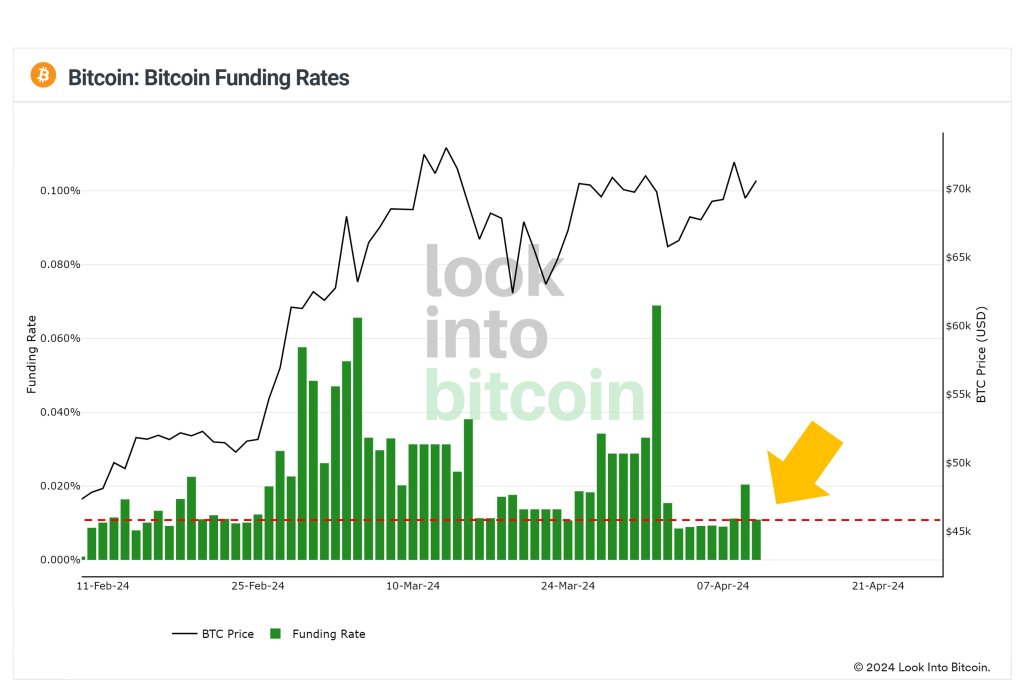

Bitcoin, one analyst notes on X, is looking healthy for the first time since the coin soared to over $70,000, printing all-time highs back in March 2024. The assessment is due to funding rates dropping to within ordinary levels, an indicator that volatility is also falling and moments of fear of missing out (FOMO) are fading.

Funding Rates At “Normal Levels” As FOMO Dissipates

In crypto perpetual trading, the funding rate is the fee exchanged between market participants. These fees are market-determined and are adjusted every eight hours or so.

Depending on market conditions, they can be positive or negative. However, they play a critical role in determining momentum. Of note, bulls pay a fee to bears When perpetual prices are higher than the spot price. This, in turn, discourages buying in the perpetual market and incentivizes buying into the spot, bringing prices closer.

Whenever prices rally, as has been the case since the start of the year when Bitcoin has generally been in the green, those who enter long have to pay sellers to keep prices from deviating, as mentioned above.

However, at spot rates, the rate leveraged buyers are paying is slightly lower as FOMO drops. Once prices rapidly expand, ideally above March 2024 highs, this funding rate will likely increase to February and March 2024 levels.

So far, Bitcoin is changing hands above $70,800 at spot rates and within a bullish formation. Of note is that buyers are in charge of reversing losses posted on April 8.

Even so, for the uptrend to remain, prices must break out above $72,500 and the April 8 high on rising volume. BTC will likely float to over $73,800 and enter price discovery in that case.

Bitcoin Rises After CPI Data In The United States, Institutions Pouring In?

With FOMO dissipating and “normalcy resuming,” the analyst said the coin is now better positioned to soar higher, backed by organic momentum generated from market participants. After dipping slightly on April 9, the coin rose following positive news about the Consumer Price Index (CPI) in the United States.

While the “hot” CPI pushed other assets lower, Bitcoin prices bounced to spot levels. Experts say the coin might benefit as risk-averse traders shift to safe-haven coins to shield their value from raging inflation.

Beyond this, analysts expect demand for spot Bitcoin exchange-traded funds (ETFs) to rise in the months ahead. As institutions pour in, buying shares of spot BTC ETFs issued by players like Fidelity, the demand for the underlying coin might soar to fresh levels, lifting prices. Moreover, some analysts are bullish, saying prices will benefit once GBTC stops offloading coins.