Quick Take

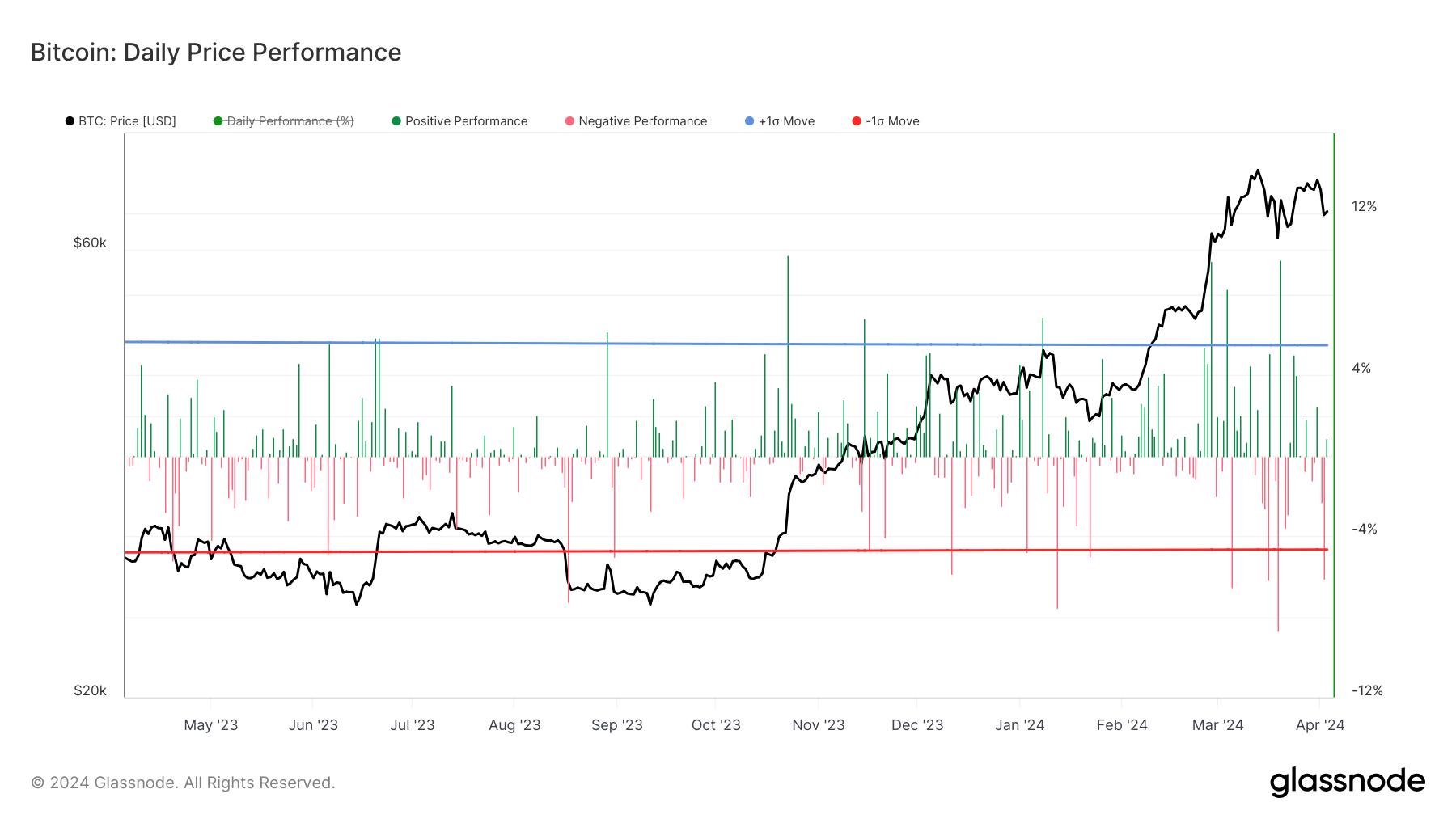

In 2024, Bitcoin has encountered significant volatility, as highlighted by Glassnode, which recorded seven instances of daily price drops surpassing 5% since January. This turbulent journey bears a resemblance to the challenges faced in 2017, a year characterized by remarkable returns. During that period, Bitcoin witnessed approximately 35 instances of daily price plunges exceeding 5%. Beginning the year at around $790, Bitcoin surged to reach approximately $20,000 by December, marking a dramatic rise amidst the tumultuous fluctuations.

The 2024 volatility in Bitcoin is being driven by two significant factors. Firstly, Bitcoin’s remarkable 50% surge this year, propelling it to new all-time highs, has prompted investors to engage in record profit-taking sell-offs. Secondly, speculative leverage in Bitcoin markets has reached unprecedented levels.

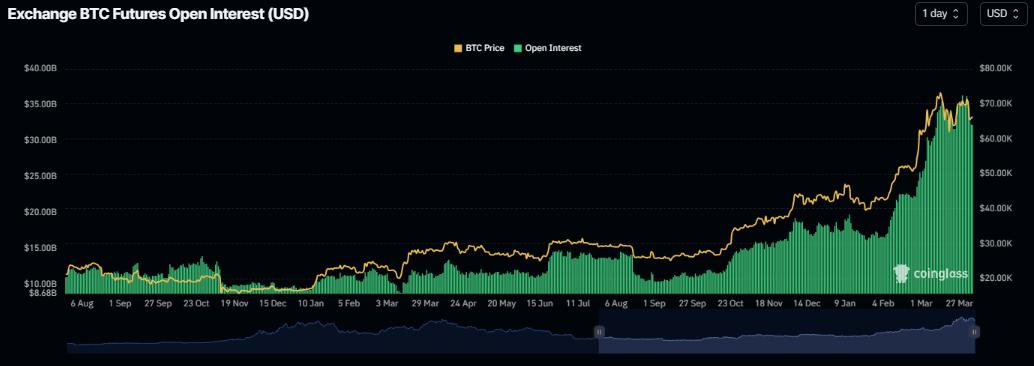

Coinglass data shows that since mid-March, the total value of open Bitcoin futures contracts has soared to around $35 billion, indicating heightened market activity. Particularly noteworthy is the frequent spike in the annualized funding rate, which perpetual futures traders pay, often ranging between 20% and 100%, underscoring the elevated risk and speculative nature of the current market environment.

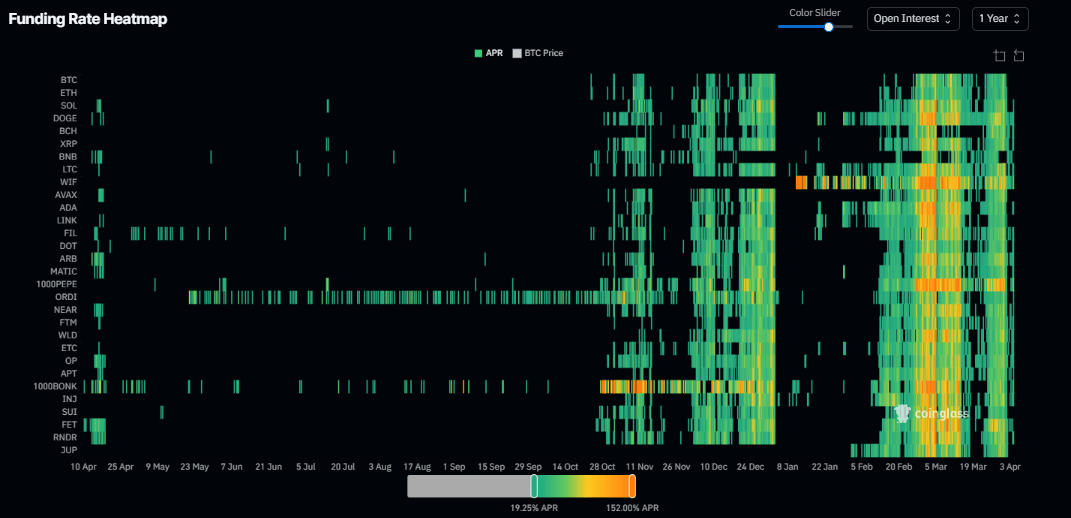

The elevated funding rates, depicted in green and orange on pricing heatmaps, indicate an abnormal level of leveraged positions within the Bitcoin markets. This excessive leverage is intensifying price fluctuations in both upward and downward directions. Historically, when the funding rate resets to levels below 20% (shown in black), it has often signaled the culmination of volatile cycles, hinting at potential stabilization or the bottoming out of market turbulence.

The post Bitcoin faces 2024 volatility reminiscent of 2017’s rollercoaster ride appeared first on CryptoSlate.