Bitcoin has surged back above the $70,000 level during the past day despite the negative Net Taker Volume for the asset.

Bitcoin Net Taker Volume Has Seen Some Large Negative Spikes Recently

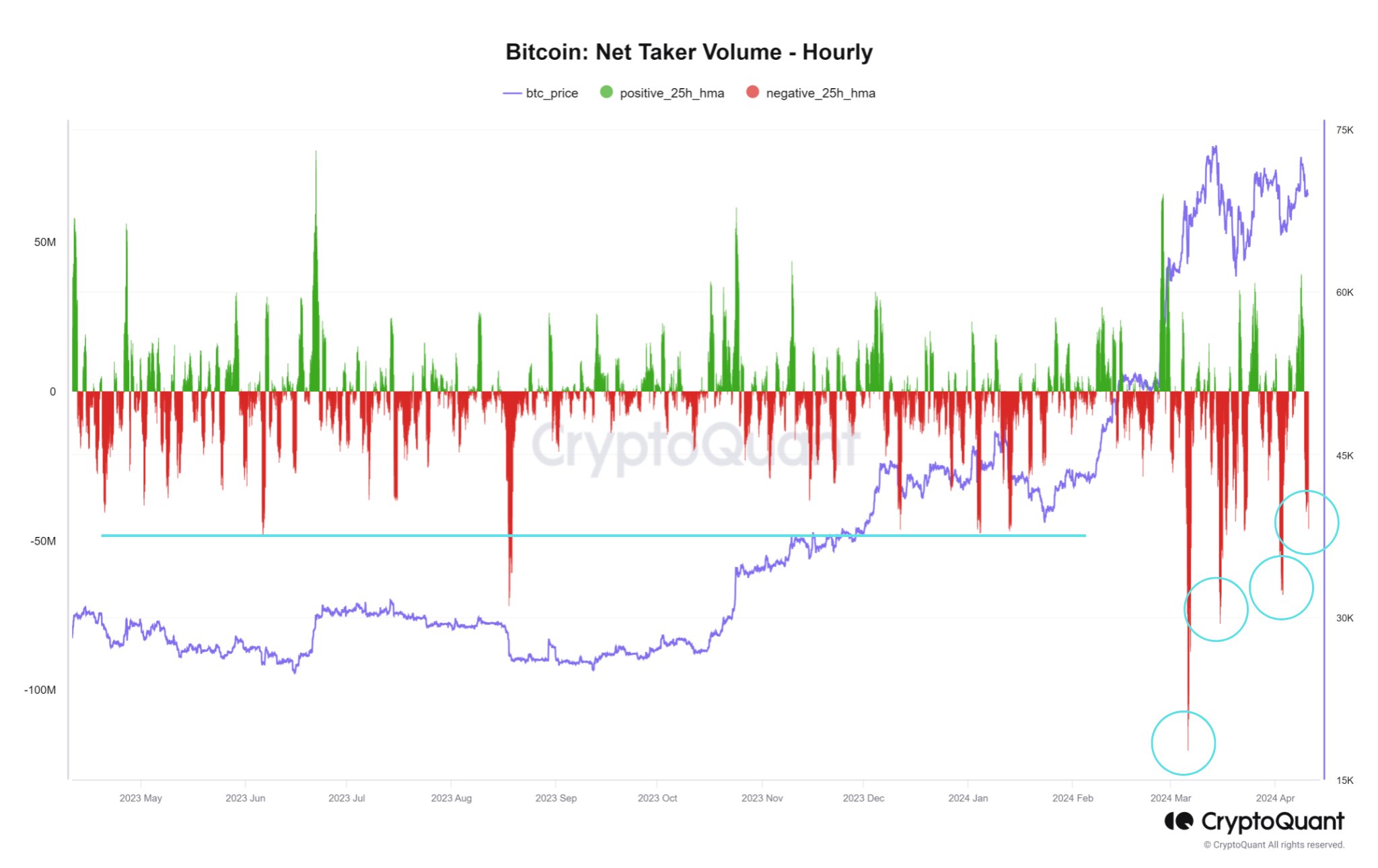

As explained by CryptoQuant Netherlands community manager Maartunn in a post on X, selling spikes of a significantly heavier scale than before have recently appeared in the Bitcoin Net Taker Volume.

The “Net Taker Volume” is an indicator that keeps track of the difference between the Bitcoin taker buy and taker sell volumes in perpetual swaps. How can the sell and buy volumes be different? As CryptoQuant explains in its data guide:

This concept is often confusing because every trade requires both a buyer and a seller of the given underlying asset. However, depending on whether the order taker is a buyer or seller (whether a transaction occurs at the ask price or the bid price), you can distinguish between long volume from taker seller volume.

When the value of this metric is positive, it means that the taker buy volume is overwhelming the taker sell volume right now. Such a trend implies a bullish sentiment is shared by the majority.

On the other hand, the negative indicator suggests that more sellers are willing to sell the coin at a lower price, a sign that a bearish mentality is the dominant one.

Now, here is a chart that shows the trend in the Bitcoin Net Taker Volume over the past year:

As the above graph shows, the Bitcoin Net Taker Volume has recently registered a sharp negative spike, implying that the taker sell volume has been higher than the taker buy volume.

The Net Taker Volume has been seeing some large red spikes for a while, as the analyst highlighted in the chart. “Bitcoin is being hammered down massively, with selling spikes on the Net Taker Volume significantly heavier than before,” says Maartunn.

Interestingly, despite this bearish sentiment in the market, the Bitcoin price has managed to hold up relatively well. Obviously, the coin’s bullish momentum has gone while these negative Net Taker Volume spikes have taken hold, but the fact that BTC has shown strength against any sustained drawdowns is still impressive.

A pattern that’s perhaps visible in the chart is that although the Net Taker Volume has continued to see red spikes recently, their scale has gradually decreased.

Thus, if this trend continues, it’s possible that the bearish mentality will eventually run out, and buying pressure will take over Bitcoin. It now remains to be seen how the indicator develops shortly.

BTC Price

Bitcoin declined below $68,000 just yesterday, but today, the asset has already bounced back and is now trading around $70,800.