The recent approval of Bitcoin exchange-traded funds (ETFs) by the SEC sent jitters through the financial world. Initial concerns about fading demand seem unfounded as Bitcoin ETFs continue to shatter trading volume records. This is further bolstered by three consecutive sessions of net inflows into these investment vehicles.

Bitcoin ETF Inflows Signal Long-Term Investor Appetite

A recent dip in ETF activity sparked fears that the initial excitement might be short-lived. However, those fears have been quelled by a resurgence in inflows.

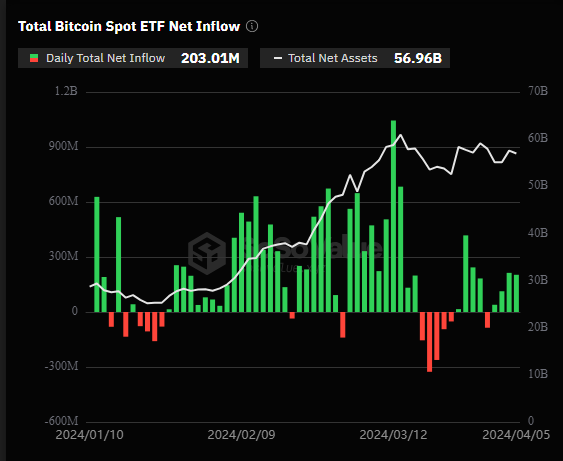

According to data from SoSoValue, yesterday saw a net inflow of $203 million into Bitcoin spot ETFs, marking the third straight day of positive inflow.

This sustained green streak suggests that investors remain interested in gaining exposure to the top crypto through ETFs, potentially anticipating a price surge due to the upcoming Bitcoin halving – a pre-programmed code update that cuts production in half, historically leading to price increases.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest asset manager, has emerged as a frontrunner in the crypto ETF space. Their iShares Bitcoin Trust (IBIT) recorded the highest net inflow on a single day, exceeding $144 million.

This impressive figure has pushed IBIT’s total net inflow over the past two weeks to over $14 billion. BlackRock’s commitment to Bitcoin ETFs is further underscored by their recent decision to include prominent Wall Street institutions like Goldman Sachs, Citigroup, Citadel Securities, and UBS as Authorized Participants (APs) in their spot Bitcoin ETF prospectus.

These additions position these banking giants as first-time participants in the ETF market, joining established players like JPMorgan and Jane Street.

The inclusion of such heavyweights is seen as a significant vote of confidence in the future of Bitcoin ETFs and a potential catalyst for further mainstream adoption.

Volatility On The Horizon For ETFs

While the recent surge in demand paints a bullish picture for Bitcoin ETFs, experts warn that volatility may be lurking on the horizon. CryptoQuant, a cryptocurrency analysis platform, points to signals in the futures market that suggest potential price swings in the near future.

A consistently high premium often signifies strong institutional buying pressure, particularly in light of the recent inflows witnessed in US Bitcoin ETFs. This increased institutional activity can contribute to price fluctuations, creating opportunities for both gains and losses.

Despite the potential for short-term volatility, the overall outlook for Bitcoin ETFs remains positive. The sustained demand, coupled with the backing of major financial institutions like BlackRock, suggests that these investment vehicles are poised to play a significant role in bridging the gap between traditional finance and the cryptocurrency world.

Featured image from Vegavid Technology, chart from TradingView