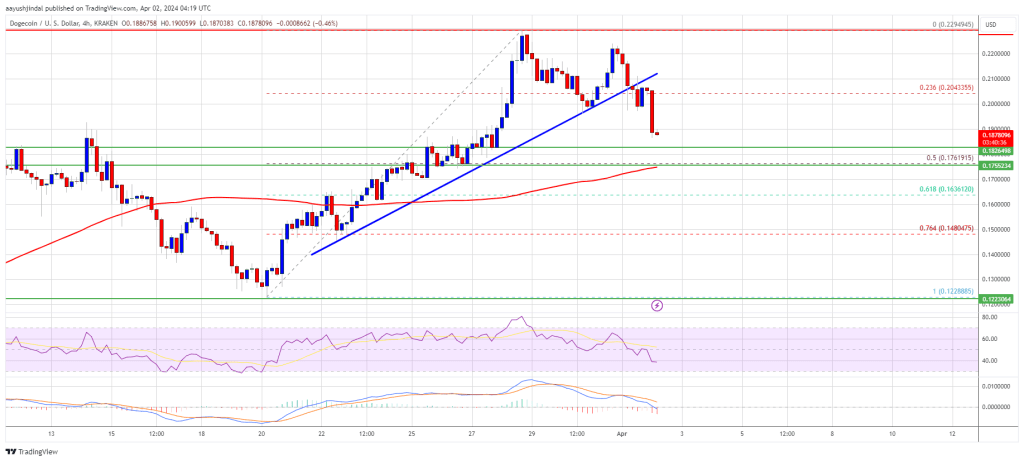

Dogecoin is correcting gains from the $0.230 zone against the US Dollar. DOGE must stay above the $0.1750 support zone to start a fresh increase.

- DOGE struggled to stay above $0.225 and corrected gains against the US dollar.

- The price is trading above the $0.1750 level and the 100 simple moving average (4 hours).

- There was a break below a key bullish trend line with support at $0.2040 on the 4-hour chart of the DOGE/USD pair (data source from Kraken).

- The price could restart its increase unless there is a close below the $0.1750 support.

Dogecoin Price Approaches Key Support

After a steady increase, Dogecoin price attempted more gains above the $0.230 zone. However, DOGE struggled above $0.2250. A high was formed at $0.2294 and the price started a downside correction, like Bitcoin and Ethereum.

There was a drop below the $0.2050 and $0.200 support levels. The price dipped below the 23.6% Fib retracement level of the upward move from the $0.1228 swing low to the $0.2294 high.

Besides, there was a break below a key bullish trend line with support at $0.2040 on the 4-hour chart of the DOGE/USD pair. However, Dogecoin is still above the $0.1750 level and the 100 simple moving average (4 hours).

Source: DOGEUSD on TradingView.com

On the upside, the price is facing resistance near the $0.1950 level. The next major resistance is near the $0.200 level. A close above the $0.200 resistance might send the price toward the $0.2150 resistance. The next major resistance is near $0.2300. Any more gains might send the price toward the $0.2500 level.

More Downsides in DOGE?

If DOGE’s price fails to gain pace above the $0.200 level, it could continue to move down. Initial support on the downside is near the $0.1820 level.

The next major support is near the $0.1750 level or the 50% Fib retracement level of the upward move from the $0.1228 swing low to the $0.2294 high. If there is a downside break below the $0.1750 support, the price could decline further. In the stated case, the price might decline toward the $0.1480 level.

Technical Indicators

4 Hours MACD – The MACD for DOGE/USD is now gaining momentum in the bearish zone.

4 Hours RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1820, $0.1750 and $0.1480.

Major Resistance Levels – $0.2000, $0.2150, and $0.2300.