Quick Take

VettaFI’s data showcases the impressive traction of BlackRock’s IBIT, marking it as the US ETF with the second-largest inflows year to date.

IBIT only trails behind the Vanguard S&P 500 ETF, which has garnered inflows of $21.6 billion year-to-date (YTD), positioning it at the forefront. Notably, despite IBIT’s trading activity spanning merely 50 days, it achieved the ninth-highest inflow in a one-year review.

On a 4-week analysis, IBIT again ranks second with inflows amounting to $7.3 billion, this time following the SPDR S&P 500 ETF Trust, which leads with $21.4 billion, according to VettaFI.

| Symbol | ETF Name | 1 Week ($MM) | 4 Week ($MM) | YTD ($MM) | 1 Year ($MM) | 3 Year ($MM) | 5 Year ($MM) |

|---|---|---|---|---|---|---|---|

| VOO | Vanguard S&P 500 ETF | -2,835.75 | 7,006.49 | 21,640.69 | 60,597.88 | 134,882.64 | 179,565.43 |

| IBIT | iShares Bitcoin Trust Registered | 715.82 | 7,348.23 | 13,089.01 | 13,089.01 | 13,089.01 | 13,089.01 |

| VTI | Vanguard Total Stock Market ETF | -649.13 | 3,251.86 | 9,343.79 | 27,160.83 | 91,957.24 | 145,947.28 |

| FBTC | Fidelity Wise Origin Bitcoin Fund | 213.98 | 2,877.62 | 7,339.88 | 7,339.88 | 7,339.88 | 7,339.88 |

| QQQ | Invesco QQQ Trust Series I | 3,045.09 | 4,108.80 | 7,136.59 | 13,984.59 | 42,035.26 | 57,387.51 |

Source: VettaFI

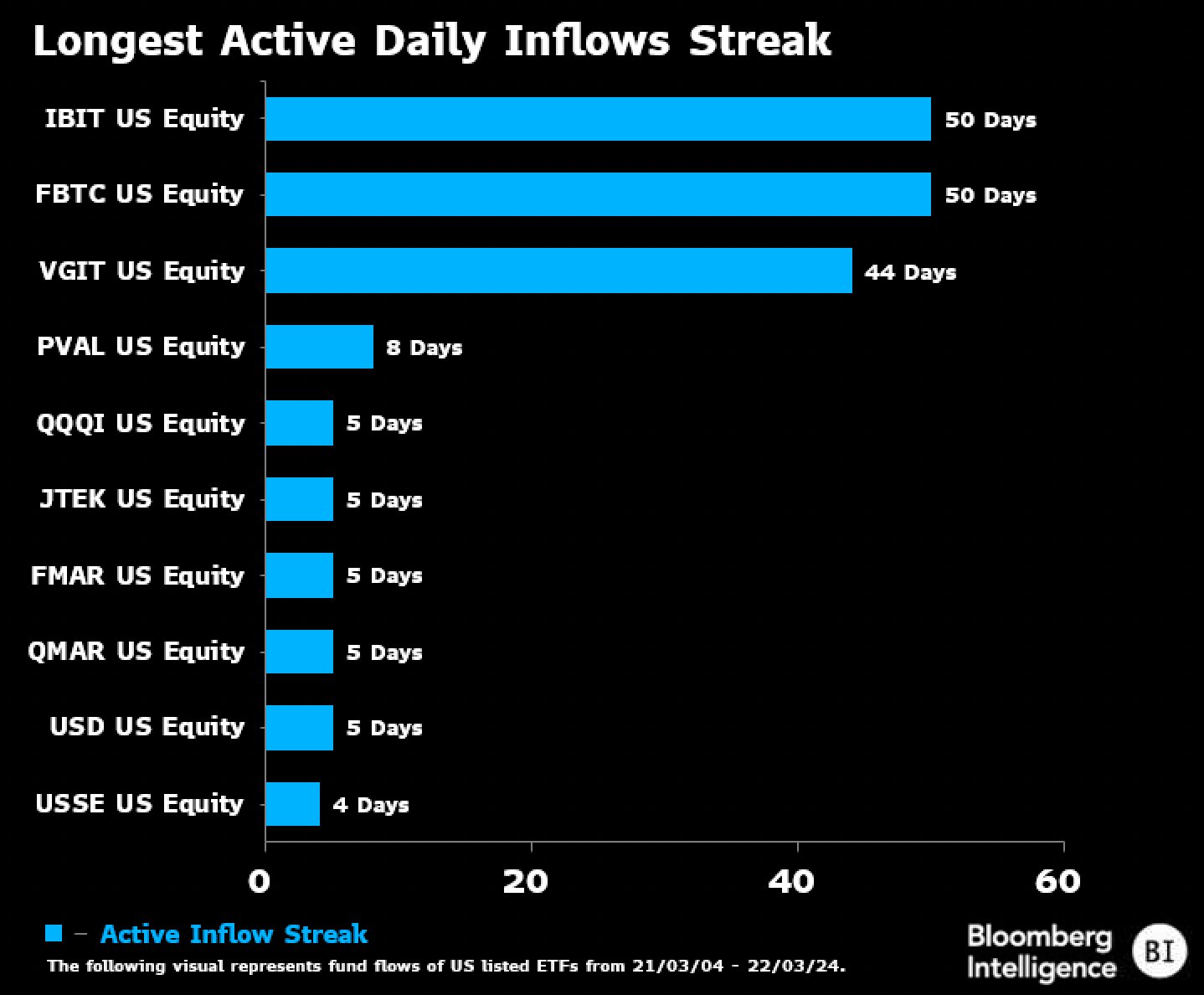

CryptoSlate highlighted that IBIT experienced 49 days of continuous inflows, a streak that Eric Balchunas, Senior ETF Analyst for Bloomberg, has now updated to 50 consecutive days. Fidelity’s FBTC and BlackRock’s IBIT have set a record with the longest active streak of daily inflows.

Balchunas further notes that despite its milestone, there’s still a significant gap to surpass the all-time record of 160 days of inflows set by JEPI.

The post BlackRock’s Bitcoin ETF achieves legendary status after hitting second-largest inflows for 2024 appeared first on CryptoSlate.