Spot bitcoin exchange-traded funds (ETFs), launched in January 2024, have become a game-changer for cryptocurrency investing.

These new financial instruments attracted a massive inflow of over $12 billion in just three months, currently holding a significant 4.20% share of all bitcoins.

Recent trends raise questions about their short-term impact and highlight the complex dynamics at play in the crypto market.

The initial surge in ETF investment was attributed to their ease of access for mainstream investors. Unlike traditional methods like crypto exchanges, ETFs offer a familiar trading platform and potentially lower fees.

This accessibility fueled optimism, with some analysts predicting a repeat of the parabolic price growth witnessed after the 2020 halving, where bitcoin’s value skyrocketed by 654%.

Waning Interest: Signs Of Concern In Recent Bitcoin Data

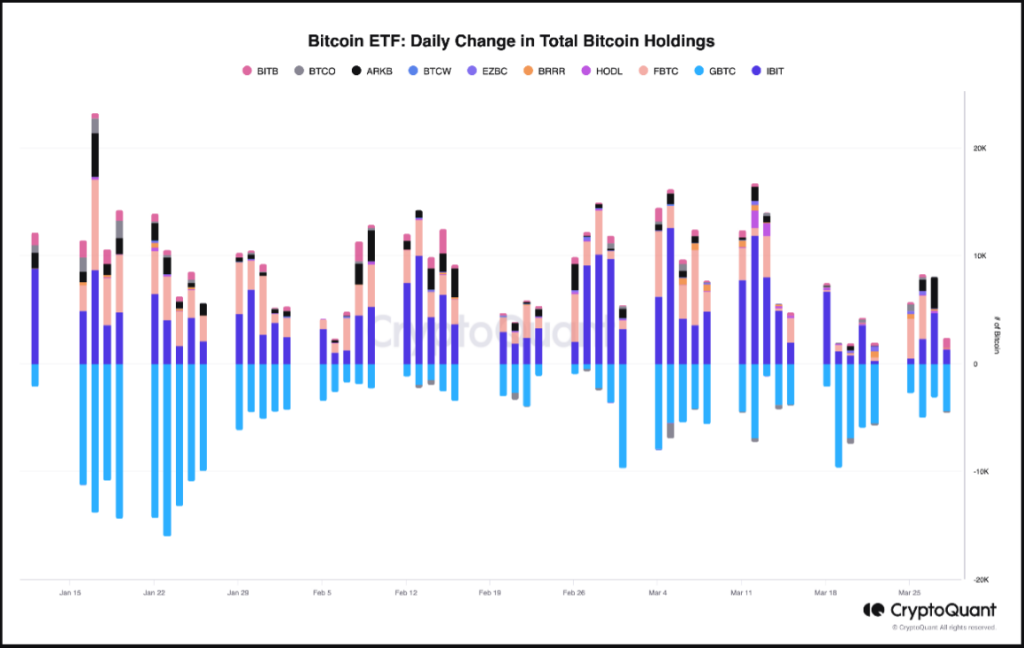

However, recent data paints a slightly concerning picture. While the initial euphoria was strong, interest in spot bitcoin ETFs seems to be waning. Crucially, these funds are no longer projected to absorb new bitcoins entering the market. In a recent report, the analyst operating under the alias Oinonen_t of CryptoQuant observed this.

This “negative supply absorption” could explain the stagnation in bitcoin’s price despite the approaching halving event, scheduled for later this month. The halving, by reducing the number of new bitcoins mined daily, is supposed to increase scarcity and theoretically drive up the price.

This slowdown in ETF investment could be attributed to several factors. One possibility is a shift in retail investor focus. With the rise of alternative cryptocurrencies like Solana-based tokens and meme coins, some investors might be exploring these potentially high-growth, high-risk options.

Additionally, concerns remain about the volatility inherent to the cryptocurrency market as a whole, which could deter some from long-term bitcoin investment through ETFs.

Bitcoin’s Long-Term Outlook Upbeat

Despite these short-term concerns, the long-term outlook for bitcoin seems to remain positive for many analysts. The upcoming halving still presents a potential catalyst for price appreciation.

Furthermore, the overall market capitalization of bitcoin, currently a fraction of gold’s, could see significant growth if it reaches parity with the precious metal, as some predict. This would translate to a staggering 1000% increase in bitcoin’s value.

However, achieving such a feat relies heavily on factors outside the immediate scope of spot bitcoin ETFs. Regulatory environments, institutional adoption, and broader economic trends will all play a crucial role in shaping the future of bitcoin.

Spot bitcoin ETFs have undoubtedly opened up new avenues for mainstream investors to participate in the cryptocurrency market.

Their initial success suggests a strong appetite for regulated, easy-to-access bitcoin exposure. However, the recent slowdown in investment and the lack of short-term price movement raise questions about their immediate impact.

Featured image from Luis Quintero/Pexels, chart from TradingView