresses that predicting the exact timing of these events is a challenge.

Based on candlestick analysis, Severino predicts that Bitcoin could peak within the next two quarters, possibly in mid- or late Q3 2024.

When writing, Bitcoin is trading at around all-time highs. Following the cool-off of last week, the coin bounced back strongly over the weekend, wiping out some losses. The coin is technically within a bearish breakout formation, trading below the 20-day moving average, clear in the daily chart.

For the uptrend to continue and extend from the formation in the daily chart, BTC must push above $70,000. The validity of this uptrend will be solid if the leg up is with expanding trading volume.

Severino also notes that the leg up will be valid and the Evening Star formation invalid if there is a strong close above $74,000 by the end of the month. Bitcoin prices peaked at around $73,800 in early March, buoyed by expanding demand, especially from spot Bitcoin ETFs.

Spot Bitcoin ETFs Post More Outflows

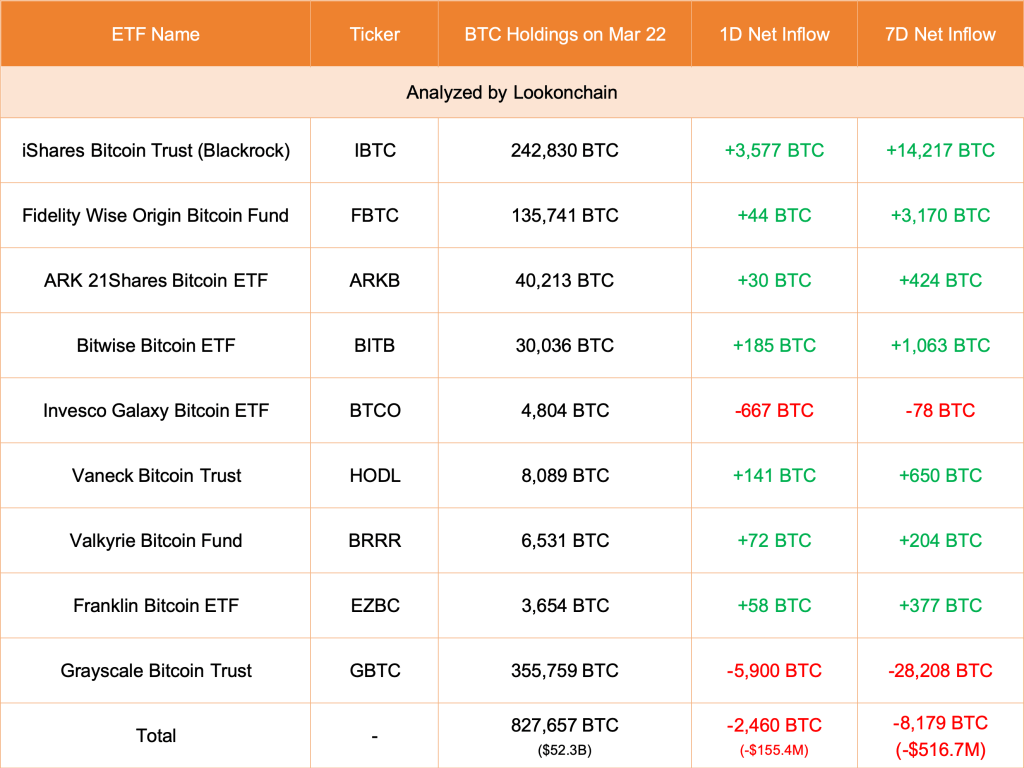

Despite the potential for a continued rally, some fundamental factors pose challenges. Notably, outflows from spot Bitcoin exchange-traded funds (ETFs), particularly from the Grayscale Bitcoin Trust (GBTC), are rising. Rumors suggest that bankrupt crypto lender Genesis could be liquidating its GBTC holdings, adding further selling pressure to the market.

By March 22, spot Bitcoin ETF issuers had experienced outflows for five straight days, according to Lookonchain data. Nonetheless, as GBTC posts outflows, BlackRock’s IBIT continues attracting more clients seeking BTC exposure.