Charles Edwards, the founder of crypto hedge fund Capriole Investments, spotlighted what he believes to be the most undervalued altcoin at the moment. Via a statement on X, Edwards pointed to PENDLE, a token operating within the DeFi space, citing its exceptional total value locked (TVL) and market cap as primary indicators of its undervaluation.

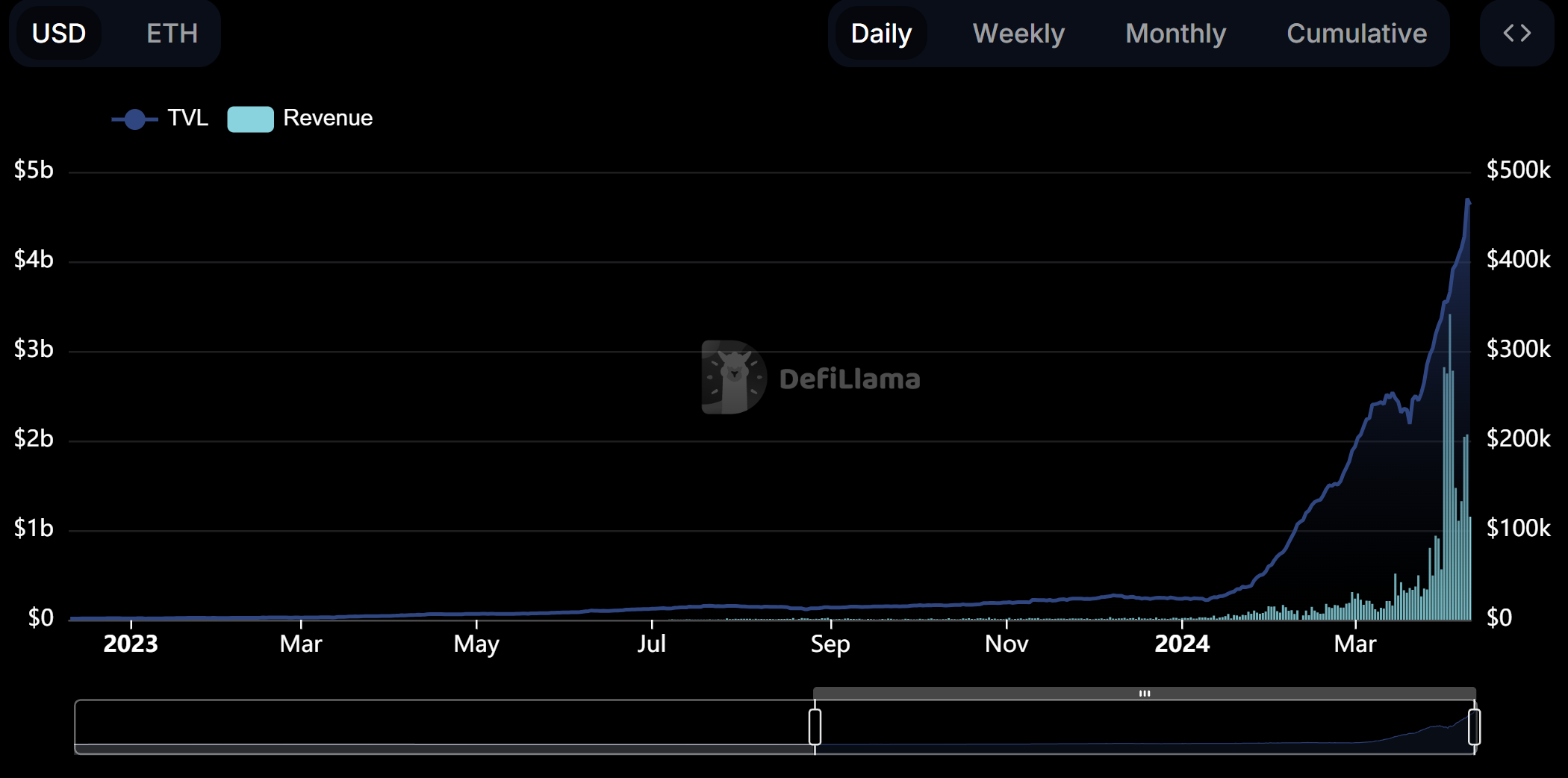

“Perhaps the most undervalued alt right now is PENDLE. Massive $4.6B TVL (about 5% of entire crypto world’s TVL) and market cap just 14% of its TVL. Huge flywheel effects with Ethena also. Ludacris growth,” Edwards remarked, sharing the total value locked (TVL) chart by DefiLlama.

Arthur Hayes, founder of BitMEX, also recently shared his optimism about PENDLE, reinforcing its potential within the DeFi sector with an enthusiastic, “The future of DEFI is PENDLE. Yachtzee bitches.”

The future of #DEFI is $PENDLE.

Yachtzee bitches

pic.twitter.com/4MtqmQvjpR

— Arthur Hayes (@CryptoHayes) April 5, 2024

Why Is PENDLE Crypto’s Hottest Altcoin?

Since the start of January, PENDLE has seen a remarkable 590% increase in price, with a 220% spike in just the last four weeks alone, making it one of the top-performing assets in the broader cryptocurrency market. This surge aligns with a significant rise in Pendle’s TVL, which escalated from just under $240 million at the beginning of January to over $4.6 billion recently.

Delving into the reasons behind PENDLE’s impressive trajectory, crypto researcher 100y.eth offered a detailed explanation on X, focusing on the token’s distinct utilities and tokenomics. “Pendle Finance revolutionizes DeFi by allowing the tokenization and separation of yield-bearing tokens into PT (Principal) and YT (Yield), tradable on Pendle’s AMM. This innovation is at the core of Pendle’s current popularity,” the researcher stated.

Further shedding light on the factors driving PENDLE’s accumulation, 100y.eth referred to significant whale activity. “According to lookonchain, whales are still in the phase of accumulating PENDLE, a testament to their belief in its long-term value,” the researcher noted, citing substantial withdrawals from exchanges as indicative of investor confidence.

Whales continue to accumulate $PENDLE!

0xe675 withdrew 295,443 $PENDLE($1.95M) from #Binance 3 hours ago and 372,752 $PENDLE ($2.46M) from #Binance 3 days ago.

0xAa4c withdrew 115,500 $PENDLE($764K) from #Binance 30 mins ago and 384,500 $PENDLE($2.54M) from #Binance 4 days ago.… pic.twitter.com/w1MZTUHSZp

— Lookonchain (@lookonchain) April 10, 2024

The essence of PENDLE’s appeal lies in its vePENDLE system, which enhances its governance model and incentivizes long-term holding. “Magic resides in vePENDLE. By locking PENDLE, users receive vePENDLE, engaging more deeply with the ecosystem. This mechanism not only fosters community governance but also amplifies rewards for liquidity providers,” the researcher added.

VePENDLE holders play a pivotal role in determining liquidity dynamics through their voting power, effectively channeling incentives to favored LP pools. “As of April 10, the rswETH Pool led with the most PENDLE votes, demonstrating the active engagement of our community in governance processes,” highlighted the discussion on yield dynamics and governance participation.

The synergy between recent market developments and Pendle’s innovative tokenomics is generating unprecedented yield opportunities. “With the frenzy around LRT and Ethena, we’re seeing huge yields, including swap fees, accruing to vePENDLE holders. Voter APYs in popular pools have soared from 100 to 400%, a clear indication of Pendle’s growing allure,” the researcher elaborated.

At press time, PENDLE traded at $7.37.